Can Digitization Offer Asia a New Form of Advice-Driven Wealth Management?

A woman browses on her smartphone as she leaves a shopping mall in Beijing on February 8, 2017. In Asia, wealth management technology has developed, and is developing, a digitized means of meeting end-customer expectations.

Photo: Nicolas Asfouri/AFP/Getty Images

In Asia, wealth management services have been focused on, and dominated by, a commission-based structure focused on sales pitches, calls and conversations all related to the newest investment product and return on a product-by-product basis. This has been a side effect of Asian investors being more “hands on” and more active with respect to managing their wealth.

However, with changing end-customer expectations, increasing regulations and the need for advisors to differentiate themselves in an ever-competitive wealth management market, digitization has made it possible for the market to evolve to a scalable, advice-driven wealth management model.

Changing End-Customer Expectations

From the end-customer perspective, experiencing a volatile market, where wrong decisions are unforgiving, has tempered the aversion to a fee-based advisory approach. Coupled with the recognition that personalized wealth management is valuable in an unpredictable environment, end-customers are now privy to more information, which may or may not have an effect on financial decisions. Both factors have led to the demand and expectation for an increasing amount of engagement through diverse and alternative means. As a result, technology has developed, and is developing, a digitized means of meeting end-customer expectations.

Form of personalization. This implies a higher expectation from being offered a one-size-fits-all wealth solution, to the belief that an advisor should personalize wealth management for each end-client regardless of amount. The growing number of financial institutions and advisors digitizing the end-client journey, from onboarding and “Know Your Customer” to suggesting personalized portfolios and execution of automatic and personalized rebalancing proves that, in response to changing end-customer expectations, the process can be systemized and constructed in a scalable way. By meeting the demand for personalization, advisors are able to more efficiently service end-customers and generate more value add, which will result in more revenues and a larger share of the end-client’s wallet.

Ability to create multiple touch points for end-customers. This allows more opportunities to commercially engage an end-customer, but more importantly, it enables advisors to learn more about the end-customer and solidify that relationship. The only difference between the traditional method of gaining this information and the digital method is that it can be done in a more consistent, scalable and result-oriented way with digital media. Through these means, digitization allows an advisor more insight into how to service an end-customer. By digitizing touch points, the possibility of a mistake, oversight or inconsistency can be reduced, and certain opportunities can be flagged and converted into revenue. Instead of creating mistrust, knowing and speaking to an end-customer about their interests and goals allows a relationship to form.

Increased Regulations in Asia

Although regulations have been slow relative to the rate at which digitization changes industry landscapes, digitization can assist advisors to mitigate the challenges of increased regulatory measures, which have highlighted statutory duties of advisors to service end-customers. This has led to the inverse relationship of the advisor’s ability to charge commissions. For example, with the advent of product pushing, conflict of interest has been one of the main problems in the wealth management industry. Consequently, many regulators have been trying to reform the industry by repositioning clients at the forefront, with the majority of regulation focused on better meeting their needs.

Although one of the most significant attempts has been led by the U.S. with the amendment of retirement regulations, Asian regulators have not been far behind in instituting gradual changes. These proactive measures include the Monetary Authority of Singapore requiring advisors “to meet key performance indicators that are not related to sales, such as providing suitable product recommendations and making proper disclosure of material information to customers.” In addition, the Hong Kong Securities and Futures Commission has made several recent changes to its rules and now requires advisors to enter into a contractual obligation to recommend suitable investments.

Even in Japan, there have been efforts to make commissions more transparent in insurance products and, thus, the transparency demanded in commissions received by advisors as a result of new regulatory measures has just begun. It is clear that the purpose of these regulations is to stop advisors from positioning their own interests over clients’ interests of obtaining the best investments at the lowest prices.

The resulting anticipated changes will enforce a new level of disclosure and a higher burden for advisors to meet this threshold. An unintended effect of these increased transactional and maintenance costs will be that business models for most financial advisors under these new restrictions on commissions may not work with small account balances. Thus, managing smaller accounts will likely become costlier and increase the risk of liability for broker dealers, advisors and others, which will challenge them to seek technology-enabled, outsourced solutions to serve such smaller accounts.

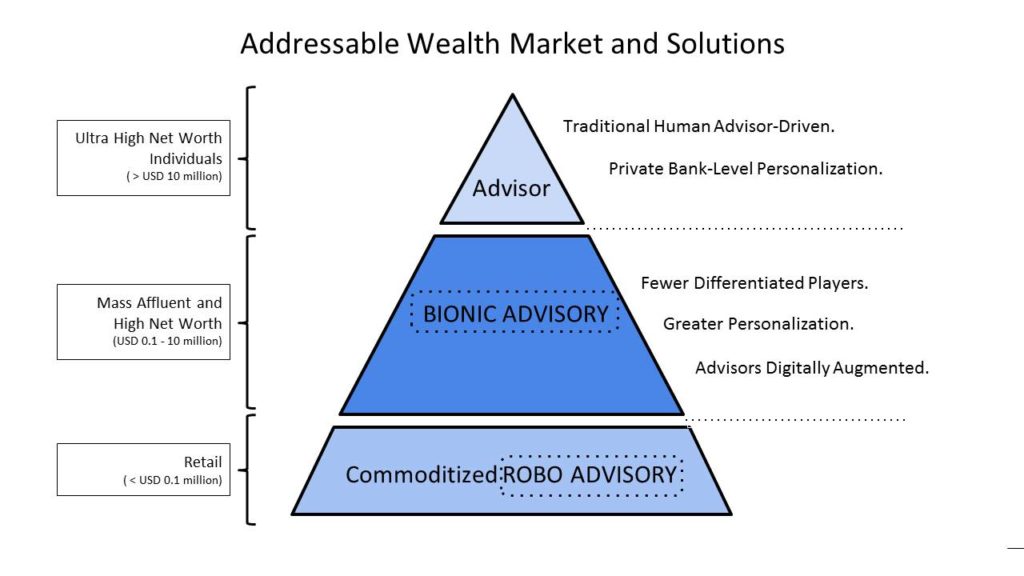

Accordingly, digitized wealth management solutions are an efficient and economical way to serve small-balance account holders as well as the mass affluent-to-affluent investors, which make up the fastest growing, most profitable and largest segment of the private wealth pyramid.

As firms move toward fee-based advisory, adopting a digitized form of advisory will no longer be seen as a service to the small-balance account, but rather a complement to the end-client–advisor relationship and a tool for client acquisition.

Need for Advisors to Differentiate

As the Asian wealth management industry becomes more crowded, advisors will need to add value in terms of not just pushing products, but providing holistic advice if they are to grow their assets under management.

Digitization makes it easier for an advisor to articulate portfolio information in a systematic and consistent way by weighing and considering an end-customer’s risk profile, suitability and other preferences.

This serves two purposes. First, it reduces the product pushing aspect and an inherent distrust of the end-customer in relation to the advisor. Second, it provides a clear way of creating value-add services, which were otherwise not available in a scalable and digitized manner. For example, advisors can provide advice tailored to each end-customer and their entire portfolio—providing this value add can be a rationale for increased fees by advisors.

As with many instances in the past, transformative technologies, even though they may be collaborative, still require forward thinkers to adopt them. Moreover, entrenched attitudes and/or legacy systems (technological or otherwise) may limit the proliferation of digitization to a degree. However, given that these three factors are converging, it seems clear that all the vested parties in wealth management are looking for innovative technologies as a solution.

Ultimately, digitization does not mean a disruption in Asia’s wealth management industry, but rather an automatization of what can be done more efficiently to enable an advisor to focus on client relationships. Digitization seems to be an ideal method by which wealth management can be offered, personalized and developed in a scalable way from the three different perspectives of the end-client, regulator and the advisor.