How HR Can Help ASEAN’s Frontier Economies Grow

Jobs seekers line up to submit their resumes in Hanoi, Vietnam. Firms in the frontier ASEAN markets such as Myanmar, Cambodia and Vietnam must improve their talent management strategies.

Photo: Hoang Dinh Nam/AFP/Getty Images

Often unnoticed in the broader, common narrative about the Asian growth story is the strong growth that countries in the Association of Southeast Asian Nations have experienced over the past few decades. For many years now, the region’s GDP growth rate has been higher than the global average.

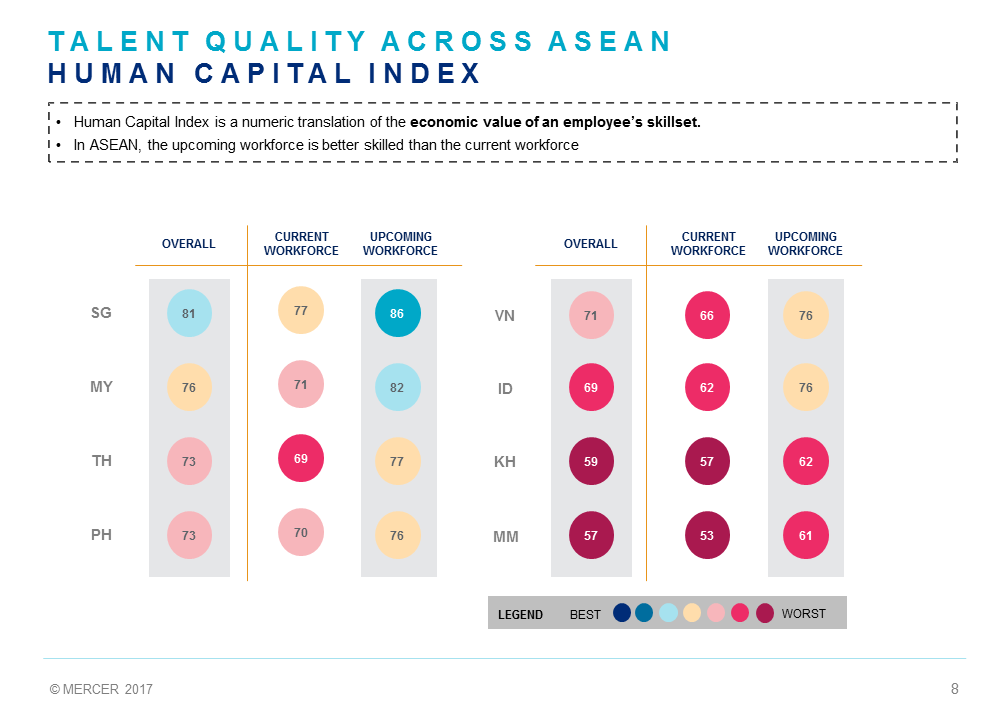

Economic growth in ASEAN is largely driven by domestic demand, and a lot of it is from emerging economies such as Myanmar, Vietnam and Cambodia growing at an unprecedented pace. In tandem, there has been increasing demand for skilled workers in the workplace—mainly in their IT and technical skill set.

However, with this growth comes human-resource challenges, which businesses need to address to operate with success in the region.

Labor-Related Challenges

The following are some labor-related issues that can potentially make ASEAN less attractive for companies.

Employee rights versus foreign investment. There is a trade-off between protecting employee rights and attracting foreign investment in the region with labor affordability. In ASEAN, especially in emerging markets, the issue revolves around the minimum wage for workers. A failure to provide adequately for workers often leads to labor strikes and protests in the region, with a notable example being the recent protests in Cambodia over the quantum of minimum wage.

Lower labor productivity. For any economy, one of the factors attracting foreign direct investment is contingent on its higher labor productivity so that the investors’ growth expectations can be met. As such, it is important for ASEAN economies to improve labor productivity to remain attractive investment destinations.

Talent demand not met by supply. As a result of the two factors listed above, there is a talent crunch in ASEAN, owing to the limited pool of qualified individuals in the region. Human capital does not possess the necessary technical and vocational skills to drive business forward. While the education infrastructure in these countries is gradually gaining ground and producing graduates with required skills, the primary hurdle is the “talent gap,” which exists between current available employees and finding suitable talent in the existing supply pool. To compete effectively, companies need to be able to hire skilled and innovative individuals locally. For example, according to the Asian Development Bank, 57 percent of firms in Myanmar think that the existing skills gap is a major issue that impedes business operations. Separately, in Cambodia, 40 percent of youth do not have the necessary skills and education to do their jobs effectively.

Poor talent management strategies. Firms in the frontier ASEAN markets such as Myanmar, Cambodia and Vietnam do not have proper talent management strategies and have underutilized their people resources by failing to nurture their potential. Additionally, most firms lack the ability to track useful and consistent human metrics. Of the firms that do, just 7 percent are able to turn the data into helpful insights that drive people’s performance.

Responding to Challenges

Pushing up salaries. One of the biggest challenges across ASEAN is lack of skilled labor. Consequently, the arrival of multinational companies into markets like Myanmar and Cambodia has only served to heighten talent scarcity, forcing wages up. As companies compete with each other, many try to attract talent with huge compensation packages. In the long run, however, this could lead to frontier countries losing their competitive advantage in low labor costs.

Shift toward benefits. Due to the increasing cost of labor, companies have also begun broadening their offerings, moving from compensation-heavy reward packages to ones that include more benefits. In Myanmar, for instance, outpatient benefits are common—with 68 percent of firms providing it. Accident and life insurance cover, however, are the least provided perquisites as this is a new concept there. Cambodia, in this regard, is more aligned with the global market compared to Myanmar. It has 85 percent of firms providing inpatient benefits, although life insurance provision lags at 38 percent. Vietnam’s benefits provision is perhaps the most evolved of the three countries, and health insurance in terms of in- and out-patient and accident insurance all stands above 80 percent. Life insurance is also more prevalent in Vietnam than in Cambodia or Myanmar.

Change in priorities. Human resource divisions have shifted their focus in order to mitigate the talent gap. Companies have shifted their HR budgets from being intensely focused on talent attraction to one that focuses more effectively on both talent attraction and retention. Companies are no longer focused solely on recruitment and salary increase but have also begun to recognize the need for internal talent development and talent management. In Myanmar’s compensation-heavy market, a diversification of HR budget shows that firms have begun to recognize that cash alone is insufficient to keep employees engaged.

Businesses in frontier ASEAN markets will need a new approach to workforce planning and talent management.

Recommendations

Most organizations do not realize the importance of measuring and tracking workforce data. This aspect is crucial, and without it, managements will be unable to adequately strengthen their companies’ business performance. Furthermore, analyzing and interpreting data is a specialized sphere that requires the expertise of data scientists. Such personnel are difficult to find, even in developed economies such as Singapore, and as such, there is an acute scarcity of such experts in countries such as Cambodia and Myanmar.

Reinventing the HR function. The HR function needs to become more strategic and have a seat at the table. There is a need to employ new kinds of analytical tools to spot talent trends and skills gaps. Analytical tools can help organizations maximize opportunities to capitalize on transformational trends by aligning their business, innovation and talent management strategies.

Data analytics increasingly important. Businesses will need to build a new approach to workforce planning and talent management, where better forecasting data and planning metrics will need to be central. HR can add significant strategic value in predicting the skills that will be needed and plan for changes in demand and supply.

Preparing for the Future

Even with proper mechanisms to manage talent and rewards, it will take time and continuous effort to build up reliable market intelligence and for managers to be able to adapt and fully implement it to make sound and fair decisions that involve people. Apart from fair compensation and benefits, employees today take into consideration factors such as career prospects and the opportunities to progress further. Organizations that want to retain talent need to be cognizant of these facts.

While the ASEAN region continues to grow rapidly, it is faced with many HR-related challenges. The region’s diversity and complexity make things harder for companies that do business in the region. Organizations will need to focus on cultivating a keen understanding of market practices, encouraging continuous innovation and operating within corporate guidelines to be successful.

This is the first part of a series on ‘Navigating HR Challenges in Asia’.