Japan’s Tenuous Grasp on Financial Digitization

A bank teller counts Japanese yen notes to give to a customer at a bank in Tokyo, Japan.

Photo: Tomohiro Ohsumi/Getty Images

Japan’s financial industry is scrambling to modernize its legacy financial systems amid a host of customer concerns and emerging digital trends.

Part of the issue is that while there is nearly complete consensus on the importance of digitization when it comes to bank modernization, there are also various interpretations of what digital means in banking, and there is no shared or uniform opinion in the industry.

When asked what digital means to their companies, executives at financial institutions offer diverse and sometimes contradictory responses. Divergent answers do not make any respective answers incorrect, but they do indicate the lack of a satisfactory definition. They also demonstrate a failure to comprehend the true meaning of digital.

What is Digitization?

Some of the relevant responses on how to define digital are:

- To use data that has been out of reach until now to attract new clients with new approaches

- To apply technology that might fundamentally change the way companies interact with stakeholders; in most cases this relates to the Internet, mobile, and big data

- To advance—relative to the competition and as a defensive measure to guard against emerging new companies

- To make the possibility of straight-through processing a reality

- To shift to paperless operations

Among the definitive characteristics that executives usually associate with digital are customer experience and mobile. However, the characteristics or attributes associated with these cover a broad scope, ranging from a multi-channel approach and social media to transformation and efficiency.

Digital is not a new trend. If you take digital’s meaning to refer to technology that replaces manual processing with computer processing, then digital banking existed back in the 1950s, when mainframe computers were first used to handle banking transactions. The next boom arrived in the 1990s with the advent of online banking.

These two developments substituted human labor (bank tellers and bank users) with technology for tasks or processes. In Japan’s market, this corresponded to the nationwide development and deployment of ATM networks that accompanied legislation that loosened and in some cases abolished regulations on bank branches.

Five Digital Trends

We see a confluence of at least five different trends that are emerging at the same time in the digital deluge, and these trends are in the midst of fundamentally and irreversibly changing both banking services and the behavior of banking customers. The five trends are as follows:

- Mobility and connectivity

- Social

- Cloud

- Big data

- Artificial intelligence and robotics

These trends represent potential threats as well as perfect opportunities—to reimagine and redesign business models—especially for so-called analog financial institutions. In other words, it is time for these companies to tackle modernization. The definition of digital in modern-day banking and modernization must transcend beyond just automating or replacing manual processes with machines.

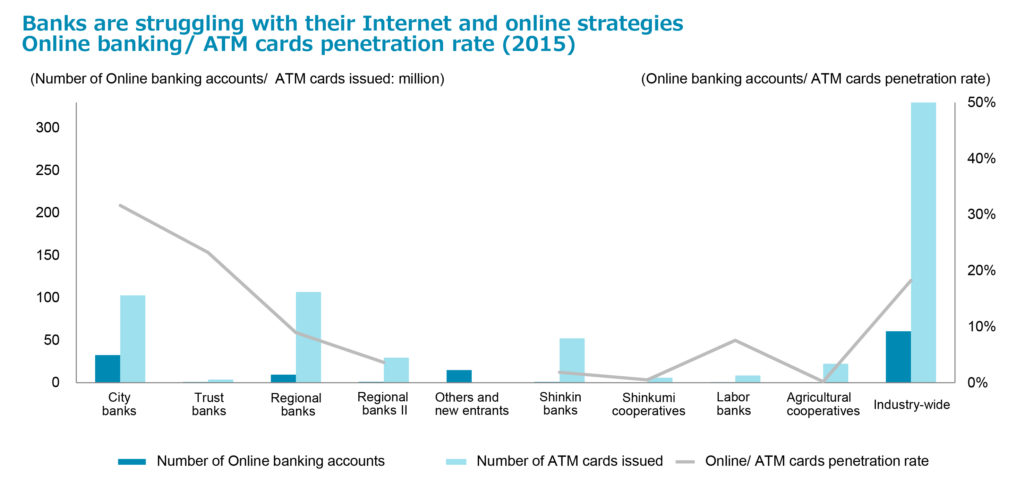

Take the penetration rate of online retail banking in Japan, for example. Compared with the number of ATM cards in circulation, the estimated penetration rates for individual online banking use by institution type is as follows: 32 percent at city banks, 23 percent at trust banks, 9 percent at regional banks, and 4 percent at second-tier regional banks (member banks of the Second Association of Regional Banks). Overall, the total rate for the industry is a meager 18 percent, illustrating clearly that Japanese banks are having a hard time with their Internet and online strategies.

Exhibit 1: Online Banking Penetration

Security Concerns Hamper Online Banking Acceptance

A key factor behind the slow adoption of online banking among individual customers seems to stem from security concerns. However, this can also be regarded as a technical challenge. Cybersecurity is a theme common to the entire industry and is not by any means limited to online banking services. More than 90 percent of Japanese online banking systems rely on outsourced services provided by vendors. This means that the challenge is not just relevant to individual financial institutions.

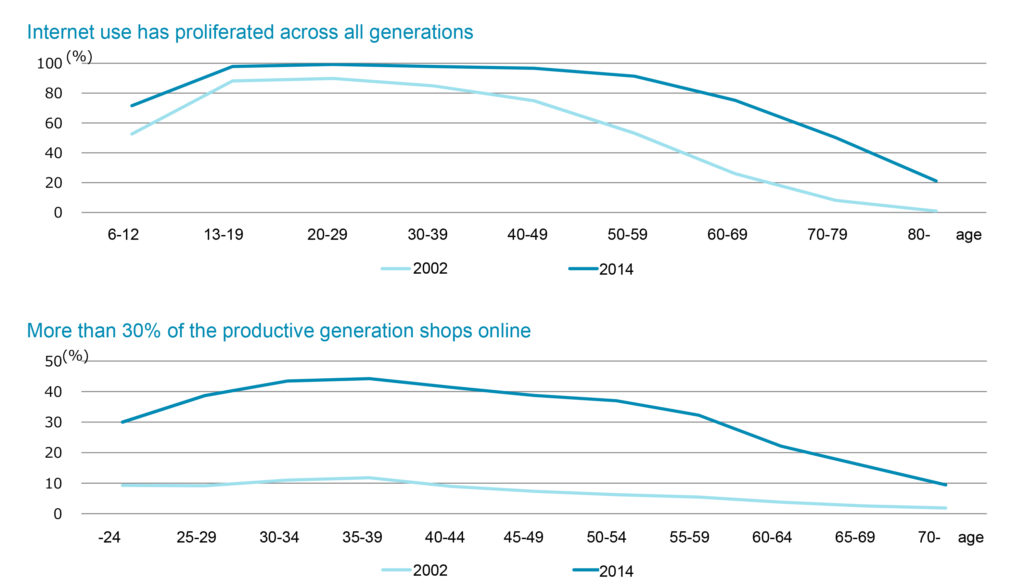

A core question to consider is whether banks are actually offering the services that clients desire. Increasingly, the senior generation’s use of online services stands out. More than 30 percent of them shop online. Internet use has proliferated across all generations, and analog banks cannot keep pace with the expansion of the online marketplace. Indeed, their menus of online banking services don’t differ greatly from ATM services. Customers’ high sensitivity to security concerns and their conservative postures have hampered the development of truly innovative online banking services. Organizations would do better to regard the Internet as an integral part of their brand strategy rather than a channel strategy.

Digital generation consumers are unlikely to get excited about conventional services available via ATMs repackaged as digital banking. These services do not offer a novel experience for customers. In the retail world, department stores without omnichannel approaches and small retail stores are being driven out of business while convenience stores and online shopping outlets are thriving. Similarly, in banking it is no longer viable to try to make banks more efficient through automating operations and having a channel strategy that principally relies on cutting costs as its main objective.

Exhibit 2: Consumers’ Digital Behavior

Digital Framework in Banking

In the banking sector, Celent takes a broad view of digital—one that transcends new apps and the deployment of new and different channels. Moreover, we believe that digital is making it imperative for financial institutions to review and transform their organizational structures to ensure success and survival.

There are four essential qualities that companies should consider in relation to this framework. They are:

- Brand experience: Customizing the brand experience of financial institutions to individual customer needs, while ensuring consistency and uniformity across all channels and points of interaction

- New capabilities: Rooted in a foundation of analytics and automation

- Business model: Operating model, namely referring to change and innovation in products and services, organization, culture, and skills and IT

- Goal: Providing both demonstrable and sustainable economic value