Regional Integration Yields Economic Resilience

A 3,096-ton cargo ship is seen at a terminal along the 18-kilometer-long channel called 'Gyeongin Ara Waterway' in Gimpo near Seoul.

Photo: Jung Yeon-Je/AFP/GettyImages

Integration among South Asian nations has been a predominant trend in the recent past. The region has been less affected by global trade and economic uncertainties. This buoyancy has largely been possible owing to increased trade and investment links in the Asia-Pacific region.

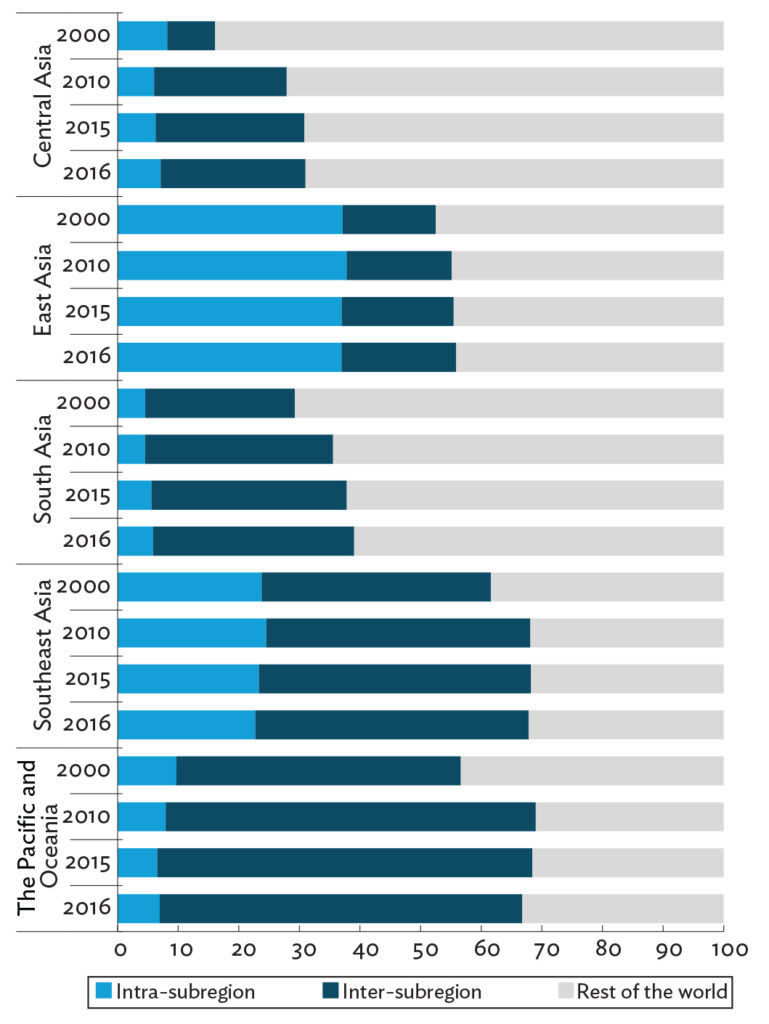

Asian financial markets, too, are increasingly interconnected—both on global and intraregional fronts. According to a recent report, in terms of value, Asia’s intraregional trade share in 2016 witnessed a record increase to 57.3 percent in 2016. The earlier average between 2010 and 2015 was 55.9 percent.

Trade and Investment

“Asia and the Pacific is leading a recovery in world trade that is helping the region to maintain strong growth momentum amid global economic and trade policy uncertainty,” said Yasuyuki Sawada, chief economist and director general of the Economic Research and Regional Cooperation Department of the Asian Development Bank.

Asia’s trade by volume in 2016 outpaced global trade, although it remained below its economic growth. Trade growth in Asia witnessed an increase to 1.7 percent in 2016 from 1.4 percent in 2015, while global trade growth declined to 1.3 percent in 2016 from 2.6 percent in 2015. It is expected that over 70 percent of the region’s economies will witness faster growth compared to 2016. Asia’s trade volume growth will likely accelerate to 4.4 percent in 2017, 1 percentage point above the forecasted global trade growth. Global foreign direct investment into the region fell to $492 billion in 2016 from $525 billion in 2015, but intraregional FDI increased to $272 billion in 2016 from $250 billion in 2015.

Exhibit 1: Asia intra- and inter-subregional trade shares (%)

Source: ADB calculations using data from International Monetary Fund. Direction of Trade Statistics.

Financial Integration

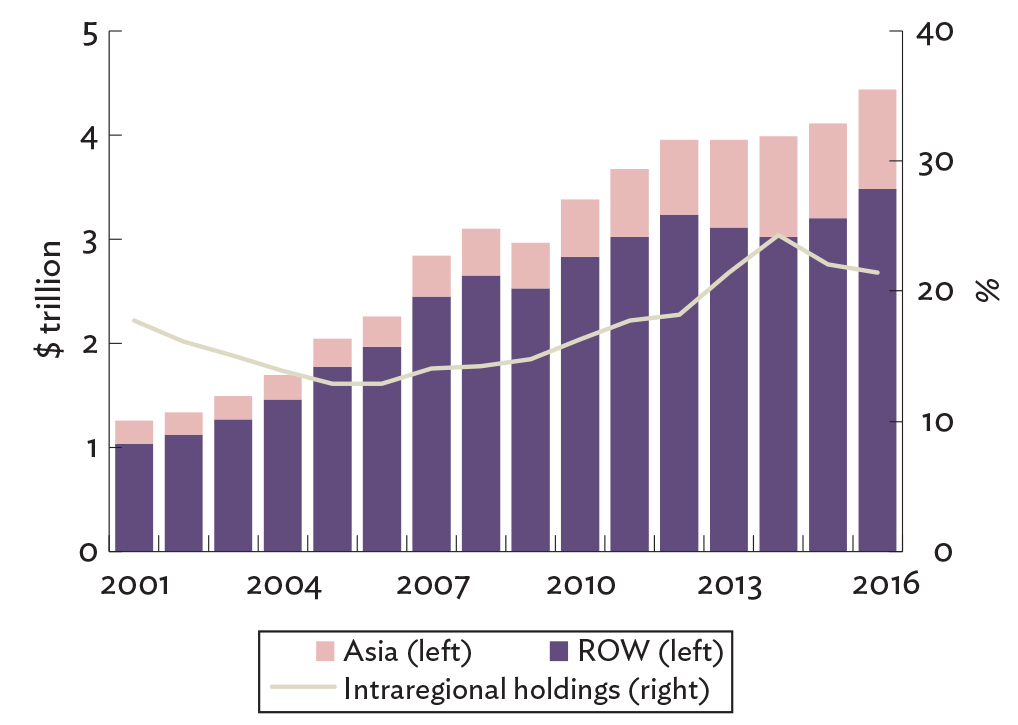

Cross-border banking activity in Asia has recorded a steady increase. The region’s cross-border banking claims were $4.4 trillion in 2016, up from $4.1 trillion in 2015. Japan accounted for 88.7 percent of the increase, mainly due to its higher lending to the U.S. and the EU. Moreover, Asian equity market return volatility is more likely to be impacted by global events as has been the case since 2015. This implies that Asia’s equity markets continue to remain more globally connected than intra-regionally connected.

Exhibit 2: Asia’s cross-border bank claims

ROW = rest of the world.

Note: Asia includes all 48 ADB regional members for which data are available as of December 2016.

Source: ADB calculations using data from Bank for International Settlements.

Integration Through Tourism and Movement of People

The tourism industry in the region has seen a steady increase. Leisure travel is growing rapidly and a positive trend has been the increase in the number of tourists traveling within the region. Although Europe continues to be the destination of choice, the second largest number of travelers visited the Asia-Pacific region. The report also stated that over 70 percent of outbound Asians traveled within the region. Tourists from China increased 11.8 percent in 2015 and in keeping with the trend, 61 percent traveled within the region. The total revenue generated from tourism was an estimated $398.6 billion in 2015 marking an average annual growth of 10.1 percent. The increase in tourism has been a key binding factor in the region. However, remittances to the region witnessed the largest drop since, falling to $259 billion in 2016 from $269 billion in 2015.

Regional Integration in Asia-Pacific Versus EU

Although regional connectivity has been greater than ever, regional integration in the EU is the benchmark. It has the highest regional integration score on almost all fronts. Asia does however perform better than Africa and Latin America. The EU largely outperforms Asia across all six dimensions with the only facet that is marginally comparable being Asia’s trade and investment integration index. The six dimensions include:

- Trade and investment

- Money and finance

- Regional value chains

- Infrastructure and connectivity

- Movement of people

- Institutional and social integration (based on indicators for trade agreements, diplomatic ties and cultural relations)

Institutional and social integration in Asia is still predominantly weak, although regional value chain and movement of people are its most regionally integrated components.

Benefits of Regional Cooperation

Regional cooperation can ensure financial stability and continued economic development. Mr. Sawada said, “The region’s policy makers need to continue reforms that ensure good macroeconomic fundamentals, build strong regulatory and supervisory frameworks, deepen alternative sources of market financing such as local currency bond market transactions and further strengthen financial safety nets.”