The Blistering Pace of Asian E-Commerce

A delivery company sorting packages during the 'Singles Day' shopping festival in Shenyang in China's northeastern Liaoning province, November 11th 2017.

Photo: STR/AFP/Getty Images

E-commerce has emerged as the main growth engine for many Asian consumer goods companies. China is now the largest e-commerce marketplace in the world, worth $700 billion in 2016 (compared to $390 billion in the U.S.) with a consumer penetration rate of 22 percent (compared to 9 percent in the U.S.).

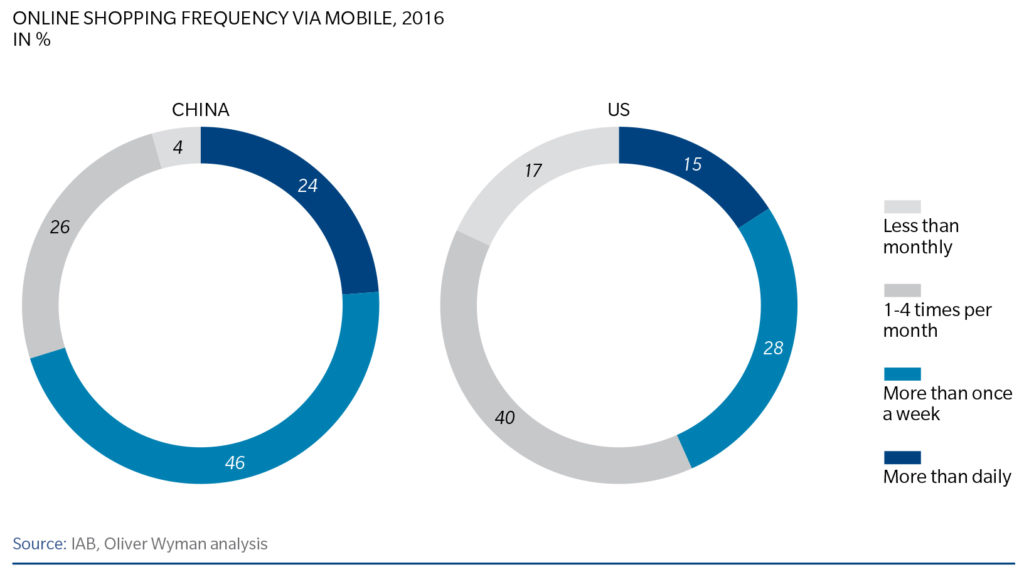

More significantly, Chinese consumers are among the most technology savvy—56 percent of total online sales are through mobile phones (compared to 18 percent in the U.S.), and 60-65 percent of Chinese online shoppers buy online more than once a week. The average delivery time for JD.com, a Chinese e-commerce giant, is half the time taken by Amazon or less, and numerous apps offer grocery delivery within an hour.

Exhibit 1: Comparison of Mobile Shopping Frequency in China vs. U.S.

This boom in e-commerce opens up a plethora of opportunities for companies. However, there are various risks that arise from not approaching these opportunities the right way:

“Missing the boat.” The speed of change in e-commerce is unprecedented, especially in China. Businesses must make decisions and react quickly to meet the latest changes in the market.

Failing to serve consumer needs. For consumer goods companies, e-commerce removes the intermediary between them and end consumers. Hence, it is critical to have the right setup to be able to respond to this new direct route-to-market model.

Taking a siloed approach to customers. Treating the likes of TMall and JD as e-tailers and selling to them no longer makes sense in China’s increasingly complex digital ecosystems. These players in many cases are also the biggest advertising channels for consumer goods companies, and failing to adapt to a more multifunctional approach risks under-serving customer needs.

Picking the Right Organizational Model

There are three main design choices consumer goods companies in China should consider when selecting an organizational structure:

Reporting lines. This refers to the level within the hierarchy in which the e-commerce organization should sit. In other words, who should the e-commerce head report to?

Dedicated functions. This implies the extent to which there are dedicated supporting functions for e-commerce, such as supply-chain digital marketing and the degree to which these functions sit within a separate e-commerce team. Linked to this is the question of whether to install a chief digital officer or equivalent and to what extent their role should include e-commerce.

Outsourcing. This refers to the extent to which some functions such as online store operations are outsourced to a third party/trusted partner.

Four primary factors should influence companies’ design choices in considering organizational models. For each, there are trade-offs to consider, but making a conscious design choice rooted in key business considerations will help to ensure that companies have the best structure to succeed.

The number of categories a consumer goods company operates in and the extent to which it operates across the same consumer segments will significantly influence the choice of organizational model.

Similarly, the maturity of e-commerce will affect its model. Those consumer goods companies that “grew up” in the digital age will tend to have flatter organization structures with all operations in-house since they have built those capabilities from the very outset. The organizations that embraced e-commerce later are more likely to rely on outsourcing. They will position e-commerce roles at a higher level to attract more senior talent to kick-start the e-commerce business.

The size and ambition for e-commerce is likely to impact an organization’s decision to adopt an integrated organization model rather than separating e-commerce into its own dedicated business function. As e-commerce becomes a significantly more important part of the business, the company as a whole will need to become more digitally focused. It cannot afford to isolate its digital talent. Just as key customers such as Alibaba and JD.com become more omni-channel focused, consumer goods companies, too, will need to think similarly.

Companies that promote a collaborative work culture and transversal way of working will naturally come together and adopt a more multi-functional approach to major e-platforms. They may not consider it necessary to be organized in this manner and hence may prefer to retain the more traditional approach.

Avoiding Common Pitfalls

There is no one-size-fits-all solution for an organizational model. The examples in China show the range of options available, and each company will need to choose the best fit for them. Ultimately, being able to meet the challenges of e-commerce will require consumer goods companies to be able to align all elements of organization behind a clear business strategy. These elements include:

Talent. Attracting and retaining the right talent is critical, especially in today’s talent market where digital experience is at a premium. Investments are required in recruitment and supporting talent with the right training, career path direction and rewards and incentives.

Culture and mindset. A company’s culture will significantly impact its performance.

Companies that succeed in the digital age will have a “can do” mindset that is open to new ideas and innovation, as well as being agile, flexible and able to adapt to change. In particular, successful companies will be able to react quickly to the latest developments in technology and data analytics. Ownership of data and building of in-house data analytics capabilities are imperative.

Ways of working. A more collaborative, multifunctional approach will be needed in the future. Front-end negotiations led purely by sales are outdated as e-commerce players evolve to become full-service platforms and invest more in joint business planning. Likewise, consumer goods companies will need to break internal silos to better serve their customers, regardless of formal reporting lines.

Decision-making processes. This is the central nervous system of a company, critical to effective governance and operations. To address the ever-changing face of e-commerce, information flows and processes need to be as streamlined and efficient as possible to ensure quick decision-making.

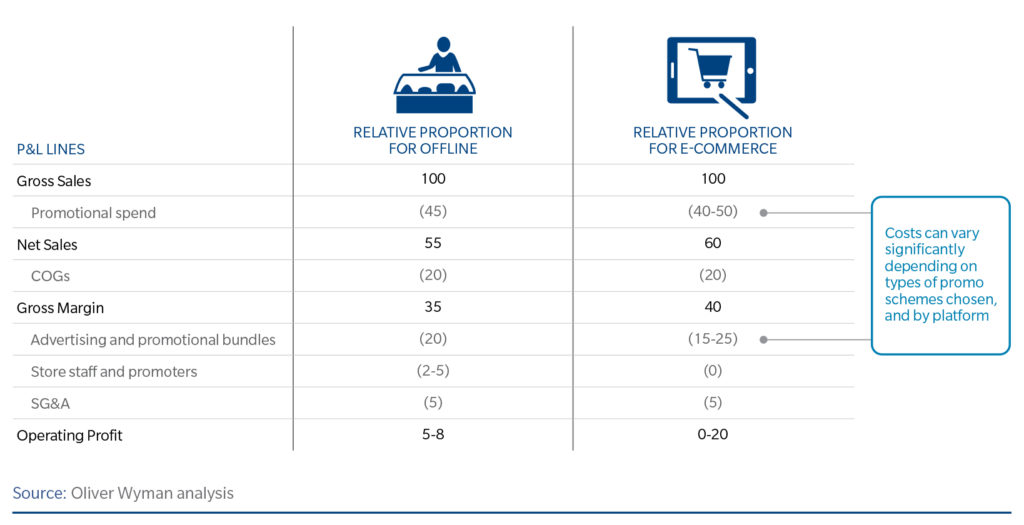

Regardless of organizational structure, companies need to also fully understand the bottom line impact of e-commerce for their P&L and plan accordingly. The structure of the P&L for e-commerce can be significantly different from an offline structure, particularly in areas related to promotions and advertising. To fully understand these nuances and gain more control, it is worth considering a separate, dedicated e-commerce P&L.

Exhibit 2: Comparison of Indicative P&L Structures for Offline vs. Online Channels within Consumer Goods

The Need To Be Well-Equipped

E-commerce is big, complex, fast and constantly evolving, and this is not going to change any time soon. Companies that are slow to adapt to this changing reality run the risk of falling by the wayside as other adaptable companies capitalize on the growth being witnessed in this sector across Asia.