Asian Banks Need to Rethink Digital Banking

As Chinese e-commerce giant Alibaba expands beyond online retail, it is shaking up staid state banks—and drawing regulators' attentions—after 100 million customers poured more than $90 billion into its investment fund.

Photo: Johannes Eisele/AFP/Getty Images

Asia is digital. For example, more than one billion Aadhaar* ID cards have been issued in India; the Internet populations of China and India together outnumber the entire population of the United States. A modular Asian financial-services industry is rapidly emerging, driven by, and as a response to, digital trends. Yet, while technology has displaced incumbents in many industries, for Asian banks, disruption to business models is more likely than displacement.

The potential digital disruption has several possible outcomes. Banks could prevail by embracing change, or new banks could emerge. Incumbents could transform to survive, or the whole banking system could be upended with different players assuming specialist roles across the value chain.

As Asian central banks promote inclusive growth and push to digitize economies (such as the push for demonetization in India and a cashless economy in Thailand), regulators are looking to new, open and innovative financial systems that could change the business models of banks and marginalize them as balance-sheet players.

What strategies have Asian banks pursued to counteract this digital disruption?

Asian banks flirted with a number of strategies in the first era of digital banking (circa 2012-2016). Most strategies had common threads: the focus was on digital natives (roughly 10 percent of the total bankable population); growth or defense was the primary motive given the perceived threat from fintech players. Transaction banking was the primary focus, but it was largely gilded with a digital veneer.

Lessons from Digital Banking 1.0

Business model. The first-mover advantage is overrated, as most digital banks faced challenges with scaling. Capital requirements, challenges with client acquisition and regulations prevented fintech players from making a significant impact. One Malaysian bank found that acquiring new customers through digital channels, including aggregator websites, was twice as expensive as doing so through traditional channels. In addition to that, the focus on digital natives made for a crowded segment with little differentiation and marginal profitability.

Operational. Banks have realized that they can achieve more through collaboration than by themselves because fintech players have the advantage of specialization and speed. In addition, banks initially underestimated the cultural and technological effort required to extract value from data, a process that forms the core of digital dexterity. One major Asian bank had cultural challenges when it encouraged the risk function to use alternative data from digital-accounting companies for underwriting small- and medium-sized enterprise (SME) customers. Another global bank with significant Asian operations was challenged to make real-time marketing decisions with real-time information that was available through external digital partnerships.

In addition, large incumbents have learned that the real growth opportunities still reside within the core business—not new spin-off digital ventures—and that the best return on equity with digital offerings is in end-to-end simplification of the core business.

A Strategic Framework for Digital Banking 2.0 (2016-?)

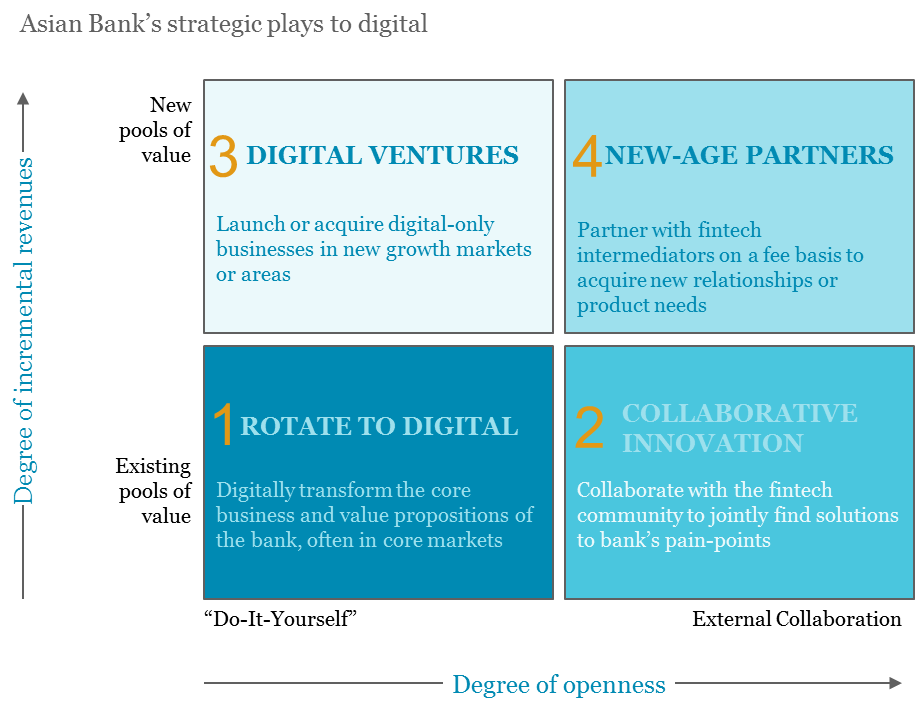

Banks should respond to threats and opportunities created from digital initiatives by pursuing four distinctive strategies:

Rotate to Digital. They should initiate digital transformations of the core franchises (for example, by replacing cash with mobile wallets).

Collaborative Innovation. They should also partner with fintech players to jointly find solutions to pain points (by using measures such as know your customer (KYC), credit scoring, fraud and risk).

Digital Ventures. They should launch or acquire digital-only ventures in new geographies or segments that have little to no share and are in search of growth..

New-Age Partnerships. Banks should partner with digital companies to acquire customers or add new services (for example, by partnering with e-commerce companies to use order data for online-merchant financing).

What is the Right Strategic Response?

There are several factors, driven by internal readiness and market attractiveness. In our experience, banks both overestimate their readiness and underestimate the market opportunity.

Large incumbent banks can extract the most value from digital initiatives by applying them to core-value pools. Digital Banking 2.0 strategies will focus on driving simplicity and improving cost positions. Banks will need to drive innovation beyond transactions and into lending and wealth management. They should look to enlarge target populations (as digital offerings are more widely adopted by consumers), and work with a range of ecosystem partners to embed finance as part of customers’ daily lives, redesigning user experiences with mobile-first principles.

This pursuit of digital banking excellence calls for a change in mindset, requiring both enterprise innovation to drive agility, and collaboration with external parties. Depending on their starting point, banks may need to play a role across all quadrants. But at least now they can draw on lessons from recent history to guide them forward in the digital age.

* Aadhaar is a 12-digit unique identification number issued by the Indian government to its residents