Financial Services Are Uninspiring. A Fresh Start May Be the Solution.

The next big innovations in financial services will be driven by existing firms starting with a blank canvas, using the “greenfield” approach.

Source: Shutterstock

The next big wave of innovation in financial services will be driven by existing firms starting with a blank canvas. For an industry whose product—the movement and storage of money and the management of risk—is electronic, financial services processes are surprisingly manually intensive. Surveys show that customers are rarely inspired by the service, and yet there’s a consensus that a digital overhaul of legacy systems will take many years. At the same time, new businesses underpinned by digital capabilities are gaining traction.

Flywheel of Growth

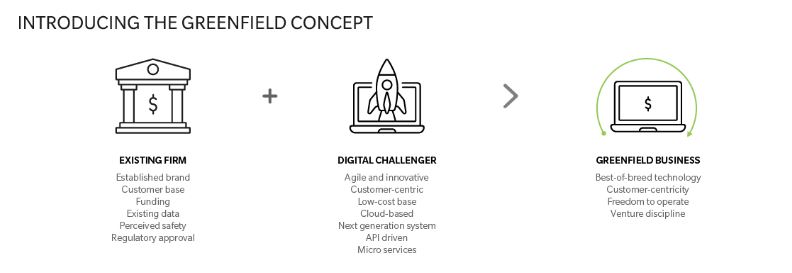

Imagine if you could combine what is possible in a new build with the business model advantages of an existing firm. We call this approach “greenfield.” It means tapping into the same flywheel momentum of growth employed by big tech and breaking out of the low-returns cycle. Several factors make this idea compelling right now.

Time-to-market and build costs have decreased dramatically, thanks to advances in cloud-based services and technology. Starting with a blank slate, it is possible to create businesses that are digital by design and have significantly lower run costs. And new business models and data-driven approaches are winning over customers.

Examples are beginning to be rolled out across the globe.

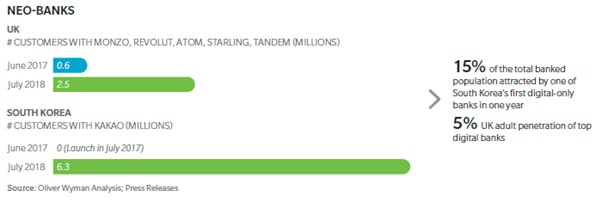

In consumer banking, digital “neo-banks” such as South Korea’s Kakao have attracted 6 million sign-ups in less than a year. In Britain, startups Monzo, Revolut and their peers boast 5 million customers. RBS Group will soon launch Bó, a greenfield digital offering, built with new technology in under 12 months. National Australia Bank has had success with QuickBiz, a fully digital unsecured lending solution, and German insurer ERGO has built Nexible as a challenger to its existing auto insurance business. Goldman Sachs launched Marcus in the U.S. and Europe, allowing it to enter consumer banking.

Faster Time-to-Market

Digital challenges are gaining traction in parts of the financial services market, even while facing skepticism about whether they can scale up. What’s interesting are the possibilities these new businesses point toward: the falling time-to-market, the possibility of significantly lower run costs, and the fact that new business models and data-driven approaches are winning customers.

To be successful in the future, financial institutions need to have the same advantages as digital challengers. The State of the Financial Services Industry 2019 report by Oliver Wyman compares a group of traditional banks with a group of digital challenger banks. The average number of customers each person in a challenger bank serves is over 2,500, compared to 1,000 in existing banks. Digital challengers launch new products or services in two weeks—compared to three-to-six-month release timetables for traditional firms. And the cost to acquire a new current account customer is $30 for the new breed of banks, while a traditional bank spends $150 on average.

A Catalyst for Change

Greenfield is a method for existing firms to build new businesses. A business starts with a specific customer need, typically identified from existing customer data, in an area that is already strategically important.

Greenfield businesses help to accelerate change in the parent organization. Conventional wisdom gets heavily challenged, customer offerings can be tested more quickly, and access to external innovation is improved. As it expands, the operating platform can be leveraged across the whole business, providing an alternative approach to transformation.

Start with the Customer

A greenfield build is an attempt to break free from the constraints imposed by existing systems, business models, and talent models. To succeed, it needs to start from the customer, put data and analytics at the core, have a distinct culture and governance, and be built so it can scale up, while meeting security demands.

To drive growth in today’s environment, financial services firms need to get on the front foot and build. Rich seams exist across all financial services from which new solutions can be developed and expanded into greenfield businesses.

With the development process getting cheaper and the potential to reuse components across the business, the downside is small. Most important of all, senior management must believe in the endeavor, give it sufficient time, support and attention, and proactively drive the benefits back into the core business.