Has the Belt and Road Initiative Become a Political Liability for China?

An engineer stands at the site of the Southern Expressway from Matara to Hambantota in Sri Lanka, one of the major infrastructure projects of the Belt and Road Initiative.

Photo by Paula Bronstein/Getty Images

Given the international community’s ambivalent attitude toward the so-called Belt and Road Initiative, the world will be closely watching the second BRI Forum, which is due to be held April 26-27 in Beijing. Two years after the first BRI summit, which was greeted with enthusiasm by the developing world, things have changed rather quickly.

Since President Xi Jingping announced the Belt and Road Initiative in late 2013, shortly after his arrival to power, China has invested some $300 billion in it, mainly in connectivity among neighboring countries. While the project is only five years old, President Xi Jingping’s grand plan for China’s global expansion has elicited strong reactions from the rest of the world, both from countries that will benefit from the BRI as well as other major players, such as the United States and the European Union.

A Tool of Soft Power

Over the five years since its announcement, the BRI has evolved in terms of its objectives: from its initial economic focus related to trade connectivity—and a way for China to export its excess capacity—to much more of a soft-power tool. A large number of the BRI’s infrastructure projects now appear to be strategic rather than economic in nature.

This change in tone is driving the increasingly negative view of BRI in the West with the EU expressing concerns about China’s strategic ambition at the annual EU-China summit earlier this month. Nonetheless, this has not stopped Italy from becoming the first G7 country to formally join the BRI. There has also been backlash in the developing world where recipients of BRI’s infrastructure projects are having to borrow aggressively to be able to finance them.

Worsening Sentiments

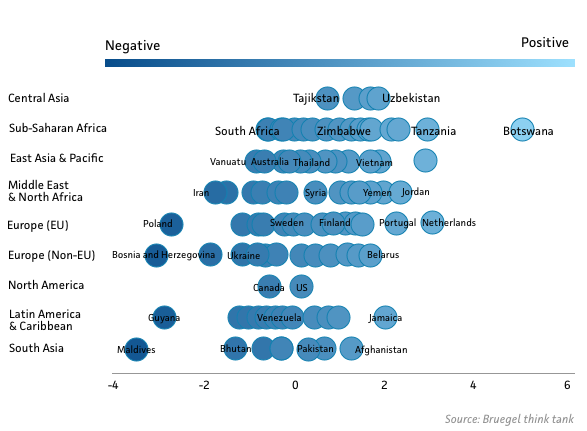

A recent analysis that we conducted confirmed that sentiment toward the Belt and Road has indeed worsened in many countries. Our report, which drew data from the Global Database of Events, Language, Tone (GDELT) that covers broadcast, online and printed news from 132 countries in over 100 languages, shows a sharp move away from an averagely positive image before 2018 to a negative one thereafter. The only exceptions are the Middle East and North Africa. The worsening image of BRI is a wake-up call for China as it seeks to increase its soft power globally.

Sentiment towards BRI

Too Many Objectives

Too Many Objectives

Our analysis offers some insights into the reasons for the worsening image of BRI. The first and foremost is trade. Countries appear increasingly wary of excessive dependence on Chinese imports and an imbalanced trade pattern. In addition, the difficult debt dynamics in recipient countries are an issue.

More generally, China may have been piling up too many objectives under the guise of the BRI, some of which could be inconsistent with one another as it tries to replicate its internal way of doing business in overseas markets: using China’s resources and materials with a clear flavor of state capitalism.

While keeping state-owned companies busy with BRI projects may be appealing from an economic perspective, it only exacerbates foreign concerns, weakening China’s international image. Most of the recipient countries welcome infrastructure financing from China, but also expect transparency and fair competition. The latter is at odds with China’s existing strategy.

The fact that the BRI’s image is suffering is also demonstrated by the announcement of alternative proposals from both the U.S., through its Indo-Pacific strategy with Australia, India and Japan, and the EU with its EU-Asia connectivity plan. Some argue that the BRI may have been the tipping point for the U.S. administration to move from engagement to containing China, which has contributed to the current trade war between the two.

Learning How To Handle Soft Power

While painful, this is not a complete negative for China, as it is clearly learning how difficult it is to acquire soft power, no matter a country’s economic size. In fact, such a backlash offers China an opportunity to explore a more sustainable strategy. China is realizing that a confrontation with the U.S. may not be a winning strategy, no matter the economic benefits.

Given the diminishing returns on investment at home, China needs to expand in overseas markets, but it should not do so by excluding other investors from benefiting from such projects. Against this backdrop, the next path for China’s Belt and Road needs to be a more flexible and open route to building its soft-power image.

The worsening image of the Belt and Road is definitely a wake-up call for China in its pursuit of increasing its soft power globally.

A More Flexible Approach

To that end, China has recently made a number of strategic changes regarding the BRI, which have largely remained unnoticed, given the lower-key approach.

First, China has sharply increased the number of countries signing MOUs from the original 63 to 150. The key is to make the Belt and Road less targeted, so as to limit the West’s geopolitical concerns about this project.

Secondly, China is trying to use a more multilateral framework to push the BRI, and especially the Asian Infrastructure Investment Bank. Such a multilateral framework retains Chinese characteristics, thereby allowing China to keep the ultimate control of key projects, but it also offers room for other developed countries to get involved, especially Europe and South Korea.

China may be willing to make some compromises in the way it shares the benefits of the BRI, but multilateralizing the strategy does not equate to a full retreat to the Western model.