How a Digital Twin Can Create Faster Stress Testing

An employee presenting a graph to his coworkers. Strategy groups are increasingly factoring in emerging risks using scenario sets.

Source: Shutterstock

Strategy groups are increasingly factoring in emerging risks using scenario sets. In a recent Enterprise Risk Management Survey, 63% of respondents said their company uses scenarios as part of their business risk analysis. The most reported applications include: annual supplier renewal and reviews, capital allocations and reviews, company annual reports and viability statements, information technology infrastructure, insurance/reinsurance purchasing, preparedness planning, strategic planning, market assessments, and risk tolerance and appetite benchmarking.

The Cambridge Scenario Suite provides an extensive list of scenarios that have the potential to provide significant global-scale disruption to finance, economics and trade for companies operating in certain regional markets.

The Digital Twin

But while a risk lens can offer focus, it is not always clear how to align this view with measurable business relevancy.

Stress tests are common within a medical context, and this concept of a “digital twin” is being adopted by businesses to depict the ability to efficiently administer stresses and measure responses — i.e., by pairing stress parameters with response readings. A digital twin can be seen as the human body equivalent for a company.

A digital twin of a company can help translate a company’s “stresses” into a quantified view of real balance sheet consequences. The ability to exercise a digital rendition of a company can allow faster stress testing against a broad range of scenarios. We propose five key attributes for a digital twin of a company that best allow for a quantitative risk picture:

- Balance sheet and future five-year earnings

- Market and distributions

- Product mappings

- Production and manufacturing footprints

- Supply chain deconstruction

An Anonymized FTSE 100 Company

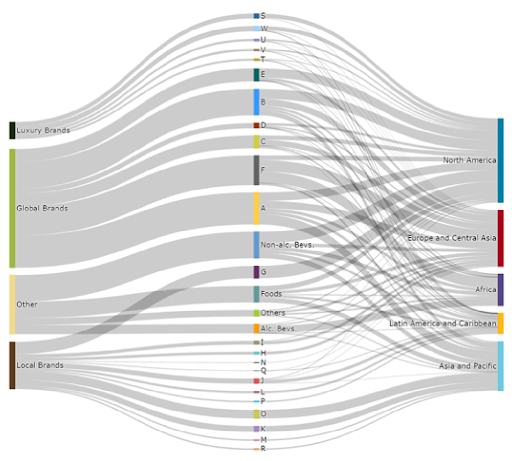

A newly released case study, Risk Management for the Consumer Sectors draws on information modeled from several real businesses to create various elements of an anonymized business. The business’s digital twin is built across these five key attributes, for example, Figure 1 is an example of the market and distribution attributes of the digital twin with Categories A-W representing specific brands within each category.

Figure 1: Market and Distribution of Net Sales for an Anonymized FTSE 100 Company:

Source: Cambridge Centre for Risk Studies; Data from simulation of consumer sector companies in the FTSE 100.

This company model can be used for superimposing any set of stress test scenarios. Global companies self-report their risks in annual filings according to jurisdictional regulatory guidelines. Being U.K.-based, the case study is required to include a consideration of the principal risks and uncertainties facing the company.

As is the case for many companies, the reported risks are generic, referencing a combination of threats, consequences and management measures, while lacking detail on specific scenarios through which these risks might manifest.

Assessing Actual Loss

The challenge of proposing a scenario-based methodology lies in applying loss modeling to a business from a wide variety of disparate causes of risk.

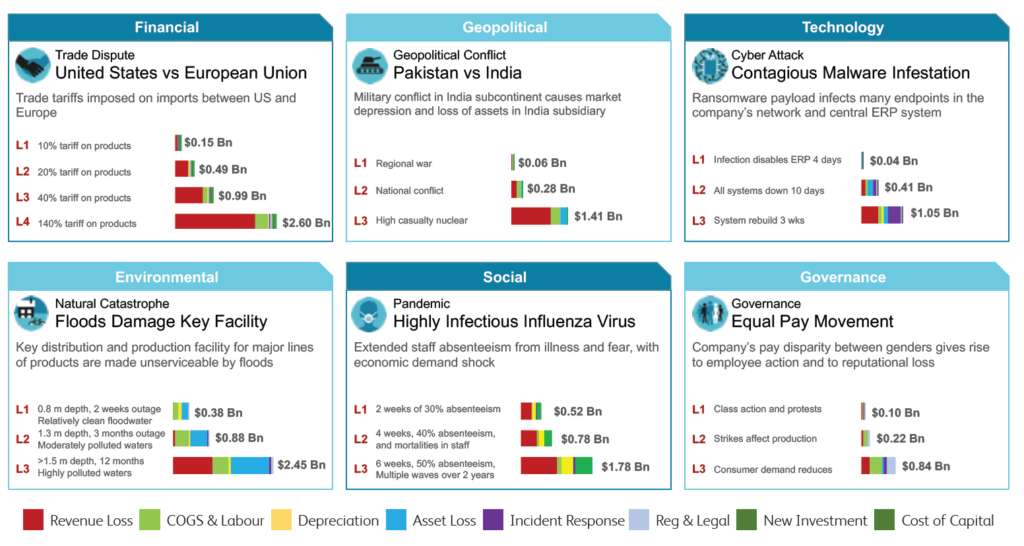

Each scenario stress test is translated to shock each of the attributes of the digital twin and thus estimate the lost value that would result, if that scenario were to occur. The valuation metric of choice is the five-year enterprise value at risk, which is calculated as the net present value of the future cash flows of the business, by applying discount conventions. The financial impact results highlight that each scenario has a distinct loss profile.

Figure 2 shows the results of the analysis of six selected scenarios, with three levels of severity for five of the scenarios and four levels of severity for the first scenario (financial).

Results are indicated by their impact on six categories of variables of the balance sheet, aggregating the 18 financial metrics of the modeling.

The losses are provided in monetary value, summing the losses over five years in terms of depletion of the enterprise value of the organization. They range from $60 million ($0.06 billion) to $2.6 billion. Five events cause a loss of over $1 billion to the organization. The annual net income to the organization is $3 billion, so these are very material scenarios. Four of the events out of the 19 cause losses that exceed 10% of the value of the enterprise.

Figure 2: Scenarios Application Results from a Digital Twin

Source: Cambridge Centre for Risk Studies; Data from simulation of consumer sector companies in the FTSE 100.

While scenarios present hypothetical what-if situations, they offer opportunities to stress a company’s strategic plan. The addition of a digital twin allows for a more tangible and dynamic discussion around a company’s risk appetite and tolerance.

Subsequently, risk mitigation actions can be formulated for both threat-specific mitigations as well as general resilience-strengthening purposes. A deeper study would expand the analysis to dramatically increase the number and type of risk scenarios, given the unpredictability of catastrophic events that global organizations experience.