How Banks Can Keep Up With Digital Disruptors

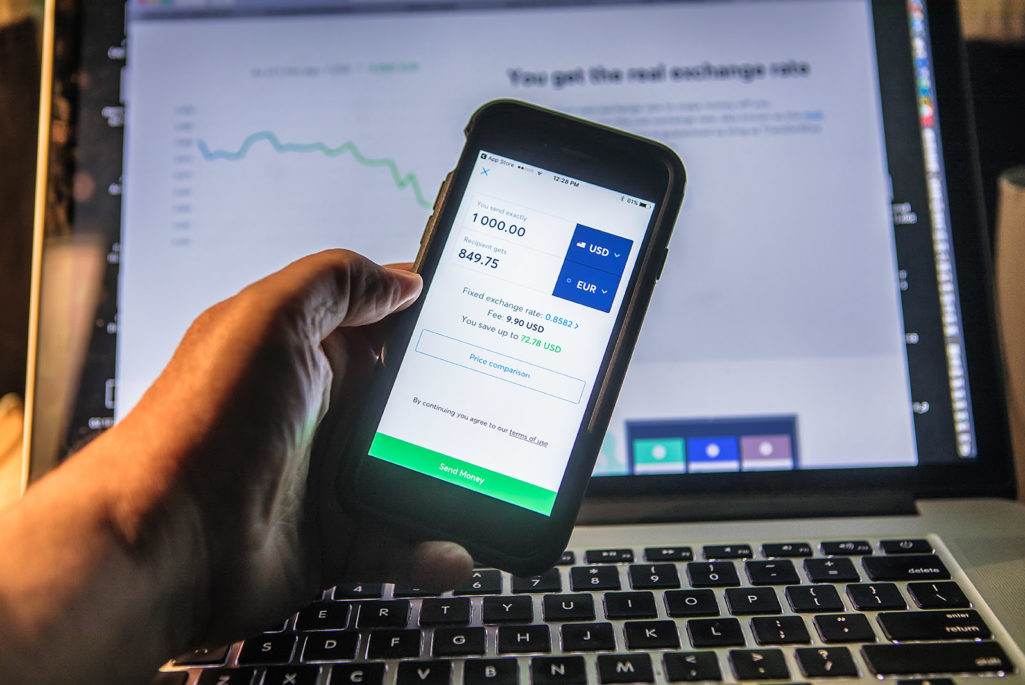

Despite their historic advantages, banks need to start transforming themselves to deliver highly personalized physical and digital experiences. One way is seamless banking, such as the TransferWise app shown here, which takes the pain out of moving money across borders.

Photo: Brock N Meeks/BRINK

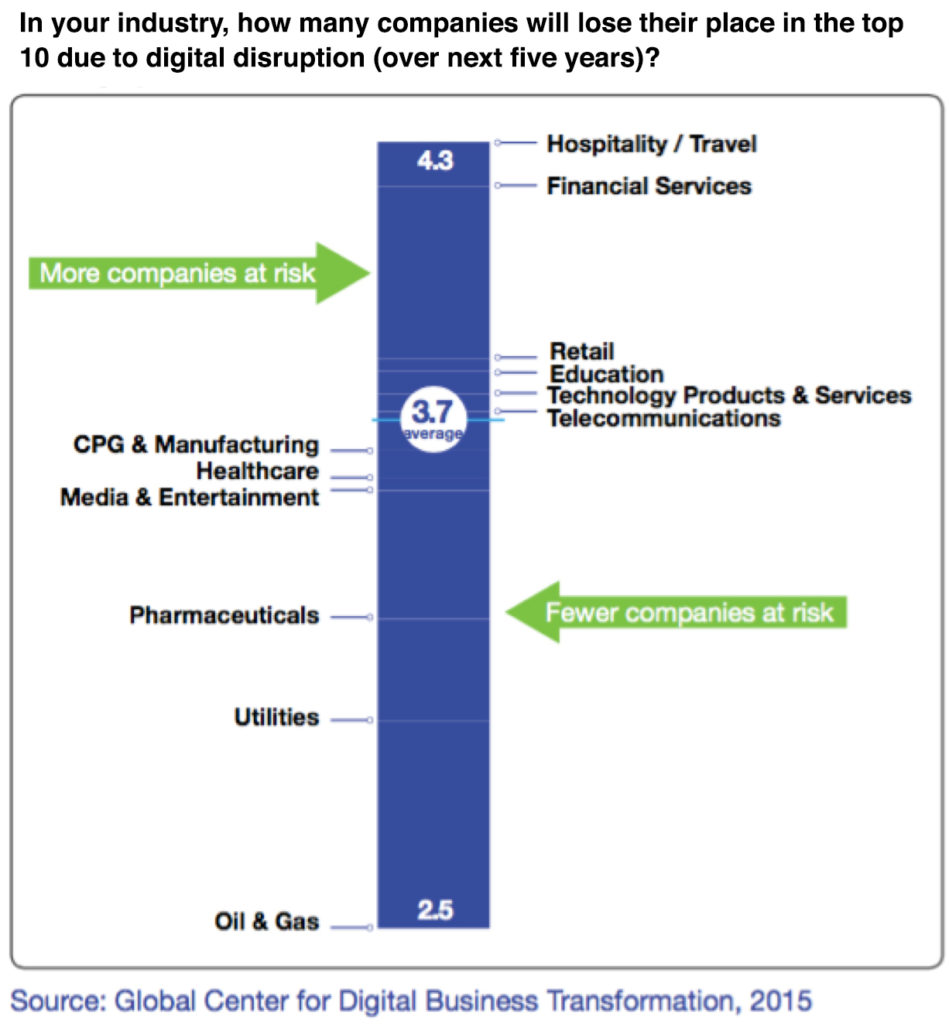

Hardly a day goes by without seeing a new business article or blog post on digital disruption. Blockbuster is dead, taxis are struggling and hotels are losing customers, who are increasingly renting rooms in homes of ordinary people. We get it: Incumbents get disrupted by new entrants armed with digital technologies, talented and highly incentivized teams and fresh venture capital. There are very few industries in which CEOs do not live in fear of digital disruption.

Banking is no exception: Executives believe digital disruption will drive 40 percent of companies out of the top 10 in the next five years. As Antony Jenkins, former CEO of Barclays, aptly put it in a 2015 speech: “Over the next 10 years, we will see a number of very significant disruptions in financial services, let’s call them Uber moments.”

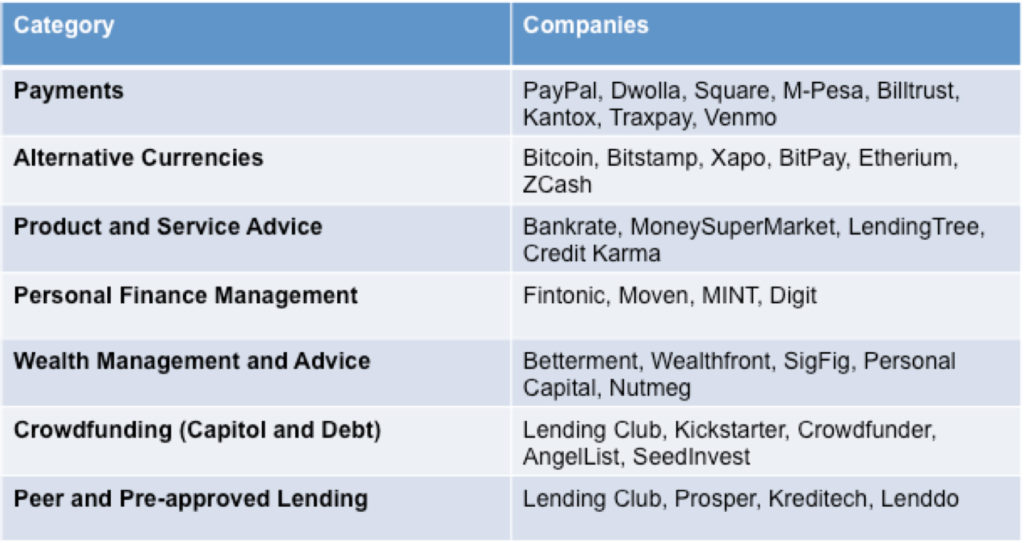

Ten years may be wishful thinking, as significant disruption is already happening. Massive investments in fintech are spawning a wave of new companies reinventing everything from payments and money management to lending and financial planning. The chart below shows examples of companies disrupting financial services. Some analysts believe Fintech disruption could take as much as 10 percent to 40 percent of bank revenue and eliminate 1.7 million banking jobs by 2025.

Couple this with increasing regulation, historically low interest rates and the fact that most (73 percent) millennials would prefer to get their banking services from a non-financial services company, and banks seem to be headed the way of Blockbuster.

Before we declare the game over, let’s think about some of the unique advantages banks possess.

Frequency. Next to social media platforms, banks are the second-most frequently touched platforms in our lives. People engage with their banks 17 times per month on average, versus 14 times per month for retailers. Most brands spend billions to increase customer engagement. Banks already have it, yet bank loyalty is not much better than cable companies.

Reach and trust. The blend of physical and virtual touch points can extend to more of people’s everyday needs; people want to know banks are nearby and part of the community. Defunct online banks such as Wingspan and ING Direct, now Capital One 360, didn’t scale without the brick-and-mortar element, much like Amazon, the e-commerce giant, now sees the need for physical presence with the roll-out of lockers, pick-up points and even Amazon Go stores.

Knowledge. Banks have an enormous amount of data on customers and their needs, spanning from where you work to what you buy, how much you save and even where you like to vacation. Banks should know if you have a side job as an Uber driver to save for a new house and therefore be ready with a business banking account, a car loan to upgrade and even home-financing options. Yet most of this data lives in silos across disparate data sources, preventing these types of integrated offers.

Despite these historic advantages, banks need to start transforming themselves from inflexible, analog monoliths to delivering highly personalized physical and digital experiences in order to be relevant to the next generation of banking consumers. The key opportunities to do this are the following:

Make banking seamless. When Disney launched its MagicBand wristband at its theme parks, the company integrated a wearable that combined frictionless transaction and personalization features that improved the customer experience and increased consumption by around 8 percent per guest without requiring additional effort on their part. Banks need to do a similar job of integrating banking into everyday life experiences to stay relevant. Examples include BBVA’s Wizzo app, which makes getting and sharing money easy; TransferWise, which takes the pain out of moving money across borders or Quicken Loans’ Rocket Mortgage, which enables mortgage approvals when you need it.

Hyper-personalize. While 69 percent of customers have tried mobile banking, only 25 percent use it regularly. Much like the challenge other mobile apps face in maintaining ongoing engagement, banking apps tend to lose relevance by using a one-size-fits-all approach, failing to leverage recent activity patterns and context, and not taking advantage of different modes of engagement based on what users prefer. In order to deliver “hyper-personalized” experiences that increase engagement, banks must combine predictive analytics with multiple modes of interaction. By using data to adapt to customer behaviors, banks can determine which customers will respond well to self-service robo-advisors versus human ones, or which customers can elevate their financial literacy and savings discipline through apps such as Simple or Digit. With emerging touchpoints such as voice agents and wearables, the opportunity to capture data and personalize will only improve.

Turn branches into experience centers. Nearly 6,000 bank branches have been closed in the U.S. since 2009, according to the FDIC, and with greater digitization, the trend seems to shift away from physical touchpoints. As we see in retail, the leaders are figuring out how to rationalize their physical space with smaller footprints and automation while also equipping employees to become ambassadors in the customer experience, since brick-and-mortar conversion rates (25 percent) are still significantly higher than online (2.3 percent).

Retail brands such as Sephora and Nike have enabled customers to easily move from online to the local store experience by allowing them to browse store inventory, make appointments and even interact with associates. Bank of America has started to connect its online and local branch experience more tightly via its mobile app, and Capital One now has 16 banking cafes aimed at creating a more relaxed banking environment. The industry as a whole is still behind when it comes to offering a truly connected and personal branch experience. To make the experience more like Starbucks and less like McDonald’s, banks will need to ramp up investments in automation (digital integration, automated tellers) as well as attracting and training talent to match the new digital-savvy customer base.

Adopt a customer-centric innovation model. In this new era of empowered digital end users, either you find a way to make the customer part of your innovation model or they will innovate around you. The best part is organizations that do this well—such as Waze, Pandora and Betabrand—are incredibly capital efficient because they leverage OPM, or “Other People’s Money,” via smart devices, broadband connections and social media platforms that someone else already paid for.

J&J has created a patient experience center for iterating on new healthcare innovations firsthand with patients and providers before deploying into the field. In the case of the African micro-finance service M-Pesa (created by Vodafone), it was the local wireless carrier, Safaricom, that saw the opportunity to innovate around the large population of unbanked mobile consumers, and the two teamed up to do it. Now M-Pesa has become the largest payment platform in sub-Saharan Africa. In banking, TD Bank partnering with Moven to engage millennials with basic banking services is a good example of customer-centric innovation, but banks still have a long way to go to fend off consumer-centric players such as Apple, Google and Amazon from disrupting their markets.

Create a two-speed business model. When GE CEO Jeff Immelt declared that the data coming from equipment is now worth more than the equipment itself, it forced GE to rethink how it captures and delivers value to its future customers. As part of GE’s transformation, every business unit now has a chief digital officer, and GE Digital is becoming one of the largest industrial software companies in the world, projected to generate $15 billion by 2020.

In a similar vein, BBVA chairman Francisco Gonzalez has said that the innovation process for banks “might be compared to changing the tires of a truck while still in motion.” BBVA started its journey towards a two-speed business capable of big innovations (“Big I”) more than seven years ago, shifting from an 80/20 current operations/future innovation focus to 60/40. This came with dramatic changes to the organization structure, a dedicated digital organization and a number of external innovations and ventures that allowed transformation of the company while still executing on the current business.

Other banks are starting to follow suit, such as Citi with its Innovation Labs, Umpqua with its Pivotus Ventures subsidiary or Rabobank incubating its MyOrder venture separate from the core business. In order to support continuous innovation in the core business, or “Little I,” in parallel with creating and accelerating “Big I” innovations that will likely disrupt the core business, banks need to have talent aligned to both missions. They also need an agile infrastructure that supports rapid experimentation along with the reliability, security and scale required by the core business. IT is no longer just the cost of doing business, but a key enabler to innovation.

In October, banking regulator Office of the Comptroller of the Currency (OCC) established an Office of Innovation, implemented a framework for responsible innovation, and is even exploring special bank charters for fintech companies. With the potential for a more relaxed U.S. regulatory environment under the new presidency, we could see these innovation avenues open up even further. This is similar to what the FDA has been doing around digital health and mobile medical apps: establishing guidelines and examples to facilitate innovation versus being a barrier to it.

While there are signs of progress on the regulatory front, most banks continue to lag on digital innovation. Despite being one of the top sectors for technology investment over the last two decades—including the creation of major products such as ATMs, debit cards, credit scoring and check scan and deposit—banks are lagging behind other industries, such as those in retail, transportation and even healthcare, when it comes to digital transformation.

The good news is that banks are still very well-positioned to win with the new wave of empowered digital customers, given their rich historic data and balance of physical and digital touchpoints; however, it will take a strong commitment to a customer-centric vision, a two-speed business model and agile infrastructure to enable “Big I” innovation and a data-driven approach to delivering personalized, relevant banking experiences.

For bank executives, it’s time to decide if you want to be Netflix or Blockbuster. Your customers won’t wait forever.

This piece first appeared on Knowledge@Wharton, which is the online research and business analysis journal of the Wharton School of the University of Pennsylvania.