How Can Securities Companies Adapt to the Evolving Wealth Management Landscape in China?

This photo illustration shows Chinese 100 yuan notes in Beijing. Though China ranks fourth globally in terms of high net worth individuals (HNWIs) population after the U.S., Japan and Germany, China’s financial services for HNWIs are in nascent stages of development.

Photo: Fred Dufour/AFP/Getty Images

For the past decade, wealth in China has been accumulating rapidly, with the number of high net worth individuals (HNWIs)—or individuals with investable assets of 6 million yuan ($881,834) or above—reaching 1.3 million in 2015, with total wealth valued at 4 trillion yuan. While China ranks fourth globally in terms of HNWI population after the U.S., Japan and Germany, financial services for HNWIs in China is still a nascent industry.

A large portion of HNWIs are newly emergent, and their wealth has accumulated only in recent decades along with China’s economic growth. As such, many HNWIs lack knowledge and experience in the financial market. As examined in a recent report, this results in polarized risk appetites (either highly conservative or highly speculative with risky investments) and less sophisticated demand of wealth management products (WMPs)

Meeting the Demand

Catering to such characteristics, China’s financial institutions predominantly offer high-yield fixed-income products (mostly nonstandard assets, such as assets not traded on the interbank bond market or stock exchanges, including trust loans, bills of exchange and other credit products), leading to a highly homogeneous supply. Firms generally lack incentives to develop new or innovative WMPs, driving investors’ reliance on existing products further and creating a vicious cycle.

However, the model is now breaking down due to China’s decelerated economic growth, which cannot continue to support the promised high return. Recently, Chinese regulators have been trying to abandon rigid or guaranteed repayments, and a few cases of breaking the “implicit guarantee” of bank WMPs have been reported.

Meanwhile, China’s capital market is seeing the emergence of various tools and structuring mechanisms, providing a new way to manage wealth. HNWIs have a close relationship with the capital markets as many have created their wealth through initial public offerings and securities investment. For example, among the first 28 firms listed on China’s Growth Enterprise Market in 2009, on average each firm led to the creation of three billionaires.

There are four distinct groups of HNWIs:

- Family. Wealth is mainly from family inheritance. On average investable asset per capita is 300 million yuan.

- Entrepreneurs. Business operation is the major source of income, with 40 million yuan per capita.

- Traditional HNWIs. Wealth comes from wages as well as investment; about 15 million yuan per capita.

- Professional investors. 160 million yuan per capita.

The report also identifies a group of “new rich,” comprising those who earn high wages and have the potential to turn into HNWIs later. Their average wealth is 2 million yuan.

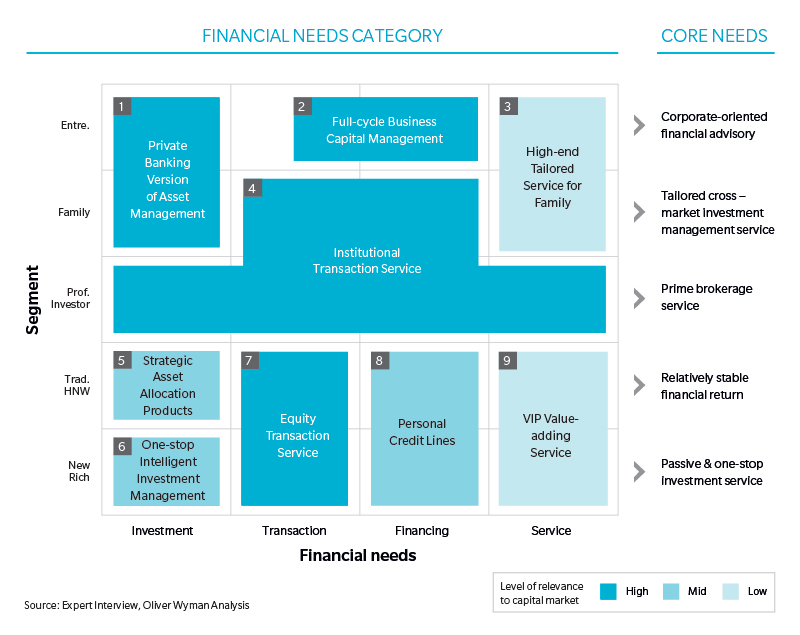

Analyzing the five groups of customers, we see nine different types of financial needs across the spectrum of transaction, investment, financing and servicing (Exhibit 1), many of which are highly linked to capital markets.

Exhibit 1

Securities Companies’ Unique Position in the Capital Market

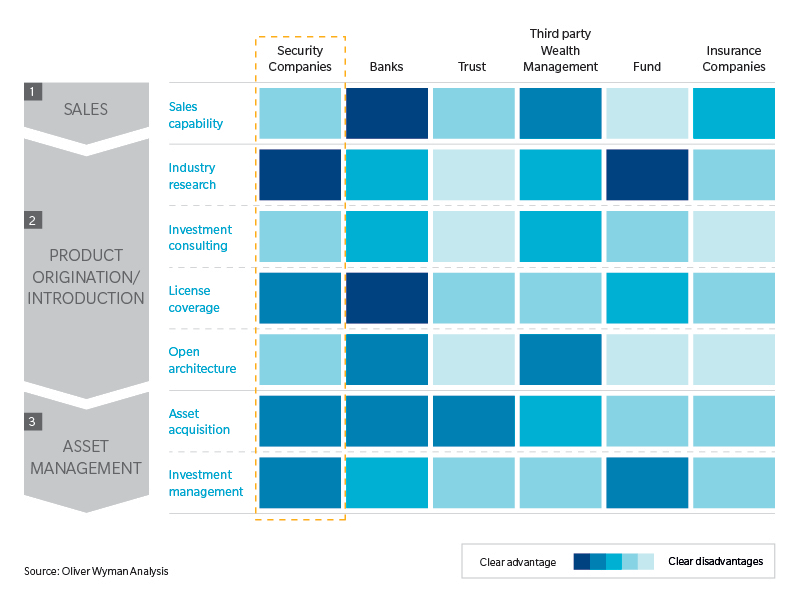

While different types of financial institutions compete in the wealth management market, each has distinct capabilities along the investment management value chain (Exhibit 2).

Under the “separate operation” scheme, cross operations among banking, insurance and securities businesses is prohibited. As such, securities companies hold a unique position as the only ones with capital market offerings, and they enjoy the advantages of being able to provide financing solutions for entrepreneurs and prime-brokerage platforms for professional investors.

The underlying asset is the source for investment returns. Securities companies have advantages in obtaining primary assets that benefit from their licenses, including primary equity market, securitization and other financial derivatives. They also excel in investment management, which can be seen from the fact that banks entrusted more than 20 percent of wealth management funds to securities companies in 2015.

However, while many banks and third-party wealth management organizations have established online platforms and open architecture to offer wide product coverage and have invested additional resources to engage HNWIs, most securities companies are lagging behind on building such frameworks.

Consequently, while securities companies have advantages in research, product design, and asset acquisition across primary and secondary markets, they have focused on institutional investors and proprietary investment—if they can “retailize” these capabilities, securities companies can offer unique values to HNWIs.

Time to Rethink Strategy?

The key question for securities companies is how they can draw HNWIs and what factors can determine their success at doing so? In an environment of compressing brokerage fees, securities companies need to evolve from a traditional fee-based and transaction-driven model to a customer-centric, solution-driven business. Some key strategic agenda items to consider include:

More granular customer segmentation. Companies need to understand the differences in customers’ needs and prioritize customer segments based on relative strengths. For example, entrepreneurs should be the priority clients for securities companies with better capabilities in servicing private enterprises.

Build layered services and distribution channels to serve different customer types and needs. For example, for family and entrepreneurs, securities companies can leverage their advantages in fund raising, securities investment, and mergers and acquisitions to provide integrated services to both individuals and their companies. While for traditional HNWIs with low trading demand, companies may need to introduce banks or third-party wealth management firms as a separate team to serve them.

Retailize core advantages in institutional business to service HNWIs. These include asset acquisition in primary and secondary markets, industry research and investment management. Companies need to be mindful that organization structure and service procedure standards also need to be updated for retailizing these traditional institutional services to HNWIs.

Broaden and build comprehensive offerings by establishing open platforms. To be able to offer one-stop intelligent investment services, securities firms should promote their own star products based on their unique positioning, as well as introduce complementary third-party products/services.

Adopt innovative technology to improve customer experience. With big data analysis, artificial intelligence wealth advisory and other new technologies being gradually applied to wealth management, securities companies need to start considering strategic plans to adopt these innovations.

While organizations contemplate their forward-looking strategies, they also need to be aware of the ensuing risks. The Chinese government is taking a tough stand against corruption; therefore, it would be critical to ensure comprehensive know-your-client procedures are in place. Additionally, risks relating to customers’ private information being leaked and cyber attacks are emerging as firms are digitizing their operations.

Securities companies will need to develop a comprehensive roadmap detailing changes for the organization including governance, talent strategy, operations, and information technology in order to capture a larger share of the growing HNWI market, while containing the accompanying risks.