How Climate Resilient Is Your Company?

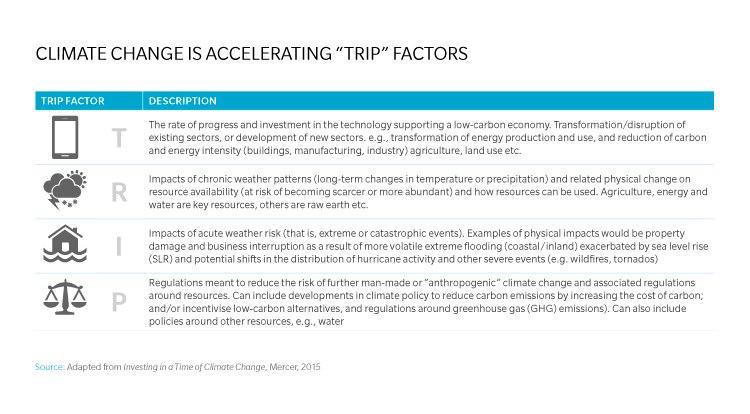

The low-carbon economic transition will include changes in policy, regulations, technology, and the market in response to mitigation and adaptation related to climate change.

Photo: Lukas Schulze/Getty Images

Companies can have a “blind spot” when it comes to the impact of climate change. Climate risks are frequently seen as an issue too complex and too distant to quantify, rendering the perception that they are too indistinct and abstract to justify a given business decision.

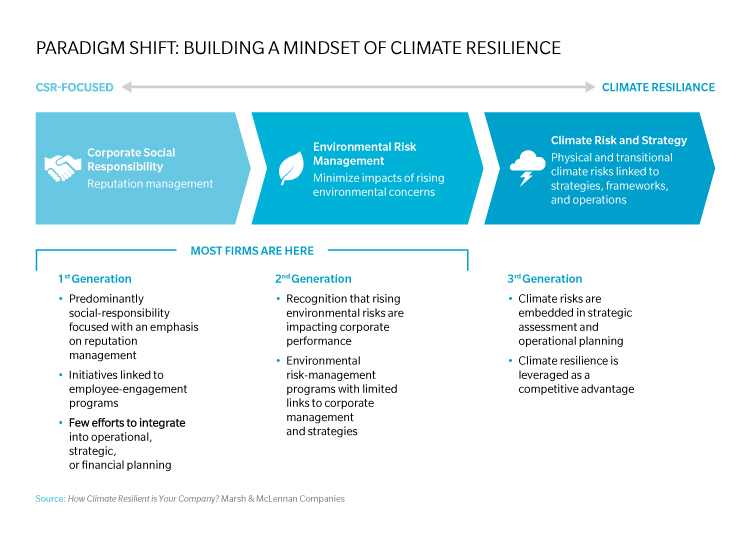

Predictions of rising sea levels or other physical impacts by 2050 or 2100 do not align to typical corporate operational and strategic planning timelines of 12 to 36 months. In other instances, companies respond to climate risks narrowly via corporate social responsibility goals in the area of sustainability reporting. Consequently, they have focused the management of climate risks to being compliant with regulatory or market standards.

However, to consider climate risks simply in terms of mid- to long-term direct physical impacts or as a corporate social responsibility issue raises the risk of lost opportunities to build climate resilience in the transition to a lower-carbon economy. The low-carbon economic transition will include changes in policy, regulations, technology, and the market in response to mitigation and adaptation related to climate change.

Changes Are Much Closer and Evolving Faster

Since the 2015 Paris Agreement on climate change, more than 190 nations worldwide have indicated their commitments to the goal of limiting the rise in global average temperatures to less than 2 degrees Celsius. Notwithstanding the announcement that the United States will withdraw from the agreement, global support for the commitments that were made in Paris has remained steadfast. Across every industry, the increased focus on climate change is interacting with and accelerating other major global trends, such as disruptive technologies, digitization, urbanization, and evolving demographics. These rapidly changing economic activities and shifting technologies, combined with new policies and regulations, are racing us toward a lower-carbon economy.

In addition to these global trends, companies are facing pressures from five major forces to better assess, redefine, and enact strategies to increase their climate resilience.

Investors, customers, and supply-chain partners are raising issues regarding direct environmental impact and indirect risks associated with climate change with greater frequency and urgency. In addition, policymakers are enacting regulations in response to climate change, and the shift to de-carbonization will drive dramatic structural changes across the economy.

Going on the Offense to Build Corporate Resilience

As businesses around the world prepare to face immediate and rising climate-related pressures, proactive and forward-thinking companies that go on the offensive to build climate resilience will gain a competitive edge. A paradigm shift in outlook is necessary. Companies must pivot from a primarily defensive CSR focus to an offense-oriented mindset, which embeds climate-related risks and opportunities in the company’s strategy and operations.

Getting Started on Building Climate Resilience

Before taking actions, corporate management and the board must first develop a robust view of how climate change impacts—directly and indirectly—affect the business, company performance, and financial earnings. Or put differently, they need to address the question: What is our climate resilience?

Here are three potential actions that companies can take to build an assessment of their current climate resilience. These insights can help support organizations’ decision-making process concerning capital allocations, operation management, and risk mitigation.

Assess vulnerability to climate risks

Climate change and the exacerbated extreme weather events can have devastating effects on property and critical information infrastructure, with lasting impacts across companies of all sizes. A study conducted by the U.S. National Flood Insurance Program revealed that over 40 percent of U.S.-based small businesses do not recover from weather-related disasters.

The impacts of extreme weather events are also felt throughout local and global supply chains and can significantly erode an entire sector’s profitability. For example, the severe impacts of Hurricane Harvey in August 2017 resulted in significant operational disruptions to ports, airports, railways, roads, and oil refineries. In Texas, both the George Bush Intercontinental Airport and the Port of Houston were completely shut down for up to five days following Harvey’s landfall, causing massive backlogs and re-routing throughout the U.S. aviation and maritime systems. With oil refineries and distribution pipelines affected, fuel prices across the nation spiked up to 20 percent within a week of landfall. Initial economic losses are conservatively estimated between $70 billion and $90 billion, with a significant portion of the losses due to uninsured property, although actual losses in the aftermath may affect the GDP growth of the nation’s economy.

Companies can undertake a geographic portfolio review, mapping demographic and infrastructure vulnerabilities to natural hazards, and thereby identify the aggregated weather exposure with respect to location, facility and asset. Companies can then apply a variety of instruments in their risk-mitigation toolkit to enhance their physical, operational, and financial resilience. For example, enhanced business continuity planning—constituting supply-chain analyses and operational recovery strategies—can identify opportunities to maximize operational resilience.

Embed climate risks into enterprise risk management

Companies can also leverage existing enterprise risk management and risk assessment processes to increase their awareness of climate risks, better assess resilience across the organization, consider additional areas of analysis and risk mitigation, and develop appropriate management approaches.

Indirect transition risk of climate change, including shifting regulatory and customer demands, is a real and complex component of such assessments and should be embedded in enterprise risk management programs. For example, carbon-reduction strategies are often deployed under considerations of resource-constraint risks or regulatory risks.

Drawing on its risk assessment, an organization can identify means of increasing its climate resilience through direct physical risk mitigation, such as infrastructure reinforcement in coastal areas, or by implementing initiatives, such as sustainable supply chains and operational processes.

By ensuring that physical and transition climate risks are incorporated into a company’s risk register and management programs, risk managers can identify optimal responses and opportunities to improve corporate performance and financial earnings.

Undertake scenario analyses

Finally, by explicitly defining and separating external scenarios, such as changing weather patterns and evolving political and regulatory environments, from the internal business plans, scenario analysis ensures that the corporate strategies and plans are robust and viable under different plausible outcomes.

The effects of climate change on specific sectors, industries, and organizations are highly variable. Thus, organizations ought to apply scenario analysis in strategic and financial planning, as well as in their risk-management processes. Indeed, the Financial Stability Board’s Task Force for Climate-Related Financial Disclosures recommends the use of such techniques, noting: “Scenario analysis is an important and useful tool for understanding strategic implications of climate-related risks and opportunities” and for informing stakeholders about how the organization is positioning itself in light of these risks and opportunities.

As boardrooms and C-suites begin to examine how a changing climate is affecting their business, the urgent need to increase climate resilience as a business fundamental is evident. Companies that can successfully identify physical and transitional climate risks, and integrate these risks into strategic and operational planning, can better position their companies to improve climate resilience.