How the Board Can Be a Company’s Strongest Strategic Asset

The board of directors can be a company's strongest strategic asset with a bit of nuanced strategy.

Stephen Bradley/Flickr

The world in which corporate boards operate has been transformed in fundamental ways in recent years. The operating environment has changed dramatically: Globalization, the ascendency of the internet, corporate scandals and financial crises have fundamentally altered the business risk landscape, unleashed mountains of regulatory requirements and prompted greater engagement between investors and companies.

All of these changes have resulted in greater director accountability and new areas of oversight, which is why the modern-day board must be one of the company’s strongest strategic assets. This need to encourage self-driven transformation was the impetus for assembling the 2016 Report of the NACD Blue Ribbon Commission on Building the Strategic-Asset Board.

Building boardroom leadership is no easy task, in part because director turnover remains low, particularly in the U.S. According to a 2015 NACD survey of some 1,000 public company directors, boards added 1.2 directors on average to either replace a director or expand the size of the board. That trend is drawing increasing scrutiny from the investor community. A recent report found that 41 percent of the 413 shareholder activist campaigns mounted in 2015 were intended to unseat a director. In addition, the California Public Employees’ Retirement System and the Council of Institutional Investors updated their proxy voting guidelines to call investors to consider length of service as an indication of independence.

Consider these statistics in conjunction with a few troubling boardroom trends. NACD public company survey data indicates that more than 50 percent of boards do not conduct individual director evaluations. In its own study, the Committee on Capital Markets Regulation found that, between 2010 and 2014, 85 percent of the directors who failed to receive majority shareholder backing remained in their board seats.

Although board composition has become a battleground issue, emphasizing change for the sake of change not only fails to get at the heart of the issue, it’s a line of thought that can ultimately undermine the efficacy of the board. Specifically, director tenure becomes a target of public criticism. While some readily conflate length of service with an inability to provide independent oversight, long-standing directors can bring invaluable industry experience and institutional knowledge to boardroom deliberations.

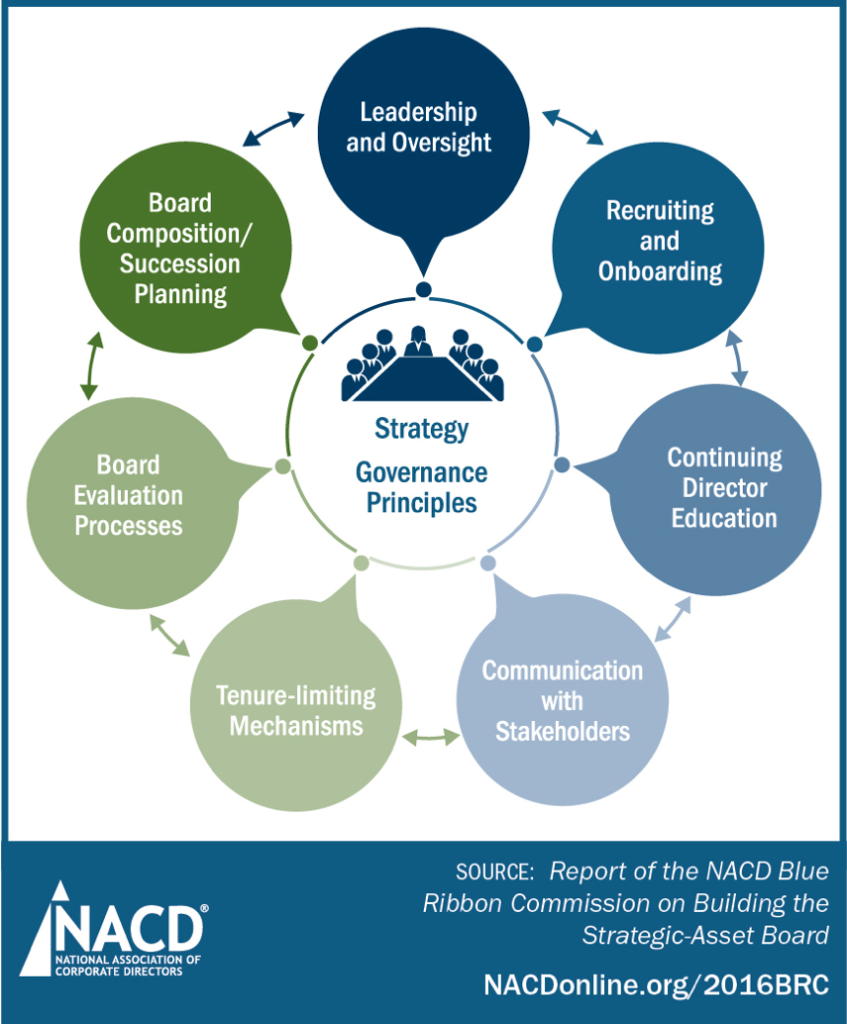

This year’s NACD Blue Ribbon Commission instead recommends a more nuanced approach that focuses on seven critical dimensions of continuous improvement for boards.

The key takeaways regarding board composition are as follows:

First, boards need to be proactive. There is a tendency for boards to push off evaluating composition and performance until an event demands it, be it a director’s departure, an activist investor engagement, or a calamity that leaves the public at large asking: Where was the board? Instead, nominating and governance committees should use the company’s strategic plan as the roadmap to determine what skills and capabilities are needed in the boardroom—not just today or next year, but three to five years out.

A proactive stance is also important in communicating board composition choices. Consider how investors might respond to the slate of directors and address any potential concerns well in advance of proxy season. Some boards, in addition to providing the basic biographical information required by the Securities and Exchange Commission in company filings, provide context that speaks to why each director was elected to the board and how they add value.

Second, boards need to have a long-term outlook. As part of their fiduciary responsibilities, directors should always consider the long-term needs of the organization in addition to short-term goals. As noted above, because the nature of doing business is rapidly evolving, it’s important to evaluate not only how the skills represented on the board meet current demands, but also how they will meet future challenges. To this end, having a diversity of perspectives represented on the board can be critical to enriching boardroom dialogues.

In addition, continuing education programs can be a powerful tool in ensuring that all board members are staying abreast of the emerging business issues likely to impact their organizations. At the same time, sitting directors should not expect annual renominations as a matter of course. The skills that initially brought a director into the boardroom are not guaranteed to be relevant to the company’s strategy in perpetuity. As such, directors need to keep the company’s best interests top of mind and have the fortitude to step down if need be.

Third, maintain a pipeline of talent. Formulaic age- and tenure-limiting mechanisms can deprive the board of the richness and depth of knowledge that can only be brought to the table by seasoned professionals. Instead, determine an appropriate balance between retaining tenured directors and bringing on new talent. Candidates should be selected on the basis of how they will diversify the board’s thinking and outlook. When bringing on new recruits, leverage institutional knowledge to onboard new directors and get them up to speed on the company and its governance processes so that they can actively and constructively contribute to boardroom conversations as soon as possible.

Another important element of board talent maintenance is performing regular evaluations at the full board, committee and individual levels. A third-party evaluation can be helpful in encouraging candid feedback on how well the board is functioning as a whole.

Aligning board composition with company strategy will ultimately drive long-term performance, and the recommendations of the NACD Blue Ribbon Commission report are designed to help boards look at themselves through a new lens. If boards pay attention to these factors, when it comes time to ask whether they are ready to confidently guide their organizations through the tumultuous year ahead, the answer will be a well-qualified “yes.”