Industrial Buying Is Changing Fast

Two in five buyers say they need same-day delivery for at least a quarter of their industrial orders, and 60 percent say they typically need delivery for all orders within 48 hours or less.

Photo: Paul J. Richards/AFP/Getty Images

It isn’t the side of European manufacturing that captures the headlines, but without Europe’s industrial supply sector, the continent’s factories would quickly grind to a halt.

It’s the first law of manufacturing: To make things, factories need things—and not just raw materials.

Industrial plants are little cities that require all kinds of stuff. Tools. Spare parts. Personal protective equipment. Mop heads. Toilet tissue.

The list is as long as the sector is key. Yet because it’s a business-facing business, it’s largely invisible to most consumers—despite its importance.

If it disappeared overnight, however, consumers would quickly know because store shelves and dealer showrooms in Europe and around the world would be bare.

The bottom line is that manufacturing is a critical business. And like many businesses on the planet, digital innovation is reshaping it.

A New Operating Model

The old operating model in place was a simple and lucrative one. Manufacturers made the things that other manufacturers needed—processed commodities, supplies, spare parts, tools—and they sold them to intermediaries who sold them to the final customer.

These intermediaries morphed, over time, into the giant industrial supply companies we know today, which keep massive inventories of every kind of industrial product imaginable in equally massive warehouses.

Then the Internet happened—and then e-commerce.

And gradually, savvy industrial buyers began to ask some difficult questions:

- Why do we use traditional intermediaries?

- Why can’t we buy from lower-cost Internet sellers—marketplaces like Alibaba?

- Why can’t we just buy directly from manufacturers themselves, manufacturers that have their own sales websites?

And just like that, the manufacturing supply industry was turned on its head.

Turning Digital

For the last four years, UPS has been tracking the changes through its Industrial Supply Dynamics surveys.

We have uncovered a consistent pattern of migration, from traditional industrial supplier relationships mediated by sales contacts and good old-fashioned product catalogs to something a lot more diverse and a lot more dynamic.

Industrial supply is turning digital. It is faster, cheaper and more efficient. It hasn’t happened everywhere, and it hasn’t changed everything, but traditional industrial suppliers have begun to respond with consolidation and better service offers.

It is happening.

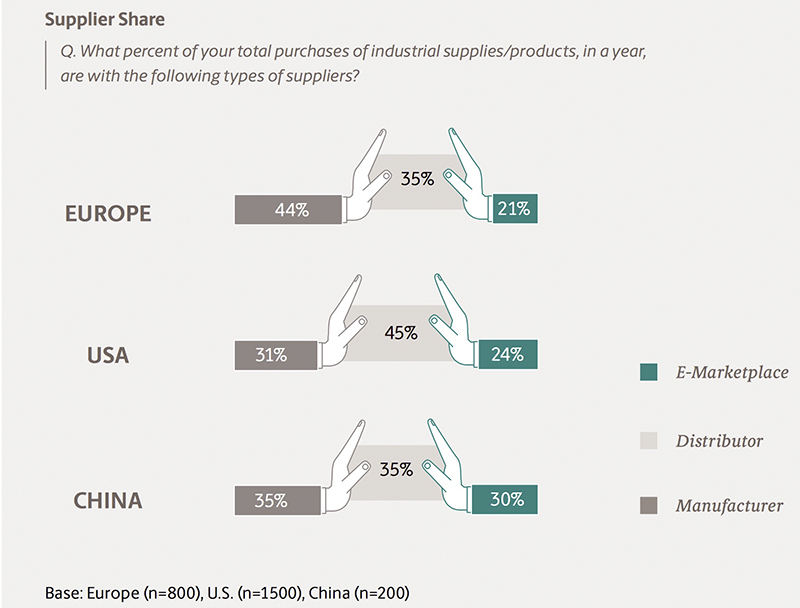

In fact, the 2017 UPS survey shows that traditional industrial distributors have been losing market share to e-marketplaces and to direct-from-manufacturer sales for the last few years.

Industrial buyers now expect a higher level of service, including training and on-site maintenance and repair.

More than 90 percent of industrial customers in Europe this year are buying directly from manufacturers, up from 65 percent in 2015.

And the amount they are spending in these direct channels is rising. Direct-from-manufacturer sales now account for 44 percent of industrial spending in Europe.

In other words, an old-established pattern of business is changing. The old model relied on personal sales calls from representatives and catalogs. Phone calls or orders on a company-to-company Electronic Data Interface would most likely trigger repeat sales.

But personal contact was the key.

That model is breaking down pretty much everywhere in Europe, and as a result, traditional distributors are feeling the pressure.

And the nimble are responding—in most cases by increasing the level of service they offer.

Raising the Bar

It is no longer enough to just deliver products. Buyers now expect a higher level of service with that product, including training and on-site maintenance and repair, often with short response times.

In 2015, 78 percent of survey respondents said they expected onsite post-sales services from industrial suppliers. This year that figure has risen to 86 percent, driven especially by higher expectations among UK and German respondents.

The study also highlights the growing importance of insurance as part of what suppliers need to offer to ensure protection from business interruptions caused by delivery delays.

Half of all European buyers in the study said that a better insurance offer would make them likely to switch business to a different supplier.

Buyers also expect faster delivery. Two in five buyers say they need same-day delivery for at least a quarter of their industrial orders, and 60 percent say they typically need delivery for all orders within 48 hours or less.

This is creating a huge challenge for distributor logistics systems. Distributing from Point A to Point B may seem easy.

When you distribute from multiple locations to multiple customers, however, logistics complexity increases exponentially. UPS has worked with businesses to develop a network of local delivery locations as one solution to the problem.

Faster Change

The rate of change will only get faster.

The UPS survey asked respondents about future actions: A third of all respondents said they are either very or extremely likely to start buying directly from the manufacturer in the next three to five years, and 27 percent said the same about buying from e-marketplaces.

It’s another example of how digital changes everything. You may not see it, but it’s happening. Plan accordingly.

This piece first appeared on UPS Longitudes.