Little-Used Retirement Option Gets a Big Boost

Variable annuities with guaranteed minimum withdrawal benefits are a solution for retirement, but these products are still early in their evolution and remain rather complex financial instruments, but that landscape is about to change for the better.

Photo: Shutterstock

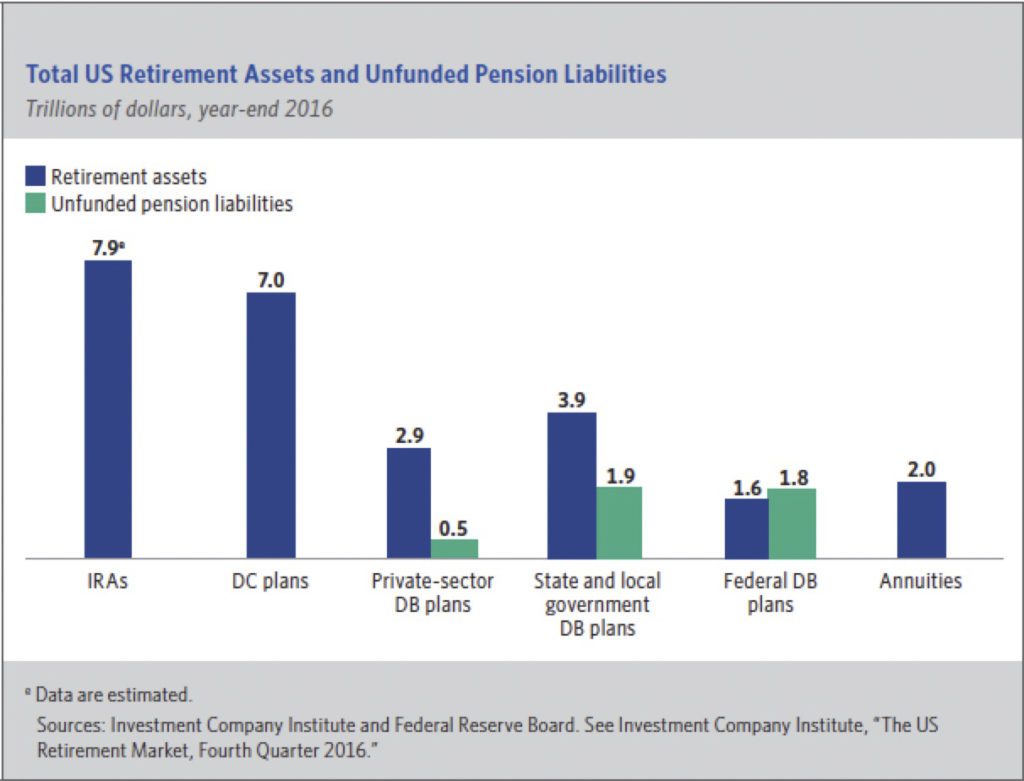

With the erosion of defined benefit pension plans and uncertainty around the future of Social Security, the current workforce must find new ways to responsibly manage their income into and through retirement.

But the environment in which they will do so is challenging. Guaranteed investment returns are at historic lows and projected to stay that way. The costs of aging are rising at an alarming rate, while post-retirement life spans are growing longer. How will current and future generations of seniors manage this evolving retirement landscape?

Insurance is currently the only available solution that adequately guarantees income once investment horizons shorten near retirement. The most prevalent insurance product used for this purpose is the variable annuity with guaranteed minimum withdrawal benefits. “Variable” is an industry term meaning that the annuity investment participates in market equity returns—critical for building maximum value for retirement. The guaranteed minimum withdrawal benefit is the insurance feature guaranteeing that, even if the underlying annuity investment should lose value, the amounts paid out in retirement will never be below a known amount.

So, if an obvious solution exists, why don’t more people take advantage of it? Simply put, these products are still early in their evolution and remain rather complex financial instruments. As they adapt to increasing consumerist pressures, variable annuities and other similar products will be simplified to create a more valuable tool to support retirement planning.

Source: Investment Company Institute. 2017. 2017 Investment Company Fact Book: A Review of Trends and Activities in the Investment Company Industry.

In the meantime, this complexity and the difficulty in explaining the product to consumers has heavily slanted sales toward expensive, commission-based channels more comfortable with products that are “sold, not bought.” Yet, as has been the historic trend for other financial products and services, demand for simpler, more transparent annuity products that encourage value shopping will be essential in driving future growth. This should favor easy-to-understand, fee-based product designs that investors buy rather than commission-based products agents must sell.

By comparison, investing in the stock market once required a broker with steep commission-based fees. But with widespread demand and advances in technology, today’s investors can independently access an enormous array of stocks, index funds and derivatives at highly competitive fees. To compete, annuity writers will need to use technology and innovation to achieve similar efficiencies.

The U.S. Department of Labor’s recently passed fiduciary rule accelerates this trend. New disclosure requirements impose higher administrative costs on variable annuity products and will create increased scrutiny of marketing materials and sales practices by regulators. Annuity agents must also now enter into a formal contract with the investor that explicitly acknowledges a fiduciary responsibility and ensures they will receive reasonable compensation. These factors make commission-based distribution channels—traditionally annuity writers’ most profitable product—less competitive. This may also lead to commission compression, impacting the ability of agents to customize unique or bespoke solutions for clients.

These factors will push annuity providers to leverage distribution channels that already practice fiduciary responsibility and agents who are comfortable with fee-based compensation. Insurers are already responding. Despite the fact that fee-based annuities have been available for over a decade, the past several months have witnessed a torrent of fee-based product launches by annuity writers. These are largely extensions of traditional variable annuities with guaranteed minimum withdrawal benefits and, therefore, still fairly complex. The real opportunity will be realized when writers find a way to offer consumers the benefits they need in a simpler, more transparent framework.

Next generation products will soon arrive to deliver the guaranteed retirement solutions today’s workforce needs and which variable annuities with guaranteed minimum withdrawal benefits currently address, albeit in overly complicated products. The successful annuity writers of the future will:

- Feature simplicity, enabling “pull” rather than “push” marketing—they will be reasonable and transparent solutions for the average consumer and compete favorably against “self-insuring” via mutual funds or other traditional savings vehicles.

- Be low cost while providing relevant protection. This includes both the insurance and investment components, ensuring costs compare favorably to passive indexed mutual funds, adjusted for insurance values.

- Favor “buy-and-hold” consumers. Future annuities may not experience the relatively high lapse rates inherent to commissioned channels and must maintain expected profitability in all policyholder behavior scenarios.

- Scale to expected demand of future retirees. The need served by the fee-based channel is immense, and companies must be prepared with both technology infrastructure and capital solutions.

These next generation products will likely follow a familiar life cycle: initial incubation by a few market leaders followed by explosive expansion to virtually all writers. Early on, product differentiators will evolve as companies vie for a share of the market, but eventually product features will commoditize.

It is likely that the enduring differentiators among companies will be how they access customers and the experience they provide to customers. Rapidly concentrating market shares will favor insurers with modular product design and management, with clean components that can be separately capitalized or reinsured as needed to optimize capital usage.

For annuity writers looking to take advantage of market growth over the next decade, now is the time to act. We believe that “next generation annuities” will, after a smoldering period of unknown duration, ignite a major shift in product design that dramatically expands the market.

Product lead times are long and early movers with strong brands can maintain advantages with aggressive product development focused on simplification, transparency and delivering a compelling customer experience.