Opportunities Arising from Structural Reform in Chinese Asset Management

A customer (L) talks to an employee of the Bank of China as he inquires about wealth management products.

Photo: Ted Aljibe/AFP/Getty Images

Foreign financial institutions have rushed into the market since China opened its financial services sector under its WTO commitments in the early 2000s. Yet they remain marginal players. This is now an inflection point for foreign asset managers, as China vows to allow foreign players to take controlling stakes and operate domestically in the private-securities fund management and even mutual-fund management markets.

In particular, global asset managers can capture the opportunities stemming from the structural reform of the market, where regulators are promoting capital markets and “traditional” asset management in order to replace the legacy “shadow banking” market.

Quasi Asset Managers: The Past

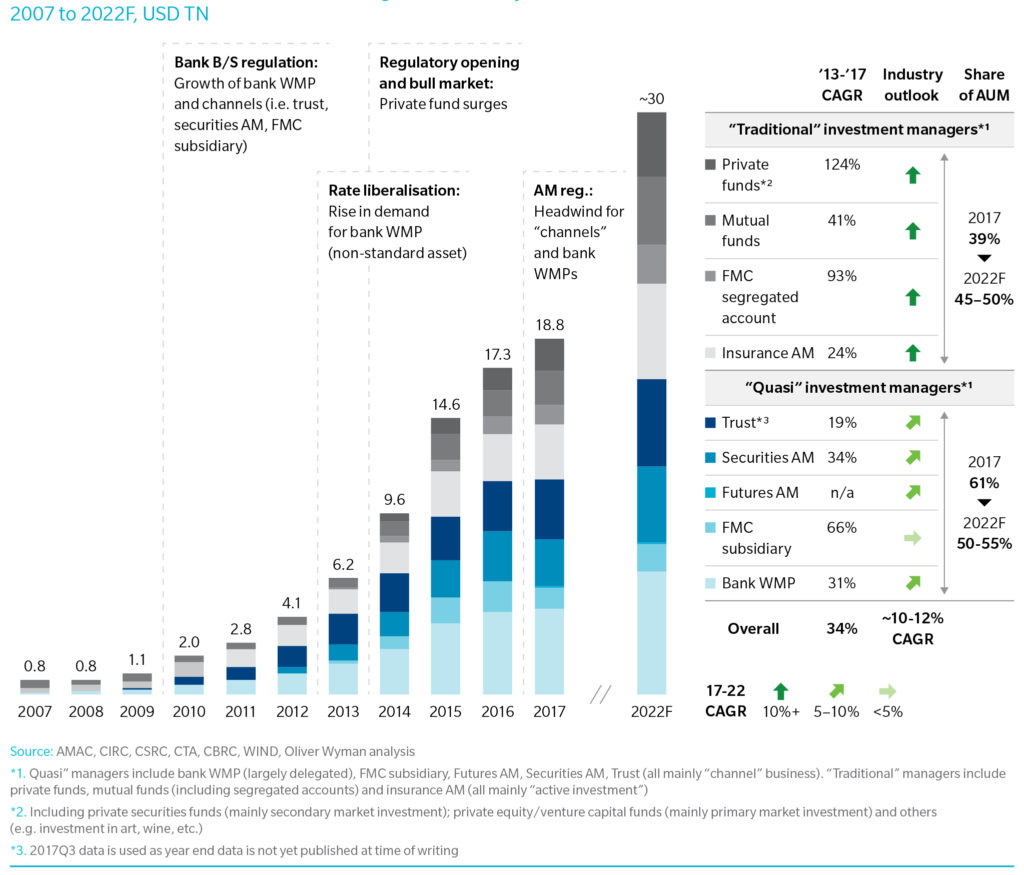

Historically, China’s asset management industry was dominated by quasi asset managers, including bank wealth management products (WMP) and trust companies, whose nature is fundamentally different from asset managers under the global definitions. Quasi asset managers account for 74 trillion yuan ($11.4 trillion) of assets under management (AUM), representing 61 percent of total AUM in China’s asset management industry.

Exhibit 1: Total AUM of Chinese Asset Management Industry

Bank wealth management products are essentially a displacement of bank deposits, which invest into products issued by trust companies, securities companies and fund management company subsidiaries (a specific type of license in China). These vehicles, in turn, provide funding to borrowing corporates. This was a means for banks to push loans “off balance sheet” in order to circumvent heavy capital requirements.

The growth of wealth management products has coincided with China’s rapid economic growth in the past years and the ability of corporates to afford high borrowing rates. As a result, banks are able to provide WMPs with very attractive yields to their customers. Given such “fixed income” nature of the cash flow and the historical context, these bank WMPs are often positioned as “return-guaranteed” or “principal-guaranteed” products. Many products are expected to be guaranteed by the banks, that is, implicitly guaranteed.

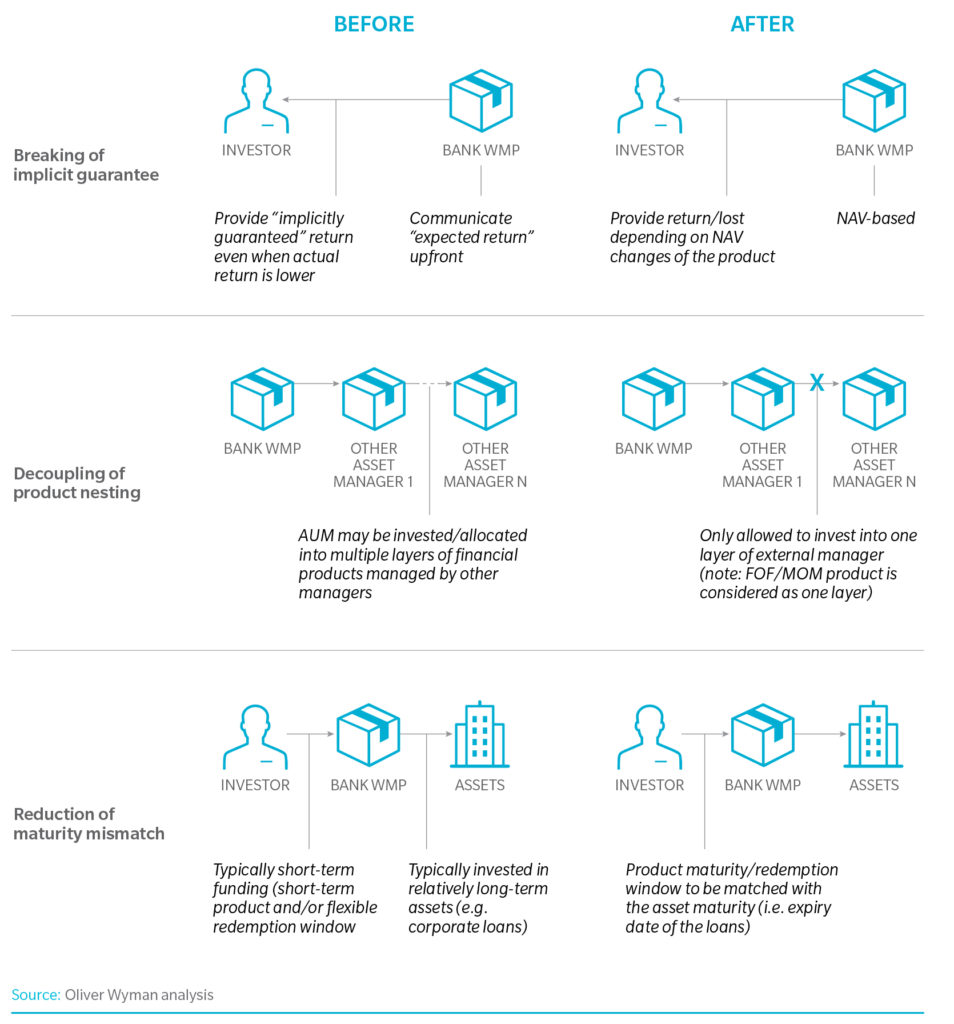

However, as economic growth moderates, the sustainability of such a model is becoming increasingly challenged. The yields of bank WMPs are dropping. The guaranteed nature of such products is under scrutiny by skeptics. The worries are amplified by the opaque fund flows between multiple layers of asset managers involved in the structure of such products (product nesting). Furthermore, the channeling of “short-term deposit-alike” funding into the bank WMPs, which in turn is invested into long-term borrowings, create yet another set of concerns around maturity mismatch.

“Traditional” Asset Managers: The Future

Driven by the agenda of the 19th Party Congress meeting, we expect capital markets to grow fast in order to facilitate the deleveraging of the banking sector and, more importantly, to displace the shadow banking market, which poses considerable systemic risks. We expect capital market development, coupled with recent asset management regulations, which tackle the above-mentioned issues (See Exhibit 2), to fundamentally change the competitive landscape, with AUM shifting toward “traditional” asset managers such as mutual funds and private funds.

Under such direction, the existing bank WMPs will face significant challenges. Bank WMP AUM has experienced the first ever drop from 28 trillion yuan ($4.4 trillion) during the first half of 2017. We expect more outflow of AUM from bank WMPs as banks consider alternative approaches to migrate funding back to deposit, convert bank WMPs into NAV-based products, and distribute products from traditional asset managers.

Exhibit 2: Directions from Recent Asset Management Regulation (Not Exhaustive)

Opportunity with Limitations

This represents unprecedented structural opportunities for traditional asset managers. On one hand, traditional managers can develop and offer alternative products for banks to distribute to their customers. On the other hand, asset managers can work collaboratively with banks that lack investment capability to run NAV-based products (most likely mid-to-small-sized banks) by providing them investment advisory services on their managed portfolio and/or directly managing part of the outsourced portfolio for the banks.

However, global players must recognize that China is still very different in that limited investment options are available, and as a result, it is a difficult market to operate in. The private securities fund market is concentrated in equity strategies, which account for 50-70 percent of total AUM of newly issued products. In particular, long only equity strategy (a buying stance) is still the mainstream of the market, with long/short equity strategy being still nascent.

The low diversity in investment strategy is due to a lack of financial instruments such as options and inefficient capital market structure. Short selling is not prevalent and not encouraged by regulators. To put that into context, securities lending balance only accounted for a meager 0.4 percent of the total margin financing and securities lending balances in 2016, as securities firms are required to use only their proprietary inventory to offer short positions, which made it an economically unreasonable business. The domestic market is isolated from global markets due to capital controls. All of these have limited the variety of potential investment strategies for managers.

However, there is an expectation that capital markets will grow fast in order to facilitate the deleveraging of the banking sector in China and to displace the shadow banking market, which poses systemic risks to the Chinese economy. In our view, the emergence and deepening of financial markets and instrumentals will provide a more conducive environment for managers to develop a wider range of investment strategies. This will, however, take time.

A second piece will discuss the various potential routes and options available for global asset managers to enter and tap into the Chinese asset management market.