Revealing the Impact of Climate Risks on Financial Performance

Photo: Shutterstock

Over time, greater transparency is needed from companies and investors surrounding the impacts of climate-related risks and opportunities and how they can affect revenues, expenditures, estimates of future cash flows and assets and liabilities. That transparency can best be delivered in mainstream financial disclosures via a standardized voluntary framework accessible to a wide variety of market participants.

Today, the Financial Stability Board’s (FSB) Task Force on Climate-related Disclosures released its draft recommendations for such a framework. The goal of these disclosures—designed to be applicable to all organizations in all sectors—is to provide relevant, forward-looking information to investors, lenders and insurance underwriters on the potential financial impacts of climate-related risks and opportunities, as well as how these are being managed.

Adopting these recommendations will require organizations to better link issues around climate with corporate and investment strategy, risk and opportunity analysis—a timely development, given the recent close of the COP22 climate meeting in Marrakesh.

The new guidelines stem from a concern among FSB members (which include G20 finance ministers and Central Bank governors) about the potentially disruptive effect of the transition to a low-carbon economy on the stability of global financial systems. Recent speeches by Bank of England Governor and FSB Chair Mark Carney clearly articulate this.

Are These Recommendations ‘New’?

Numerous climate disclosure frameworks already exist, such as CDP’s global disclosure platform, which captures climate data for more than 6,000 companies worldwide. The Task Force’s vision is that these frameworks will align their core disclosure requests with its recommended disclosures, which CDP and others have already committed to do. In CDP’s case, the Task Force’s recommendations will be assimilated into their climate questionnaires in 2017, ready for the 2018 cycle. This is key, as the Task Force did not seek to introduce yet another framework for voluntary reporting, but rather to be a catalyst for consistent provision of climate-related financial disclosures. This should increase the accuracy and volume of information available to users while reducing the reporting burden for preparers.

The Task Force recommendations reinforce existing reporting requirements in most G20 jurisdictions for companies with public debt or equity disclosure material risks in their financial filings, including material climate-related risks. The introduction of a standardized framework for consistent climate-related financial disclosures should support these requirements.

Application to a Wide Range of Industries

The job of the Task Force was to create recommendations for voluntary financial disclosures that can apply to companies and investors globally. While initial attention has focused on organizations in countries from the FSB’s constituency (i.e. G20), the recommendations themselves are widely applicable and suitable for adoption worldwide. The entities particularly encouraged to disclose include listed issuers (financial and non-financial) as well as asset owners (pension funds, insurance companies, endowments and foundations) and asset managers. The report also encourages private companies to adopt the disclosure framework in communicating their oversight of climate-related risks and opportunities. There is no specific size threshold, and the Task Force suggests that existing relevant reporting thresholds (where relevant) be extended to these disclosures.

Supplementary guidance for reporting is provided in an annex to the main report. For example, guidance is provided for companies in sectors such as energy, transportation, materials and building and agriculture, which may be particularly affected by the physical or transition impacts of climate change such as water scarcity, shifts in energy supply or use or extreme weather events.

Examine Financial Impacts of Climate-related Risks and Opportunities

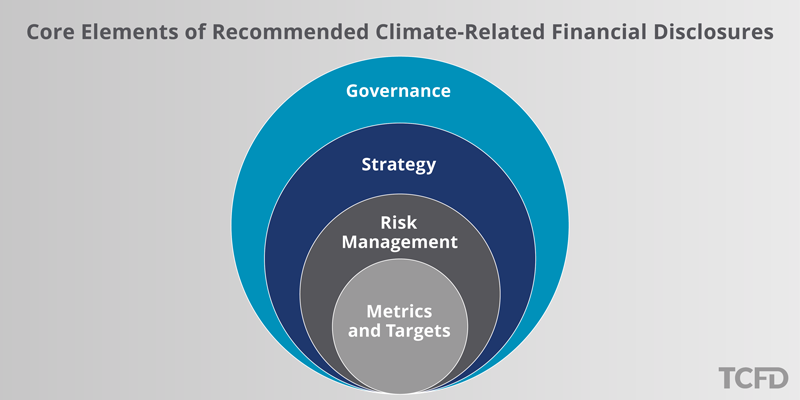

The voluntary recommendations are built around four thematic areas. Their application will have implications for boards of directors, senior executives, chief investment officers, chief risk officers, and risk leaders, and require the same level of oversight and management as other aspects of financial reporting.

The core elements of the recommended climate-related financial disclosures include:

- Governance: The organization’s governance around climate-related risks and opportunities. Consideration of climate impact will need to be integrated into organizations’ overall processes, including strategy setting and risk management.

- Strategy: The actual and potential impacts of climate-related risks and opportunities on the organization’s businesses, strategy and financial planning. This may include assessment of how various future climate scenarios (including a 2-degree scenario consistent with the Paris Climate Change Agreement) could impact the organization’s operations and performance. This will require CFOs and CIOs to become much more familiar with the impacts of climate-related risks and require increased usage of scenario planning.

- Risk management: The process used by the organization to identify, assess and manage climate-related risks. Organizations should identify these climate risks and opportunities in the short-, medium- and long-term.

- Metrics and targets: The metrics and targets used to assess and manage relevant climate-related risks and opportunities. For example, for asset owners and asset managers, the recommendations include the inclusion of investment portfolio carbon footprinting and a discussion of other climate-risk metrics or targets that could be utilized in investment decision-making and monitoring.

The Task Force also states that disclosures should be relevant, clear, comparable over time, verifiable and timely.

Develop a Framework for Climate-Related Risks and Opportunities

To support consistent identification and analysis of climate-related risks and opportunities, the Task Force has grouped them into the following categories:

- Transition risks related to the move to a lower-carbon economy, including policy and legal risks, technology risks, market risk and reputation risks.

- Physical risks relating to acute risks such as extreme weather events and chronic risks associated with long-term shifts in climate patterns with impacts on water availability, sourcing and quality and factors impacting organization’s operations, supply chain and transportation needs.

- Climate-related opportunities include opportunities to improve resource efficiency, manage energy costs, develop new products and services, capture new markets and improve organizational resiliency.

Benefits of Increased Transparency

A standardized disclosure framework should benefit multiple market participants in a variety of ways:

- Companies understand what financial markets want from disclosure (as represented in the guidance provided by the Task Force) in order to measure and respond to climate change risks, and can align disclosures with investors’ needs. Wider and consistent disclosure also allows companies to more effectively measure and evaluate their own risks and those of their suppliers and competitors, and streamlines reporting burden.

- Institutional investors, banks and insurers receive additional relevant information supporting more informed investment, credit, and insurance underwriting decisions about reporting companies, while hopefully improving both market efficiency and economic resiliency.

- Individual investors, such as pension fund members or beneficiaries and mutual fund holders, have access to information about the management of climate-related risks and opportunities undertaken on their behalf.

- Regulators are better positioned to assess the concentrations of carbon-related assets in the financial sector and the financial system’s exposures to and management of climate-related risks.

Task Force recommendations will likely be accepted by the market as a starting point for climate-related disclosures by companies and investors. There will be significant opportunity for companies and investors who have made progress on climate-related intellectual capital to become leaders in this space.

What Should Companies and Investors Do Now?

First, organizations and their advisors, along with credit rating agencies, stock exchanges, the analyst community and other stakeholders, should review the Task Force’s report and draft recommendations and provide feedback to the online consultation, which is open until Feb. 12, 2017.

Second, companies and investors—and their boards—should take the opportunity in 2017 to consider how well-positioned they are to provide the recommended, voluntary disclosures to stakeholders. Is there a thoughtful approach to considering climate risk and opportunity and the associated financial implications? If not, how will the approach be developed?