The Dawn of Digital Sales: Disruption in Real Time

Reinforcing the higher expectations, purchasing departments have become increasingly professionalized, which leads to more and broader information collection in the pre‑purchase phase, before they even contact a sales rep.

Photo: Shutterstock

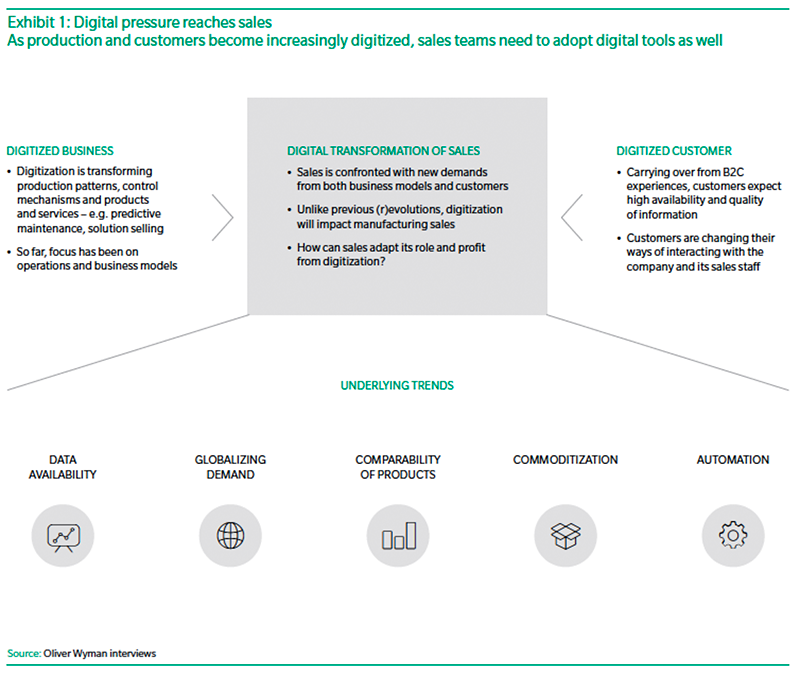

Sales organizations were largely immune to earlier manufacturing upheavals, such as “lean” and “re‑engineering,” given that their work centers on personal relationships with customers. While manufacturers’ sales executives expect to benefit from new tools in the digital revolution, a series of interviews conducted by Oliver Wyman reveals they believe the attendant changes will be moderate and not disruptive. As a result, the vast majority are only starting to adapt their sales organization to the new possibilities (see Exhibit 1).

We, however, think digitization will transform selling, and that changes seen up to now—such as apps that provide product and contact information more conveniently—are only the tip of the iceberg. New technology will overturn established working habits, alter the products and services sold and elevate sales to a higher order of involvement with clients. Sales reps of the future will think less about transactions for goods and more about how to boost a customer’s overall performance. Executed smartly, the digitization of sales could help manufacturers fight off lower-cost competitors in a world where growth in many markets has slowed. The changes can be divided into three key areas.

Digitizing Core Processes

First, digitization will boost the essential processes of sales: what to offer customers, when and for how much. Of course, nearly all manufacturers employ some kind of customer relationship management (CRM) system gather general business facts, past sales and equipment in operation. These often do little more than track customer information and they lack true forecasting power. Current CRM systems are mostly about “getting the dots—and not yet about connecting the dots,” as one sales executive said.

Smarter use of data will change this. Instead of waiting until a customer expresses his needs, a manufacturer will be able to use analytics to predict those requirements from operating data. A firm that sells a customer, say, a conveyer belt, monitors how much it is running, the products it is used to manufacture and developments in the customer’s overall business. Then the belt maker should have a better idea of what kind of new machine to offer and when. Demand patterns can also help evaluate the potential for getting a customer to upgrade or to buy additional products. By anticipating a customer’s needs in this way, a manufacturer’s sales force can make proactive offers, boosting its success rate and efficiency.

Analytics can also reduce the workload in the annual creation of a revenue budget for the coming years. This process involves reps, managers and executives and often goes through several iterations, only to produce unreliable results. Data can help anticipate demand for different products over months or years and can thus help plan sales activities for different sectors, regions and customers.

Digitization can also streamline the price quotation process, especially in segments where machines require customization. For instance, selling a machine that puts a variety of cookies into different sorts of customer-specific packagings often involves engineers having to design a technical solution before a price quotation can be given. Yet, most of the time, the customer decides not to follow through and make the purchase and the work gets thrown out. In a digital world, these quotations can be made based on statistical analysis without involving engineering. This not only reduces cost, but also provides real customer value, as quotes can be generated on the spot.

These data-driven tools can be integrated seamlessly into the work routine of a sales rep via mobile apps, dramatically improving the management of a sales force. Reps have typically planned their work based on a combination of intuition and their experiences with particular customers. They might enjoy visits to certain customers and give these more attention, while avoiding those that are difficult, even if potentially lucrative. A stream of hard data and insights should lead to more rational decisions so that the right expert will call on the right customer with the right offer at the right time. Companies should not, of course, imagine that it’s enough just to equip sales reps with apps and iPads. Without integrated, data-driven, algorithm-based intelligence, reps will continue their old ways of working online.

Digital Interaction

The digital revolution will also force manufacturers to interact with customers in new ways. In their spare time, customer representatives are also consumers, and their experiences as retail shoppers affect their expectations when buying something for their company. Much retail purchasing is carried out online, where shoppers can refer to ever-expanding sources of information. Then, a consumer will likely customize a new car or cell phone using an online configurator. Someone considering a purchase on behalf of their company will expect similar facilities, including rapid, high-quality information and the availability of different product varieties and add-ons. Reinforcing the higher expectations, purchasing departments have become increasingly professionalized, which leads to more and broader information collection in the pre-purchase phase, before they even contact a sales rep. So, though the sales function has traditionally been a people-to-people job, some customers now want less personal consultation than before.

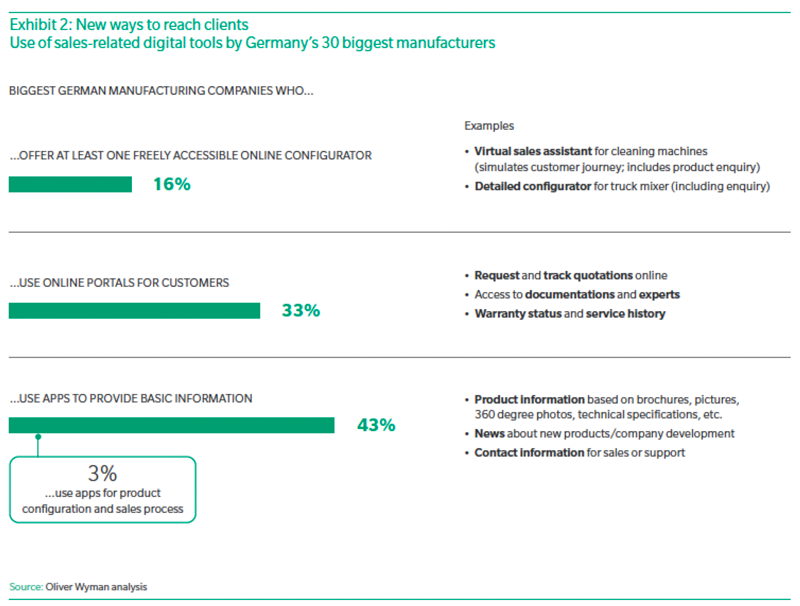

Manufacturers need to respond to these changing needs and develop ways to empower their customers. As one executive put it: “Help customers to help themselves.” One step is to cease focusing directly on sales and instead provide facilities where customers can make their own journey to the right product or solution. Online “product-wikis,” for example, give technical specifications for different versions of a product, provide detailed documents such as manuals and fact sheets and even offer online tutorials. All these sales channels need to be designed strictly from the perspective of the customer journey. Also, as the customer uses different modes of interaction—mobile app, website, phone inquiry, or personal interaction—these channels need to be coordinated so that each one “knows” what the customer has done in the others (see Exhibit 2).

Selling Digital Solutions

Sales departments must also learn to persuade customers of the benefits of the new digital business models that big data is spawning. A maker of high-quality inspection equipment can also propose the use of process-integrated hardware, software and deep data analytics so that it sells a specific yield improvement rather than just the equipment.

Selling solutions like these is very different from selling a physical product based on specs and price. It requires a deep understanding of the customer’s processes and economics in order to depict potential gains from the solution, an approach similar to that of a consulting firm. Sales staff therefore needs to be trained more broadly so that they have expertise in fields related to physical products’ operation and performance, such as systems integration and software solutions.

Moreover, as discussions will now center on the customer’s overall business, contact will shift from the operational purchasing department and the technical buyer to the executive level. Sales staff needs to become more senior so that they can sit down with a client’s top executives and engage on the same level. Developing this sort of capability from an existing sales team is difficult and manufacturers will often need to hire new talent, but getting this right is crucial. If a manufacturer does not have the ability to sell its digitally-enabled solutions, they will remain in the concept stage.

Time to Act

Putting all this into practice will be hard, and it’s important to be aware that some changes are harder to implement than others. To spur progress, a firm can set up a lighthouse project, where a pod in the sales team is encouraged to charge ahead and work with the new digital tools, methods of interaction and solution-based products. This will create the opportunity for test-and-learn cycles that hone the new working techniques without being slowed down by organizational inertia. To get the new initiatives working in unison, manufacturers should design a central digital infrastructure that connects diverse information, from product features to customer preferences.

Eventually, the sales organization will need to be adjusted on three levels. For standardized off-the-shelf products, the sales process will become fully automated, saving time and money. Technical expert sales will to some extent be replaced by digital guides, such as product-wikis, but this sales role will continue in a more targeted way. A solution sales team of consultants and technical experts will become increasingly important, driving long-term personal interaction with senior management. The race to digitize sales has already started. As one sales executive put it: “It is almost too late to talk about quick wins.”

This piece was first published in Perspectives on Manufacturing 2016 from Oliver Wyman.