The Meteoric Rise of Venture Capital in Asia

A general view shows Hong Kong's Victoria harbor. Greater China (comprising China, Hong Kong and Taiwan) is the biggest hub of venture capital activity in the region.

Photo: Anthony Wallace/AFP/Getty Images

The venture capital market in Asia is breaking all previous records: Unprecedented sums of capital have been raised in the past few years, there is a record amount of capital being invested in opportunities on the continent, and Asia-focused venture capital assets under management have doubled in just three years. And even though the fund management industry in Asia remains significantly smaller than North America’s, it’s growing quickly, driven by global appetite from investors and a strong deals market.

This is not a surprise given the number of tech unicorns that have emerged in the region over the past half-decade, increased digitization across Asian economies—with a surge in e-commerce on the back of rapid Internet penetration, a move toward cashless payments and the disruption being witnessed in the financial sector with the plethora of startups in the fields of fintech and insurtech.

The Growth of the Asian Fund Management Industry

As of August 2018, there were 2,908 active venture capital fund managers headquartered in Asia. Greater China (comprising China, Hong Kong and Taiwan) makes up the significant majority of fund managers, accounting for 1,954 venture capital firms in Asia.

The rise of the venture capital industry in China has been largely helped with the establishment of Baidu, Alibaba and Tencent, as well as with the fledgling help of Xiaomi and DiDi—well-known firms that have encouraged the growth of the venture capital market in the region. The largest Asia-based venture capital firms are CCT Fund Management and China Reform Fund Management, which hold $11 billion and $9.2 billion in dry powder, respectively, and are both based in China.

Although Greater China is the biggest hub of venture capital activity, there are significant numbers of fund managers in other parts of Asia, too. Asia-based fund managers outside of Greater China are speckled evenly between South Asia, the ASEAN region and Northeast Asia, with around 300 firms based in each of these areas. It will be interesting to see if growth in the Asian fund management industry evens out further across the regions as the venture capital industry further establishes itself on the continent.

Each year between 2015 and 2017 saw over $20 billion raised for Asia-focused venture capital funds. Although there has been a slowdown in fundraising activity in 2018, as well as a decreasing number of funds closed year-on-year for the past three years, this isn’t necessarily an indication of decreased interest in the market. Rather, this highlights the fact that many large fund managers are now actively investing their capital, indicative of how 2018 is on course to break records in venture capital deal activity in Asia. As of July 2018, 2,447 deals had been made worth a total of $65 billion, bringing the year extremely close to levels seen in all of 2017, when 2,793 deals were announced for a record total of $66 billion.

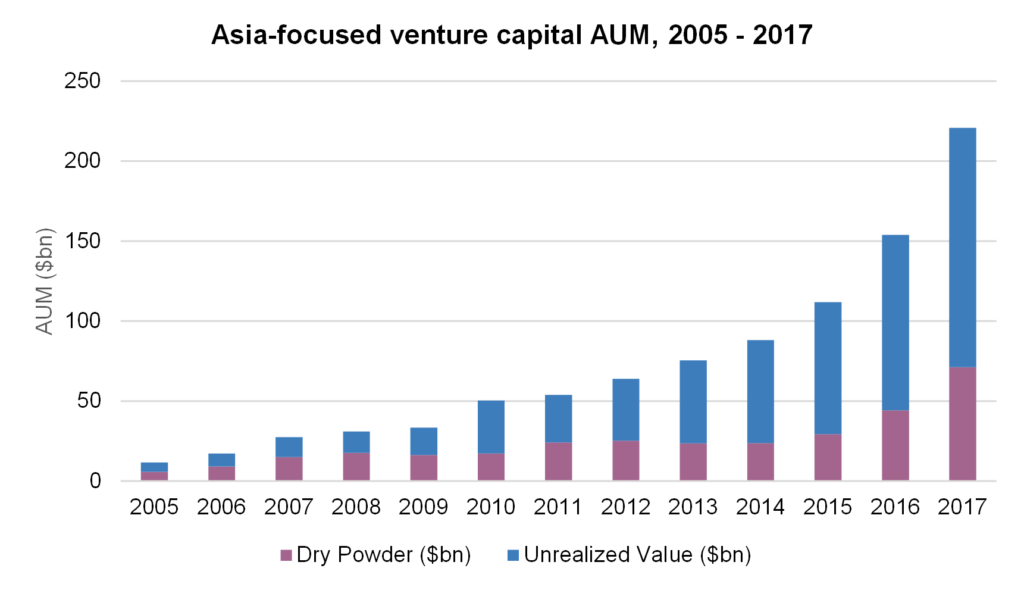

Asia-Focused Venture Capital Assets Under Management Double in Size

Asia-focused venture capital assets under management have risen rapidly recently, reaching a record high of $221 billion at the end of 2017. This is leaps and bounds above the $88 billion that Asia-focused venture capital had in assets under management in December 2014. The $221 billion in Asia-focused assets under management include $71 billion in dry powder—a spike from December 2016, when Asia-focused venture capital dry powder stood at $44 billion.

Although this is smaller than the North America-focused venture capital industry, which holds $365 billion in assets, the rapid growth in the Asia venture capital market means the region will most likely catch up in just a few years’ time. In 2014, Asia-focused venture capital assets under management accounted for just under a fifth of global venture capital assets, but in 2017, this proportion jumped to a third (32 percent) of global assets.

Strong Performance As a Driver

The Asia-focused venture capital industry has almost tripled in just three years, and although this is partially due to our expanded research coverage, it is foremost due to the Asian venture capital industry growing at a remarkable pace. One of the biggest boosts to this growth has been strong performance: Asia-focused funds have a median net internal rate of return (IRR) of 13 percent across all vintages—the highest of any region. By comparison, Europe-focused funds have a median net IRR of 10 percent across all vintages and North America-focused funds have returned 8.9 percent across vintages 2005 to 2015. However, it’s important to note that the venture capital industry in Asia continues to be less established and therefore the associated risk of investment in the region is higher than in more developed parts of the world.

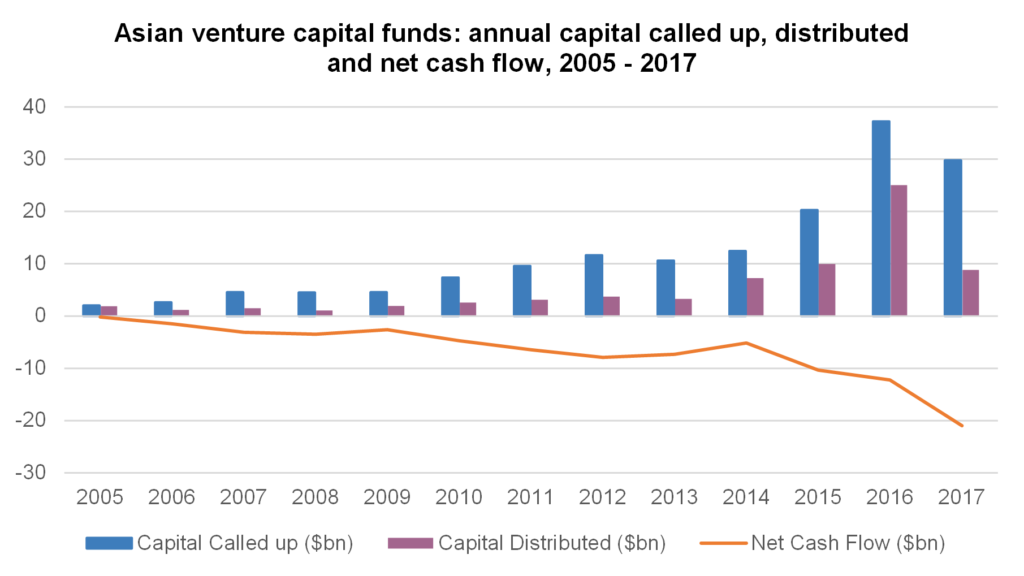

Record high assets under management have also been aided by high levels of capital called up by Asia-focused venture capital funds. In 2016, fund managers called up a record high $37 billion from investors—becoming the third consecutive year of record-breaking sums of capital called up by Asia-focused venture capital funds. Although the level of capital called up dropped slightly to $30 billion in 2017, it remained the second highest level of capital called up by the industry in any year.

The Growth of the Asian Investor

Globally, China accounts for the second-largest hub of venture capital investors. While just over half (52 percent) of venture capital investors are based in the U.S., 11 percent are headquartered in China. A further 5.4 percent of venture capital investors are based in Japan, making the country the third-largest hub of venture capital investors.

Asia-focused venture capital assets look set to increase further in the coming months: As an increasing proportion of investors targeting Asia are based outside the region, the number of domestic investors has continued to grow. As of June 2018, there were 803 Asia-based venture capital investors. This is double the 403 that were active in Asia in December 2014.

Just over half of global investors seeking Asia-focused venture capital funds in the next 12 months are based in North America. Another 28 percent are Asia-based, and 15 percent are headquartered in Europe.

Investors are increasingly attracted by strong performance as well as portfolio diversification benefits that Asia-based opportunities provide. Government support for startups across the region is another catalyst drawing interest from investors and high-net worth individuals. No longer the niche industry as it was a few years ago, investors from outside Asia are taking notice and seeing Asia as a powerhouse of venture capital.