Insurtech in China: Revolutionizing the Insurance Industry

Ships pass by the skyline of the Lujiazui Financial District in Pudong in Shanghai on August 14, 2015. China is among the countries at the forefront of fintech innovation and adoption, and its insurance industry is using the latest technology to better serve its clients.

Photo: Johannes Eisele/AFP/Getty Images

China’s capital markets aren’t yet mature enough to support financial innovation; meanwhile, existing state-owned financial institutions are not reforming quickly enough. This gap in supply has provided opportunities for Chinese fintech players—who are being supported by rapidly growing online ecosystems and a tech-savvy population—in diverse fields ranging from investing to payments.

A Growing Insurance Market

While insurance penetration in China is currently low (3.6 percent in 2015) compared to developed markets such as the UK (10 percent) and the U.S. (7.3 percent), strong government support, coupled with a growing middle class, is making insurance products more accessible. In 2015, for example, total insurance gross written premiums (GWP) in China increased by 20 percent in 2015 to 2.4 trillion yuan ($355 billion).

In fact, the Chinese insurance market has doubled in size over the past six years. Based on China Insurance Regulatory Commission’s (CIRC) five-year plan and various other sources, the insurance market is forecasted to grow at 13 percent (compounded annually) up to 2020 to 4.5 trillion yuan.

The rapidly growing insurance market—albeit from a low base—in China is also opening up plenty of opportunities for insurtech (defined as insurance further enhanced through technology in a customer-centric way).

Insurtech Makes Gains

Insurtech is revolutionizing the insurance industry by bringing disruptive products and services to a market that is fast adopting, and increasingly moving toward, an online ecosystem. The market is also seeing a surge in the number of people who are aware of and are starting to understand the benefits of insurance.

The CIRC is supporting these gains by fostering a favorable regulatory environment for insurtech. As a result, the insurtech market is experiencing rapid growth and is expected to rise from 250 yuan in 2015 to more than 1.1 trillion yuan in 2020.

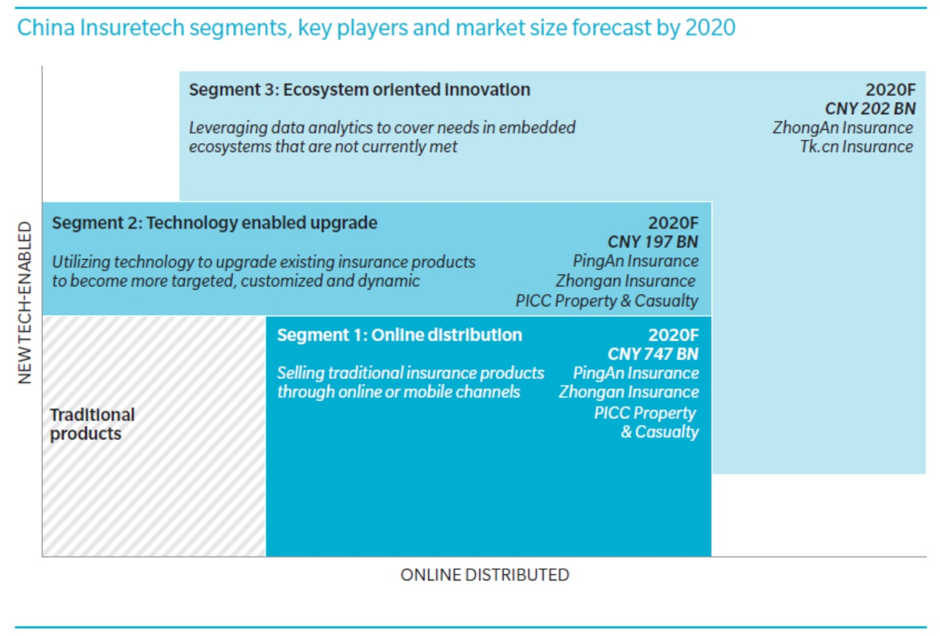

There are broadly three insurtech segments in China (Graphic 1), which are projected to grow at different rates:

Online distribution of traditional insurance products (e.g., online auto insurance sales). According to Oliver Wyman estimates, GWP for this segment will grow from about 207 billion yuan in 2015 to about 747 billion yuan in 2020. And within this segment, non-life insurance products will grow at a faster pace than life products.

Technology enabled upgrades of existing insurance products (e.g., new health insurance policies or prices based on wearable devices, telematics). GWP for this segment is expected to grow from about 28 billion yuan in 2015 to about 197 billion yuan in 2020. Auto insurance will be the highest contributor to this growth, followed by health insurance products.

Ecosystem-oriented innovation of new insurance products (e.g., shipping return insurance, flight delay insurance). Estimates show that GWP in this segment will grow from 12 billion yuan to 202 billion yuan between 2015 and 2020. The key contributors to this growth being the e-commerce and travel ecosystems because of their large market size and the growing desire among consumers to protect themselves against risks related to these ecosystems.

Graphic 1:

Risks and Uncertainties Facing the Insurtech Industry

Notwithstanding the tremendous scope and opportunity for certain simple products—such as travel insurance and shipping return insurance—in the Chinese insurtech market, several products such auto insurance and universal life insurance face uncertainties owing to the following four factors:

Macro economy. A fall in Chinese GDP growth to 5 percent or lower would have an adverse impact on per capita disposable income, which in turn could negatively affect the demand for non-essentials such as automobiles, wearable devices and connected home devices. As a result, GWP in these sectors would fall.

Regulation. In general, the CIRC has been supportive of innovation, but there are times when it has been too conservative. For instance, the regulator may put a limit on guaranteed return of universal life insurance distributed online. Online universal life was recently stopped by the regulator (which is considered a temporary measure to curb increasing risk). In another case, we observed that the slow adoption of telematics is caused by the tariff set by the regulator even after the recent pricing reform for auto insurance. In another case of regulatory back-and-forth, smog travel insurance, which compensates travelers during bad weather caused by smog, has been stopped by the regulator.

Technology. Future development of technologies such as big data, cloud computing, block chain and artificial intelligence are critical to insurtech. Therefore, technological failures of particular platforms can pose risks for companies, particularly when they are looking to ramp-up operations.

Competition. Traditional insurers and disruptors currently dominate the industry. Traditional insurers may set up joint ventures with tech companies to compete with disruptors, or they might set up subsidiaries to attack this market. New players could also emerge, increasing competition. For example, auto or 3C (computer, communication and consumer electronics) manufacturers could set up insurance companies to insure their own products. Similarly, peer-to-peer insurers may rise to cover online communities and large ecosystems might also self-insure.

Despite these uncertainties and possible risks, there is potential for the insurtech industry in China, with the forecasts clearly suggesting a growing opportunity set for businesses in this space. The question is whether it will meet or exceed expectations.