Trade Finance Gaps Continue Despite Fintech Breakthroughs

This photo taken on December 6, 2017 shows a general view of the Yangshan Deep-Water Port.

Photo: -AFP/Getty Images

2017 was the year that blockchain fully captivated trade finance. Every discussion of trade finance included at least a mention of financial technology.

In the annual ADB Trade Finance Gaps, Growth and Jobs Survey, we expected to find the 500-plus surveyed banks and 1,300-plus firms reporting significant changes in the trade finance ecosystem.

What we found instead suggests that while trade and finance are changing dramatically, trade finance is shifting more slowly. This is an important distinction for policymakers seeking to drive more finance to the small- and medium-sized enterprise sector.

Initiated in the shadow of the global financial crisis, the Asian Development Bank survey has found consistent shortfalls in trade finance for the most vulnerable populations. The 2017 survey estimated the global trade finance gap at $1.5 trillion.

Asia and the Pacific accounts for 40 percent of the global gap. Within the region, half of the rejections are in developing Asia, including India and China. In part, this reflects the high dependence of the region on traditional documentary credits. Seventy-seven percent of global export letters of credit originate in Asia-Pacific.

But it also underscores the difficulties presented by the last few years of banks shedding correspondent relationships in less profitable corridors.

One question is whether a rejection by a bank causes the transaction to fail. There are different types of funding that rejected firms may use to finance a trade transaction. However, SMEs tend to have relatively undiversified sources of finance. Sixty percent of firms report that once the transaction is rejected, the trade fails.

Lack of trade finance resulting in foregone trade may eventually lead to foregone jobs: Our analysis shows that a 10 percent decline in trade finance is associated with a 1 percent decrease in SME employment.

Much of the Gap Is Potentially Bankable

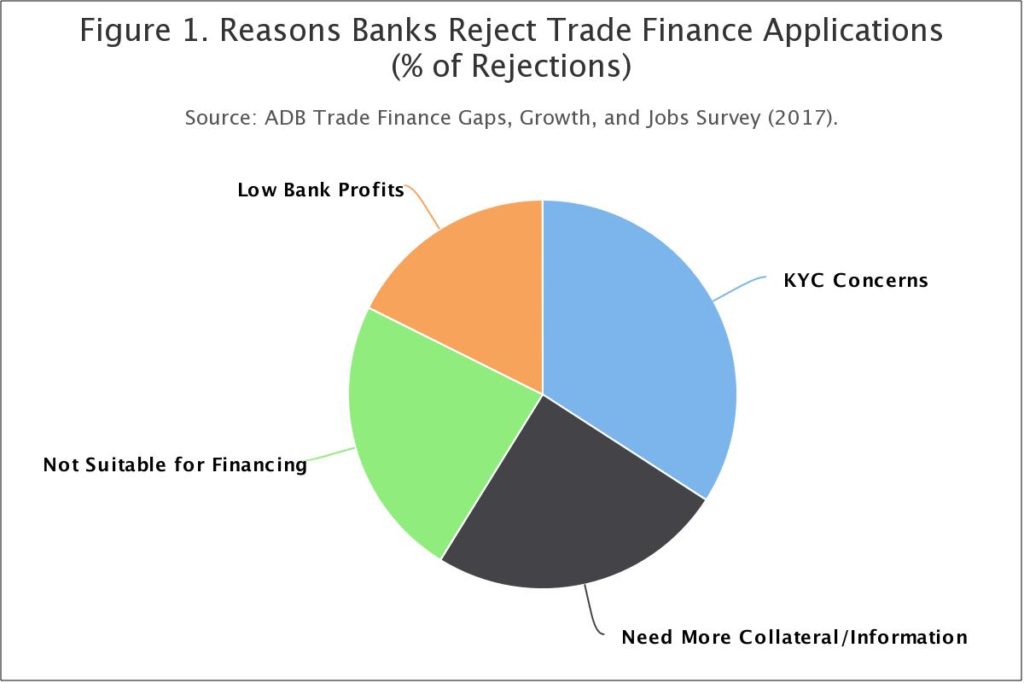

In an effort to understand whether the rejected transactions were “bankable” or eligible for banking service, banks were asked to classify the reasons for rejections. Only 20 percent of rejected transactions were considered unbankable. The other categories included reasons such as additional collateral required, low profit margin, and know-your-customer concerns.

Both banks and firms have high expectations that fintech will fill gaps. Sixty-six percent of banks expect that fintech will enable more effective SME credit assessments. Seventy percent of firms expect that fintech funding platforms will reduce gaps.

But questions related to use show a very different picture. In the 2015 survey, only 38 percent of banks in Asia-Pacific reported good progress in digitization. And there was no difference between more and less digitalized banks in their rejections of SME trade finance applications.

Forty-four percent of firms surveyed in 2017 had never heard of fintech. Only about 20 percent reported using it. Peer-to-peer lending was the most commonly used platform for the second year in a row (the question has only been asked twice).

Looking at data from both 2016 and 2017, we can see that exporting firms owned by women are the most active users of fintech. Sixty-two percent of firms that report using fintech are owned by women. This is surprising given the digital gender divide that has been shown in the literature on basic finance.

Woman-led firms are more likely to be rejected in their applications for trade finance but more likely to search for alternatives, not giving up after a rejection.

However, overall trade facilitation for women including trade finance has a long way to go. Trade facilitation for women is one of the least implemented areas in trade facilitation along with SMEs, according to the UNESCAP’s latest trade facilitation survey.

Policy Implication

Where the goal is to promote SME finance, we need to remember that fintech is not yet eclipsing any part of the financial sector and, importantly, is not having a positive impact on the gap.

There are policy lessons to be drawn from this research. Fintech’s ability to reduce the cost of delivering finance addresses just one component of the SME finance problem.

To reduce financing gaps, it is critical that fintech move forward to address due diligence challenges associated with performance and compliance (financial crimes) risks.

Two policy suggestions can be drawn from this report.

First, target the features of SMEs that keep them excluded. This can be done by promoting better firm identification to make all transactions—both informal and digital—visible. A solution to this is the Legal Entity Identifier initiative, a globally harmonized numeric identity for all companies.

Second, establish digital standards in trade. These standards, both technical and regulatory, would address the inoperability problem that impedes creating metadata.

This metadata is needed to underpin due diligence on performance and other risks that inhibit financial institutions from providing more support to SMEs.

These recommendations require leadership and can only be achieved through a collaborative effort between the public and private sectors, banking, fintech, industry and logistics.

This piece first appeared on the Asian Development Blog.