Australian Superannuation Funds Commit to Infrastructure

People cross a bridge over the Yarra River in Melbourne, Australia. Australian superannuation funds show a strong preference for so-called real assets—real estate properties and infrastructure assets.

Photo: Scott Barbour/Getty Images

While Australian superannuation funds may appear similar to pension funds across the world, their habits and fund preferences make them stand out, as illustrated in Preqin’s Australian Superannuation Funds in Alternatives report.

Among the most notable of these differences between Australian superannuation funds and other pension funds, is the strong preference that superannuation funds have for so-called real assets—real estate properties and infrastructure assets. While most large investors invest in both of these asset classes, Australian superannuation funds commit at much higher rates than the global average.

Infrastructure has traditionally excluded many smaller funds due to high up-front costs, but many smaller funds have nonetheless been enticed by the asset class’s strong returns. However, things are changing. As the superannuation market faces further growth and consolidation, average fund sizes are increasing, and many funds will find that they are able to enter the infrastructure market. But with infrastructure returns gradually falling, they may choose not to do so to the extent of previous funds.

Here we examine how these changes are coming about and the potential impact they may have on the superannuation industry.

Infrastructure: The Magic Asset

Everyone wants to get their hands on infrastructure. But not everyone can. Good assets are few and far between and, where available, snapped up quickly. Compared to other asset classes like private equity, venture capital or hedge funds, infrastructure assets provide lower risks and stable, attractive returns. For larger superannuation funds, the added benefits associated with ease of access and management of infrastructure assets make it the magic asset to which everyone wants to increase their allocation.

Infrastructure development has been a core focus of the Australian government and has played a critical role in shaping public policy as well. Australia’s robust economy and transparent business environment creates an ideal climate for many firms to finance, construct and manage major infrastructure assets. Australian superannuation schemes in particular have led the world on infrastructure investments and have had great success in the asset class over the past 20 years.

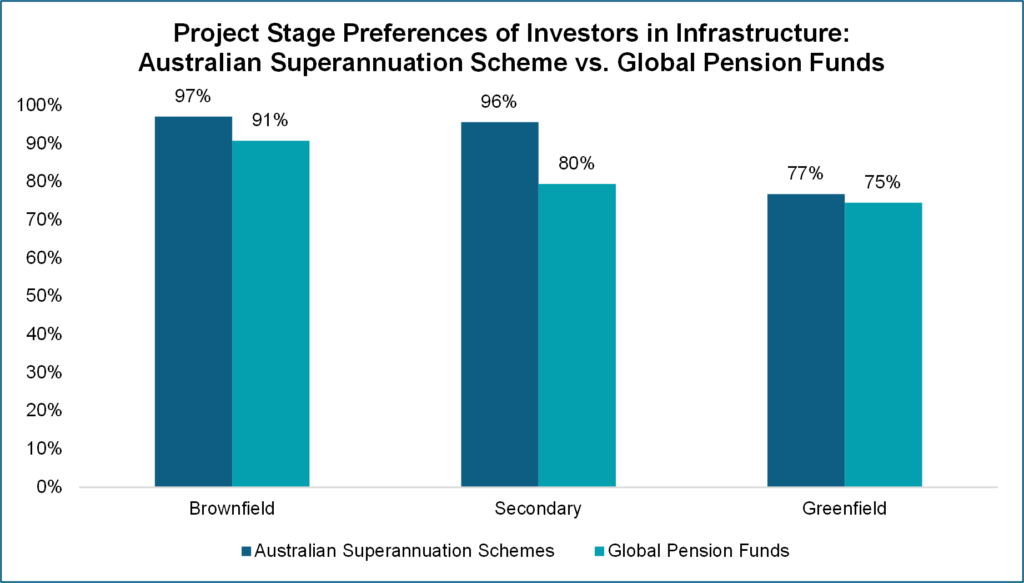

Australian superannuation schemes look to infrastructure as a source of stable returns, given that the asset class is defensive and income-generating in nature for most superannuation funds’ investment portfolios. Core infrastructure assets are predominantly favored among the industry, and Preqin data supports that view: Australian superannuation schemes have a greater preference for brownfield (97 percent) and secondary (96 percent) investments than their global pension fund counterparts.

The case for infrastructure can also be made when superannuation funds elect to seek out co-investment opportunities and separate account mandates as avenues for fee reduction. Therefore, in the event that Australian interest rates rise, returns can ideally be sustained at current levels.

An industry fund commented on the changing infrastructure investment landscape, whereby investments are more accessible when a fund teams up with a manager or other superannuation schemes—or by going direct if possible. Consultants note that the average number of co-investment mandates has been rising in the industry.

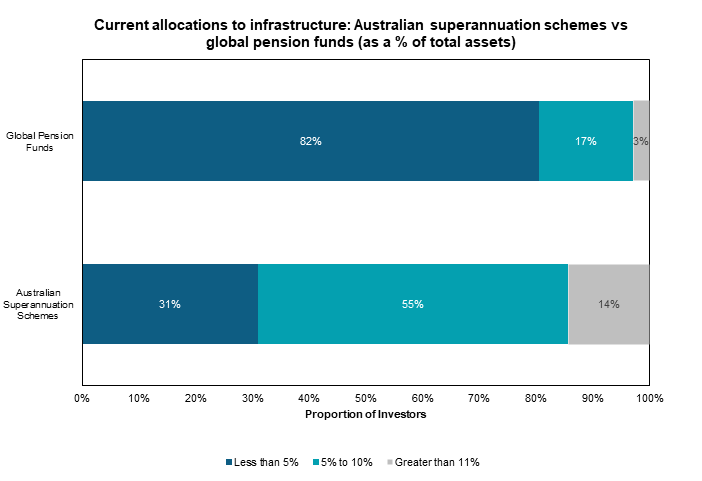

Fund size determination is one of the key considerations for Australian superannuation funds regarding infrastructure. Among the superannuation schemes Preqin interviewed, a good proportion said that a substantial amount of “buy-in” capital is required to invest in infrastructure to see any material returns on their overall portfolio. “Infrastructure is attractive for supers due to their large fund size, hence, better opportunities for higher returns,” said one. “Additionally, it also has a fee structure which is suitable for most superannuation fund structures in Australia.”

As the Australian superannuation industry experiences further consolidation, fund sizes will increase, making infrastructure investments more viable for smaller funds that could not previously access the asset class, ultimately benefiting their members’ retirement portfolio in the long term. One superannuation fund Preqin spoke to said “we think there are good-quality assets, and we allocate a reasonable sum into infrastructure via a consortium.”

Patience is critical when it comes to investing in infrastructure, as it is an asset class that needs to be invested in through long market cycles. Liquidity is not that much of an issue as investors take a long-term view with core infrastructure, but there is a concern that the number of infrastructure assets is limited, and therefore, opportunities to gain access to premium portfolios are scarce, too.

Secondary markets offer an alternative solution to circumvent this by allowing superannuation funds to purchase fund stakes that are already between mid-to-late cycle phases. However, gaining access to those secondary markets is not cheap. Superannuation funds are not sure it is worthwhile. Asset managers require return hurdles, particularly on infrastructure, to be higher to justify their investment in the asset class. On a similar note, one industry fund observed that skilled infrastructure managers are few and far between, but as it tends to be a simpler asset to manage, investors are more likely to establish separate mandates with their fund managers or bring that capability in-house and invest directly in the asset class.

Although Australian superannuation schemes have been investing in infrastructure for the past two decades, industry funds and consultants alike still consider infrastructure a relatively new asset class for the superannuation industry, and most investors still see room for growth. “Australian supers are way more progressed than [those in the] U.S. and EU; no one is looking to reduce their infrastructure allocation. We are less optimistic on real estate than infrastructure,” commented an asset consultant.

But while superannuation funds maintain a bullish outlook on the asset class, like real estate, views have also become increasingly cautious as historical returns were largely based on a low interest rate environment and easy access to cheap borrowing. Some industry funds are seeing their infrastructure returns gradually decreasing. One asset consultant advised that investing in infrastructure or illiquid assets requires taking a long-term view; it is hard to navigate short-term changes: “You need to take into account inflation, interest and growth rates. From that perspective, infrastructure is mostly a defensive asset and it’s a benign outlook on that.”

Appetite Remains Strong

The infrastructure market may be changing, but for now, Australian superannuations seem to be willing to change with it. “It’s changing for sure. You can’t directly invest in infrastructure, but together with a manager, or teaming up with other superfunds, going direct, it is more possible,” said one Australian superannuation. Overall, the sentiment within the superannuation market seems to be that investing in infrastructure is still a solid decision for all types of funds, and this appetite in the asset class doesn’t appear to be diminishing anytime soon, despite the few challenges being seen.