How to Increase the ‘Tech Dividend’ in a Digital Future

A general view of the Data Analysis Center during the 2017 China International Big Data Industry Expo at Guiyang International Eco-Conference Center on May 27, 2017 in Guiyang, China.

Photo: Lintao Zhang/Getty Images

Risk management is becoming an increasingly crucial function for businesses. As Asian firms navigate a variety of emerging risks, investing in risk monitoring and mitigation strategies is becoming higher priority for the C-suite across the region.

Risk factors in Asia are set to become more complex and more impactful. Macroeconomic headwinds driven by global and Asian debt levels, slowing global productivity and rising anti-globalization sentiments are all driving increasing uncertainty.

Technological advancements are also exposing organizations to emerging risks, such as data fraud and cyberattacks, and threaten to undermine business operations by disrupting industries and replacing human labor. As regulators in Asia work to protect their domestic industries, prevent future financial crises, preserve their natural environments and arm against cybersecurity threats, businesses in the region are also set to face much tighter and broader regulations.

Grappling with these complex global shifts will require a robust risk function, equipped with additional funds and resources. Emerging technologies are poised to play a key role in enhancing firms’ risk management capabilities, according to a new report.

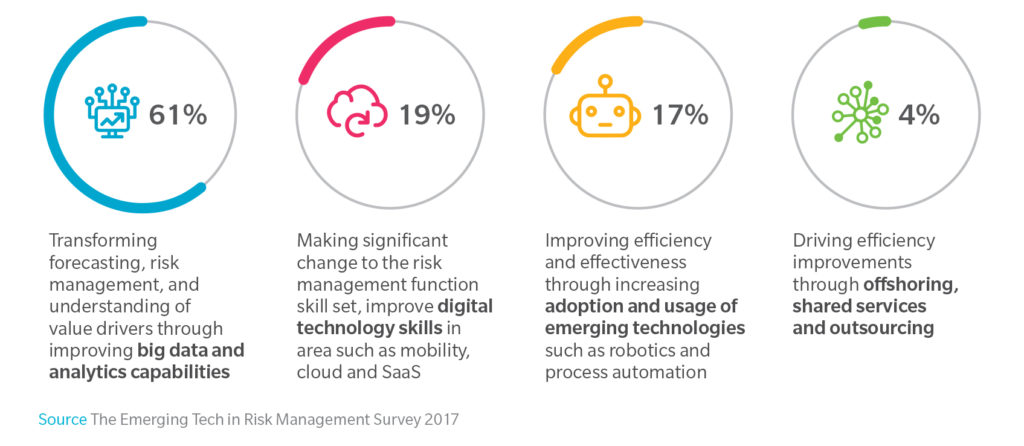

The report, Targeting a Technology Dividend in Risk Management, analyzes results from a survey of more than 130 professionals across various industries in the Asia-Pacific region. It finds that a majority of firms have already started planning to digitize their risk function either in large or full measure. In particular, more than 60 percent of respondents said that they were prioritizing the transformation of their risk function through big data and analytics technologies, outshining other emerging technology solutions such as robotics and the cloud.

Exhibit 1: Priorities for the future risk management function

The Risk Manager’s Conundrum: Obstacles to Digitizing the Risk Function

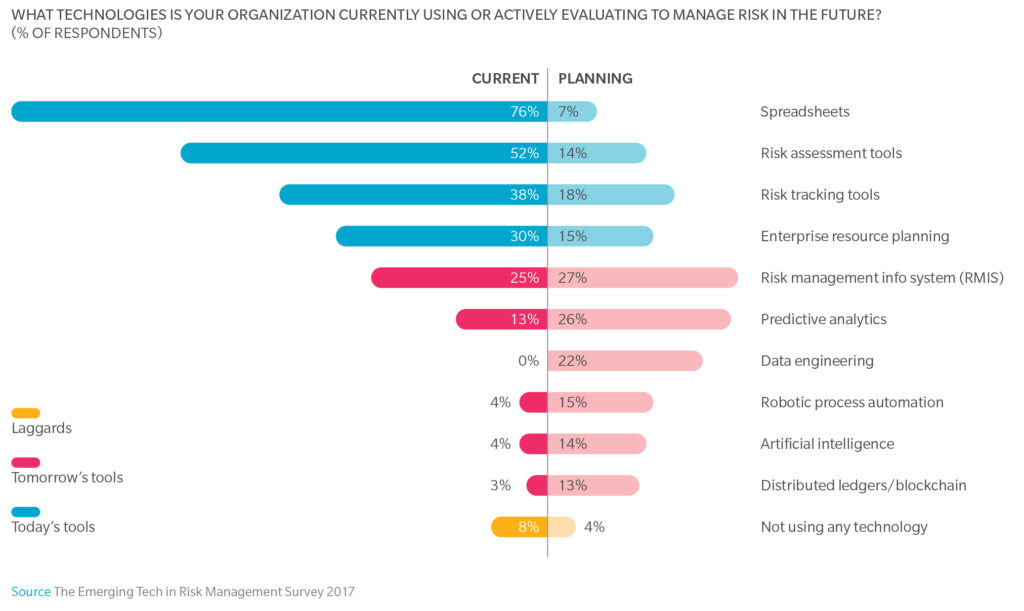

Although a majority of the survey respondents reported to have plans to deploy risk management technologies in the future, current adoption rates are low. More than half of the respondents indicated that risk managers within their firms are still assuming traditional roles such as managing financial and regulatory risks for business operations. Similarly, a majority of organizations today are still using traditional technologies to manage risk—such as spreadsheets and risk assessment tools—and only few have adopted predictive analytics, data engineering, or process automation. In fact, 8 percent of respondents stated that they were not using any technologies for risk management at all.

Exhibit 2: Discrepancies between planned and current implementation of technologies in risk management functions

The survey results also found that Asian risk managers struggle to find adequate support from senior management in digitizing the risk function. Two in three respondents reported that cost and budgeting concerns were key attributing factors preventing them from acquiring the necessary risk technologies, with many further noting that support from other functional areas and senior management was lacking.

Managers today, facing increasing risk and uncertainty, have to figure out how to do more with less. What risk managers bring to conversations about augmenting the effectiveness of the risk function and enhancing insights will be critical in the coming years, and technology must play a key role in that augmentation process.

Targeting a Technology Dividend

As risk functions prepare for the uncertainty ahead, it is crucial that risk managers recognize that there is a large technology dividend to be gained by leveraging three key capabilities: data, analytics, and process automation. These three technologies should be used to kick-start a broader technological pivot, leading eventually to a fully digitized risk function.

Data. Risk management functions must ensure that they develop a consistent and comprehensive collection of data. New sources of data, such as social media, geolocation software or industrial sensors need to be considered. Risk functions will need to extract forward-looking insights from large volumes of real-time data and incorporate new data sources into their models as they emerge.

Analytics. Machine learning and other advanced analytics have become affordable and readily available and are already providing dividends through applications across a wide variety of industries—from transportation, to risk underwriting, to market forecasting. Developing an advanced analytics capability will be a minimum requirement for any business seeking to attain parity with their competitors.

Processes. Robotic process automation is maturing and can now be applied to an increasing number of standardized tasks to increase efficiency and reduce costs. Risk management and monitoring processes need to be digitized with these new forms of risk processes to convert heavily paper-based, manual and slow tasks into automatic, dynamic and digital ones.

Getting Started: Implementing the Change

For firms to reap the rewards of their investment, digitized risk functions will have to look different from risk functions of today. Benefitting fully from the digital revolution will mean initiating a complete change in risk management processes, people, systems, and data use, meaning that risk managers must be prepared for their role to transform.

Being conversant in “tech-speak,” attracting “new-age” talent such as data scientists and being familiar with technological trends will be critical for future risk functions. The ability of a risk manager to communicate the “story” of the data to wider business audiences will also become a much more important skill. And most crucial: As automation refocuses skills away from manual, number-heavy and compliance-related tasks, managers will need to be able to provide higher-value strategy-oriented analysis for the C-suite.

Given the importance of risk mitigation in today’s landscape of uncertainty, leaving risk decisions to chance or intuition is no longer sustainable. With technologies advancing and becoming more mature and accessible, the time for risk functions to act is now. Organizations need to look beyond the immediate costs of digitization and realize the large dividends that can be gained by arming the risk function with technologies of tomorrow.