AI Is Growing, but Strategy and Skills Need to Catch Up

Source: Enterprise Technology Trends, Salesforce

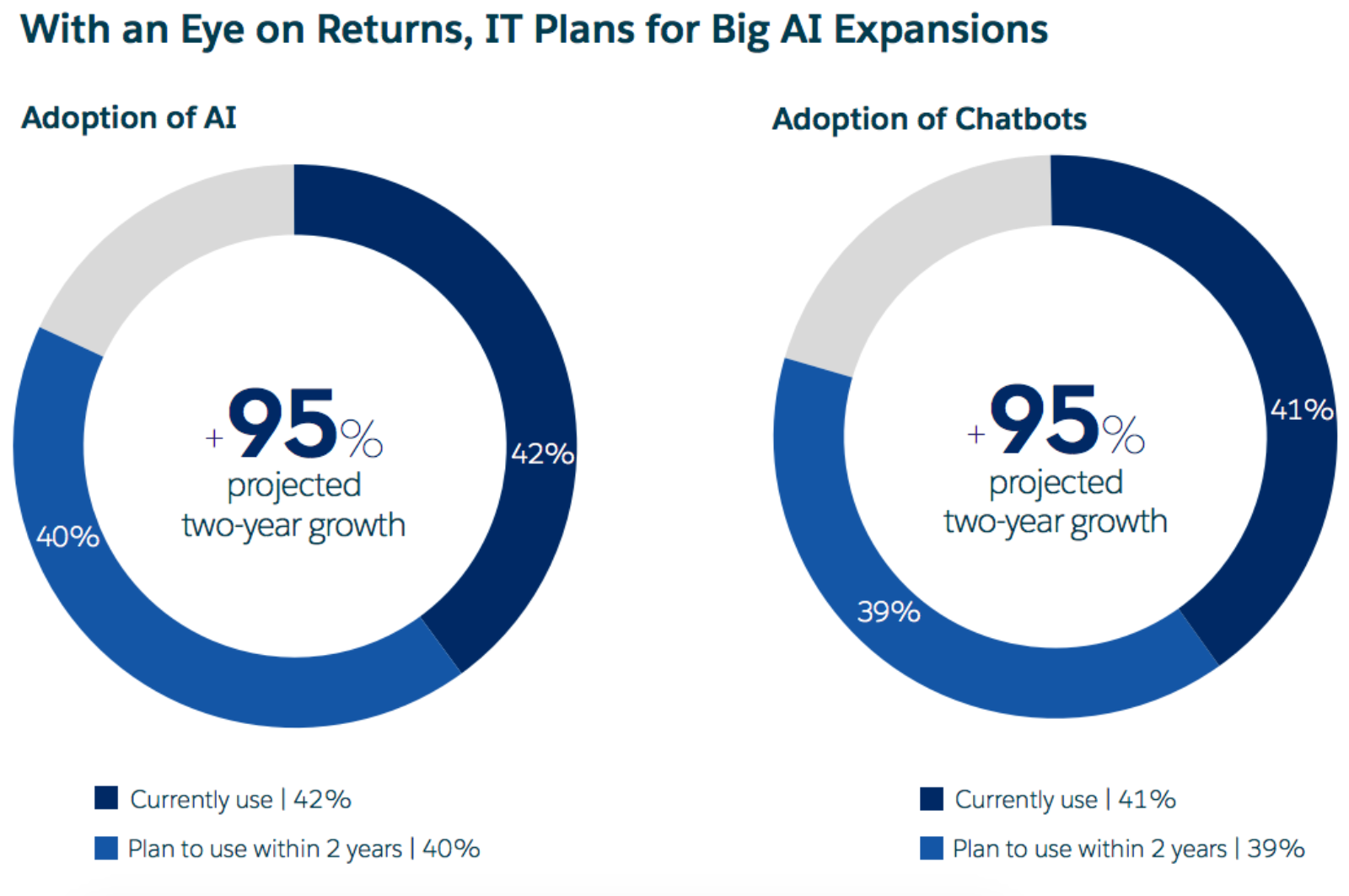

AI adoption is expected to double within two years in the IT industry. And chatbots — a form of AI that have maintained the same pace of adoption as AI at large — are also expected to double in use within the same time frame, a study by Salesforce shows.

Eighty-three percent of industry leaders say that AI is transforming customer engagement, and 69% say it is transforming their business, with customer service and marketing ranking as the areas of AI’s highest potential value. Beyond customer service, roughly 80% of industry leaders anticipate AI contributing to increased business security and operating efficiency.

However, while 37% of leaders say AI is a high priority, only 7% have a completely defined AI strategy. Insufficient skill sets are the biggest barrier to AI implementation, with just 10% of workers having advanced AI skills to match the desire to adopt the technology.

But who is responsible for closing this skills gap? Ninety-six percent of general public respondents said: companies.