Only Half of Workers Say Their Company Provides a Positive Experience

Source: LinkedIn Global Talent Trends 2020 Report — Employee Experience

More companies are investing in improving employee experience as competition for talent intensifies in a tight labor market, a new LinkedIn report found. Job titles that include the phrase “employee experience” have more than doubled since 2014, highlighting an industry-wide shift toward providing satisfactory working environments for employees.

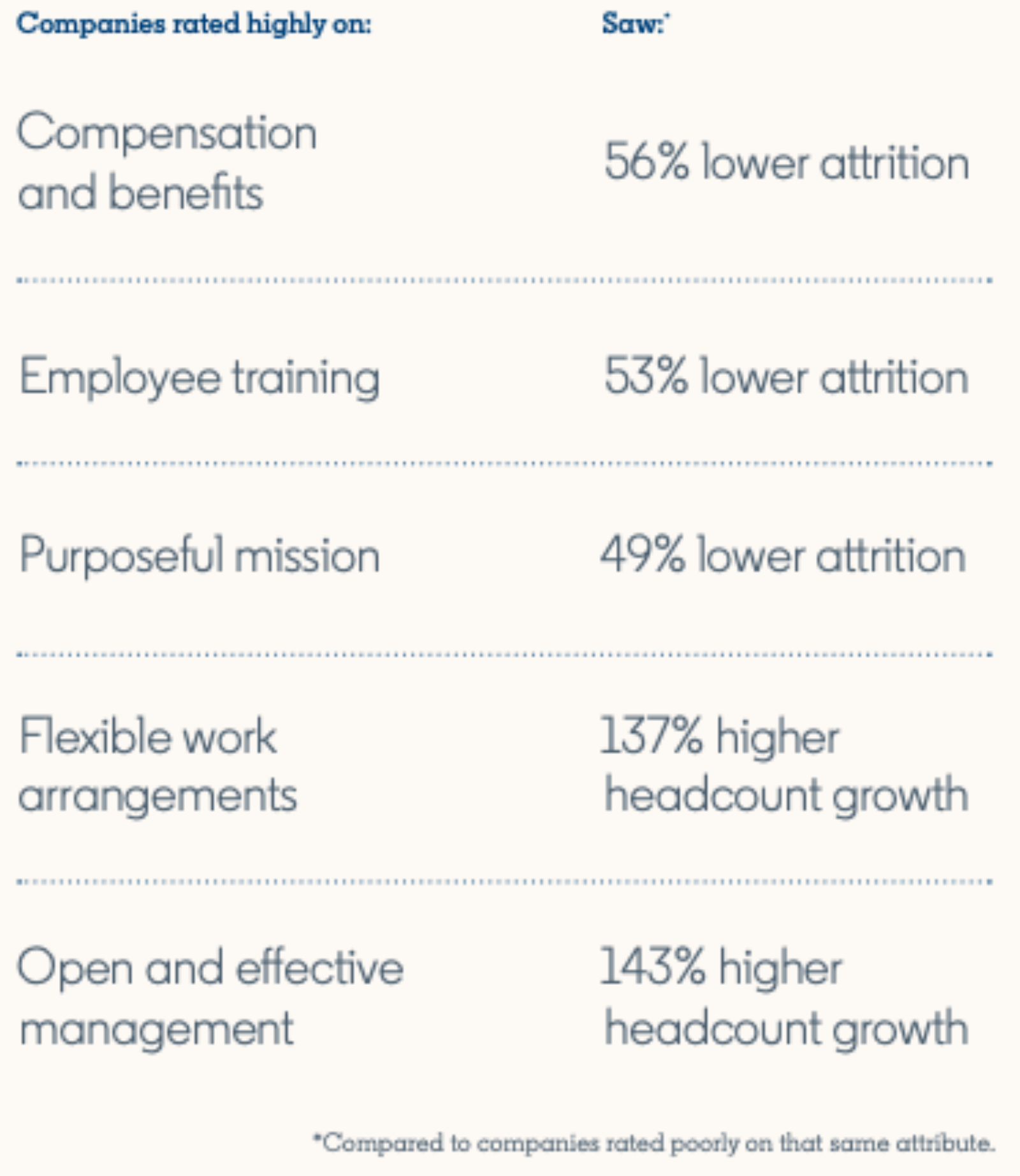

The LinkedIn report defines employee experience as “everything an employee observes, feels, and interacts with as a part of their company.” And companies investing in their employee experience are already seeing benefits to their bottom line, including higher productivity and staff retention, as illustrated above.

But there’s still a ways to go. Two-thirds of employees say their companies have improved their experience in the last five years, but only half of them said their experience was positive. A perception of company inaction and lip service to employee feedback and concerns remains prevalent. “Businesses need to put their money where their mouths are,” the report read.