Tech Hubs in the US Are Fueling Regional Divides

Source: Brookings Institution

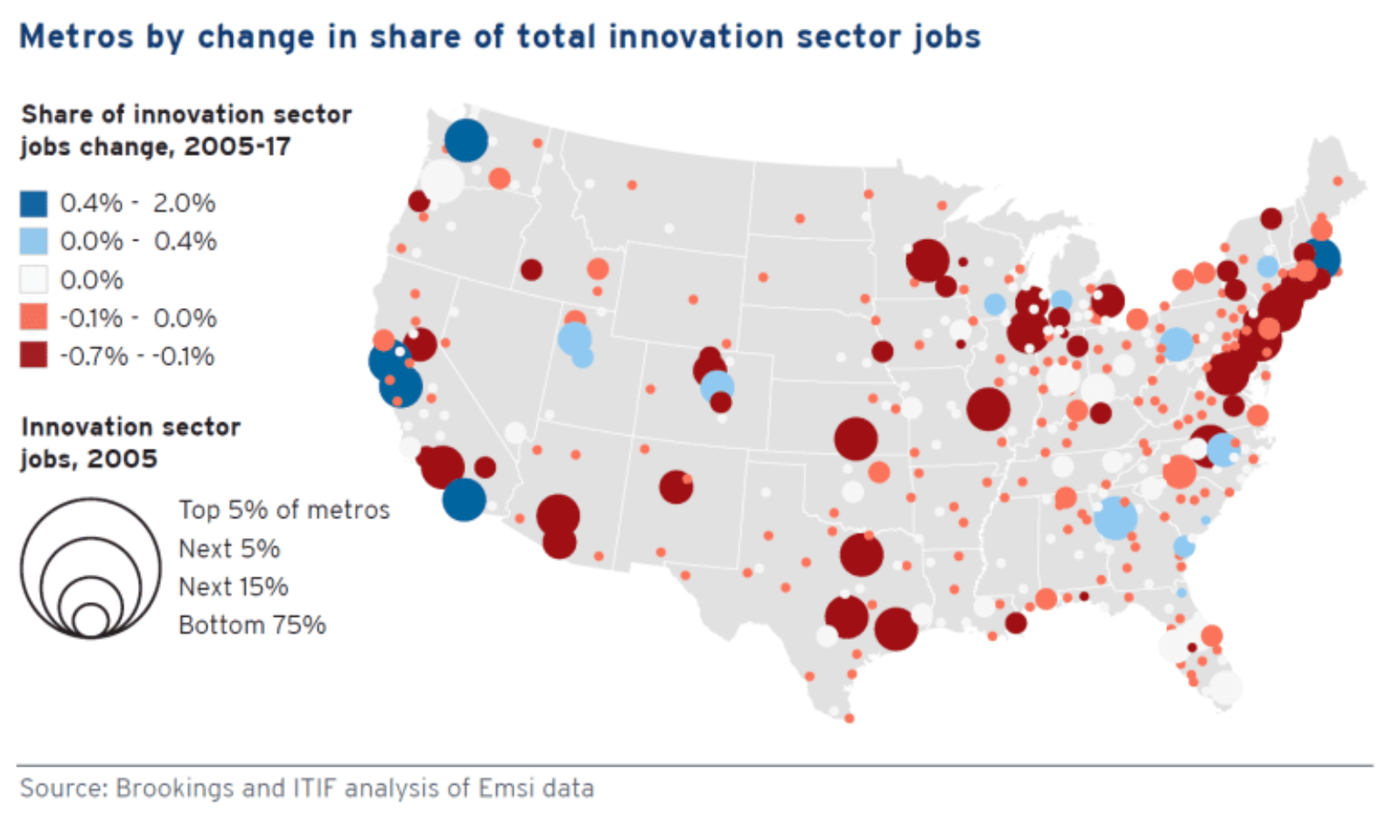

America’s high-tech innovation sector has exacerbated the nation’s regional divides, fueling growth in select metropolitan areas at the expense of other cities in the country. Boston, San Francisco, San Jose, Seattle and San Diego have benefited the most from the tech boom, accounting for “more than 90% of the nation’s innovation-sector growth during the years 2005 to 2017.”

A recent Brookings Institution report warned that the sector’s geographical concentration was a “grave national problem.” From spiraling home prices in tech hub cities to underdevelopment in regions left behind, “regional divergence is … clearly driving ‘backlash’ political dynamics.”

The report urges the U.S. government to immediately counter the trend by “creating eight to 10 new regional ‘growth centers,’” tying in tax and regulatory benefits to encourage the tech-innovation industry to expand beyond its concentrated hubs. The think tank estimated federal government investment for such an initiative to be $100 billion over 10 years — “substantially less than the 10-year cost of U.S. fossil fuel subsidies.”