How To Be a Player in China’s Asset Management Market

Employees of the Industrial and Commercial Bank of China talk with clients inside a newly opened branch.

Photo: Jasper Juinen/Getty Images

Recent structural reforms of the Chinese asset management market have given global asset managers unprecedented opportunities to enter the market, which is estimated to have approximately 48 trillion yuan ($7.4 trillion) under management.

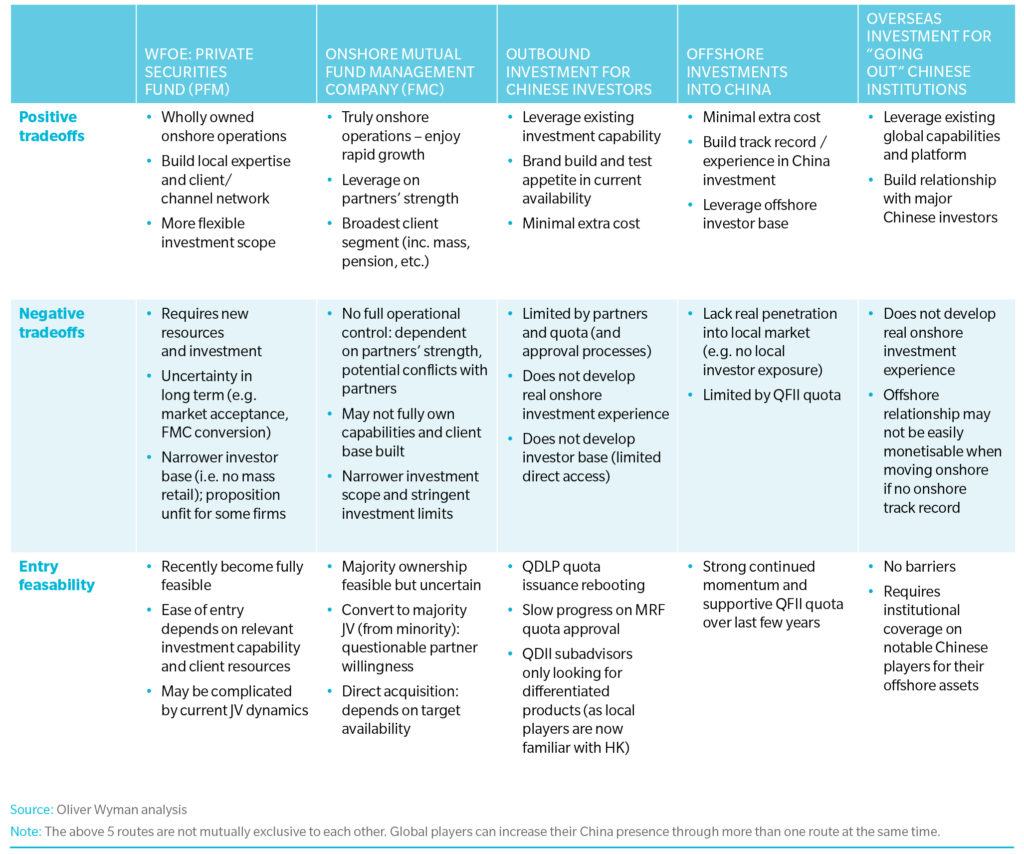

There are a number of ways global asset managers can participate in the market. These include:

Onshore private funds: Set up an investment management wholly foreign-owned enterprise (IM WFOE), and apply for qualification to operate a private securities fund management (PFM) business.

Onshore public funds: Participate in a joint venture of mutual fund management companies. Note that the foreign ownership limit is now lifted to 51 percent and will end after three years.

Outbound investment for Chinese investors: Provide Chinese investors with investment products/advisory on offshore assets through quota programs such as qualified domestic limited partners and mutual recognition of funds programs, or become an adviser to qualified domestic institutional investors.

Offshore investments into China: Invest in Chinese assets via offshore entity and various quota programs such as qualified foreign institutional investors (QFII) and qualified foreign limited partners.

Purely overseas investments for “outgoing” Chinese institutions: Manage global mandates for Chinese institutions with considerable offshore balance sheets and investment needs.

Exhibit 1: Comparison of Different China-Related Asset Management Entry Routes

Private Funds Offer Easiest Route

While the above five routes are not mutually exclusive and global players can attempt to increase their China presences through all of them, the opportunity to set up an IM WFOE and run private securities fund businesses has emerged as one the most tangible routes for global players to enter and operate domestically under full control in China.

At the time of writing, 10 global asset managers have already received the PFM qualification, while many other players are already registered as IM WFOE and are in the process of applying for PFM qualification. Several WFOE players have converted their previous advisory licences to IM licenses in order to be eligible to register as PFM managers. Five players, namely Fidelity, UBS, Man Group, Fullerton and Value Partners have already issued their first product.

Majority Ownership Still a Tough Road

In contrast, the inroad for developing majority ownership in mutual fund management companies remains opaque.

For those who are already in a minority joint-venture, pursuing majority ownership may be challenging considering the bargaining power of the local partners. In reality, the success of the leading joint-venture mutual fund management companies is often dependent on the distribution network and brand of the local partners, as well as alignment of interest between the foreign and Chinese management teams.

For those who do not already have a joint-venture mutual fund management company in China, the question remains as to whether one will be able to identify the right local partners.

Given China’s unique nature, global managers wanting to be successful in China will have to adapt and be open-minded to “execute strategy in uncertainty.” This means they should act fast to seize tangible entry opportunities and then leverage their early entry to build capability readiness in order to become relevant contenders for future larger opportunities.

Balancing Global and Local

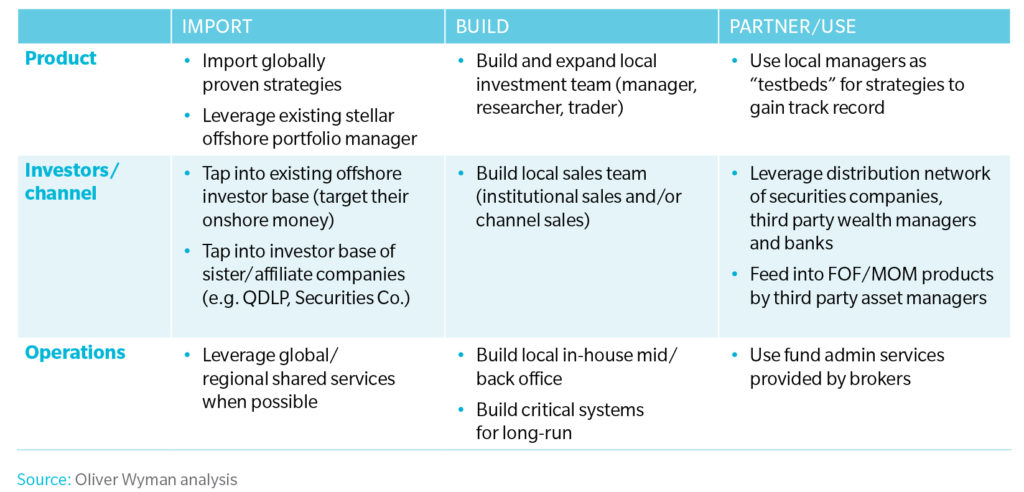

To successfully establish their presence in the private securities market, global asset managers must identify their target proposition in China and then consider how best to leverage their global capabilities to achieve that. They should also identify where the building of local capabilities and partnerships are needed to better fulfill the target proposition.

Exhibit 2: Strategic Levers for Starting a PFM Business

Developing Local Capabilities

Some asset managers have essentially leveraged on proven track records of their QFII share funds to launch their first products, while others focus on their global strengths in quantitative strategies.

This can help global players quickly establish brand and scale and meet the stringent requirements on issuing the first product within six months of PFM registration. Nevertheless, global asset managers should note that there may be challenges in replicating offshore/global strategies directly to China.

For example, the universe of fixed-income instruments traded offshore is very different from those traded onshore, which require fairly different credit analysis expertise.

All announced IM WFOEs are highly committed to developing local capabilities, with many of them expanding their investment teams with local recruits. Most of the firms have reportedly set up teams of 10-25 to support investment strategies development, brand building and business/partnership development.

Finding Win-Win Deals

Global asset managers should also actively explore different types of partnerships, as the local channels and brokers can provide a range of necessary resources from distribution to fund administration outsourcing. The key for global asset managers is to understand the differences in requirements, capability and incentives of different channels and to use such intelligence to strike “win-win” deals with local partners.

For example, local securities companies tend to be willing to support distribution and provide seed capital to managers to cement prime brokerage and fund administration-outsourcing businesses.

Entering China will not be an easy task for global players. However, the potential prize is worthwhile for those who calibrate their moves right.