Fintech in ASEAN—Collaboration Is Key

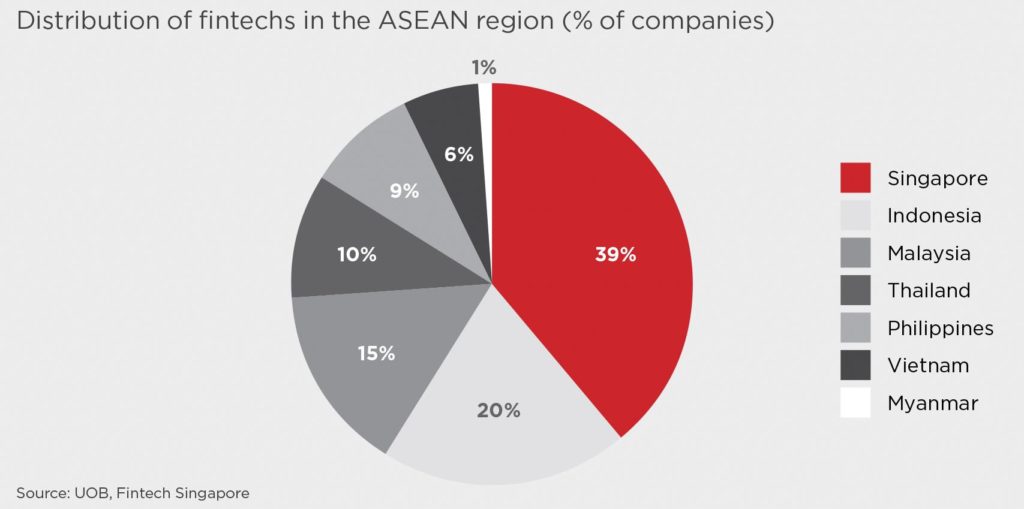

A general view of the financial business district in Singapore, illuminated with lights. Singapore is home to 39 percent of all fintech organizations among the seven ASEAN markets.

Photo: Roslan Rahman/AFP/Getty Images

With a population of over 600 million people, the ASEAN region is considered an expansion opportunity for fintech companies, given the large potential customer base that fintechs can tap into. A recent report by the Economist Intelligence Unit states that “Given population and GDP growth rates, combined with an increase in online access and smartphone penetration, ASEAN countries offer a fertile ground for fintech investment.”

Singapore Leads the Pack

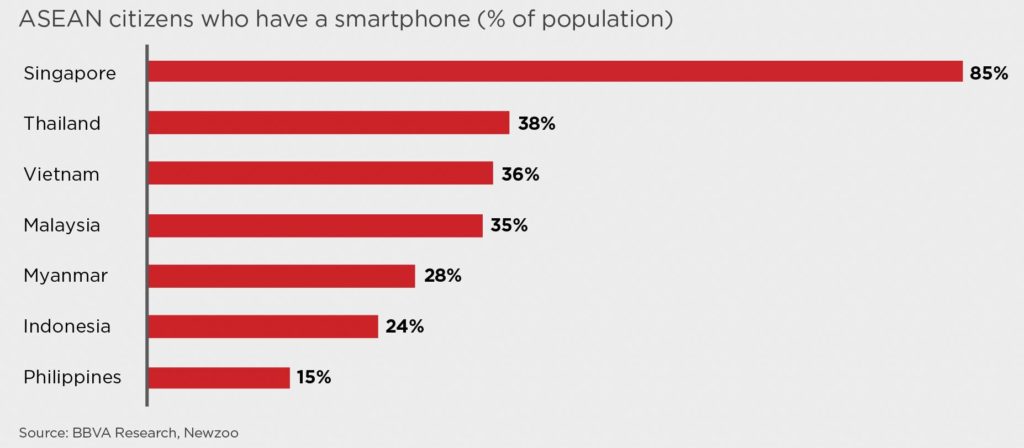

The report highlights Singapore as providing, “a mature market for fintechs while other countries offer major potential in terms of scale.” It also adds, “Singapore has the most buoyant fintech ecosystem in the region.” The city-state is the undisputed leader across most areas of measurement, followed by Indonesia, Malaysia and Thailand. Singapore boasts a smartphone penetration rate of 85 percent, twice that of its closest contender, Thailand. Furthermore, 98 percent of its population aged 15 and above holds a bank account. This high rate of financial inclusion also presents huge opportunity. With an average income higher than its ASEAN counterparts, four in 10 fintech companies choose Singapore as their operating base—more than any other regional country. In fact, Singapore is home to 39 percent of all fintech organizations among the seven ASEAN markets.

Opportunities in ASEAN

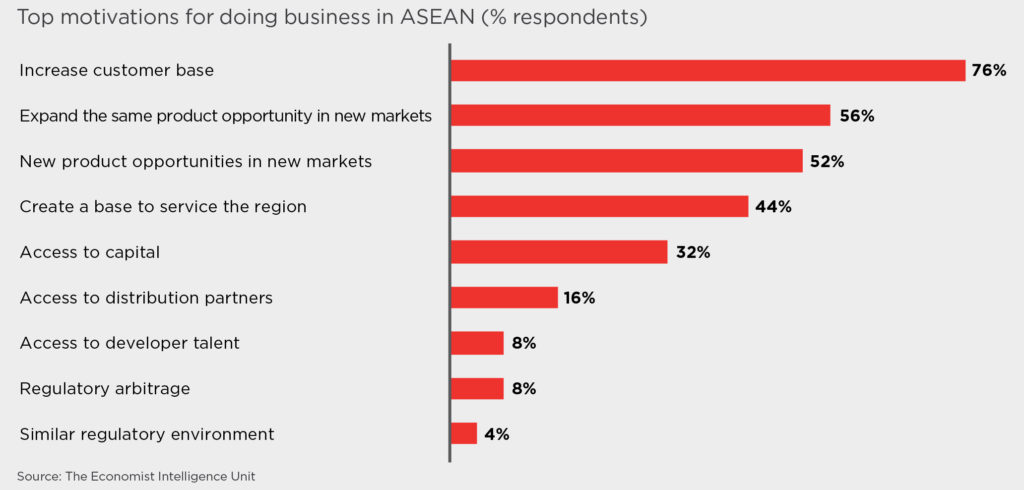

An estimated 76 percent of fintech executives have cited the potential to access and service a large customer base as their top motivation for engaging in business in ASEAN. The ensuing priorities include expanding the same product opportunity in new markets (56 percent) and new product opportunities in new markets (52 percent). “Our strategy is to find global banks that share the same vision as us and partner with them to provide next-generation unified commerce solutions to their customers,” says Simon Lee, CEO of Assembly Payments, an Australia-based fintech payments provider that is set to expand to Singapore by the end of 2018. Mr. Lee further added, “We believe in the next five years payments will be free,” highlighting the fact that traditional financial institutions typically generate profits from additional services, such as credit cards and foreign exchange and are, therefore, eager to partner with a fintech company.

Forging Partnerships Is Key

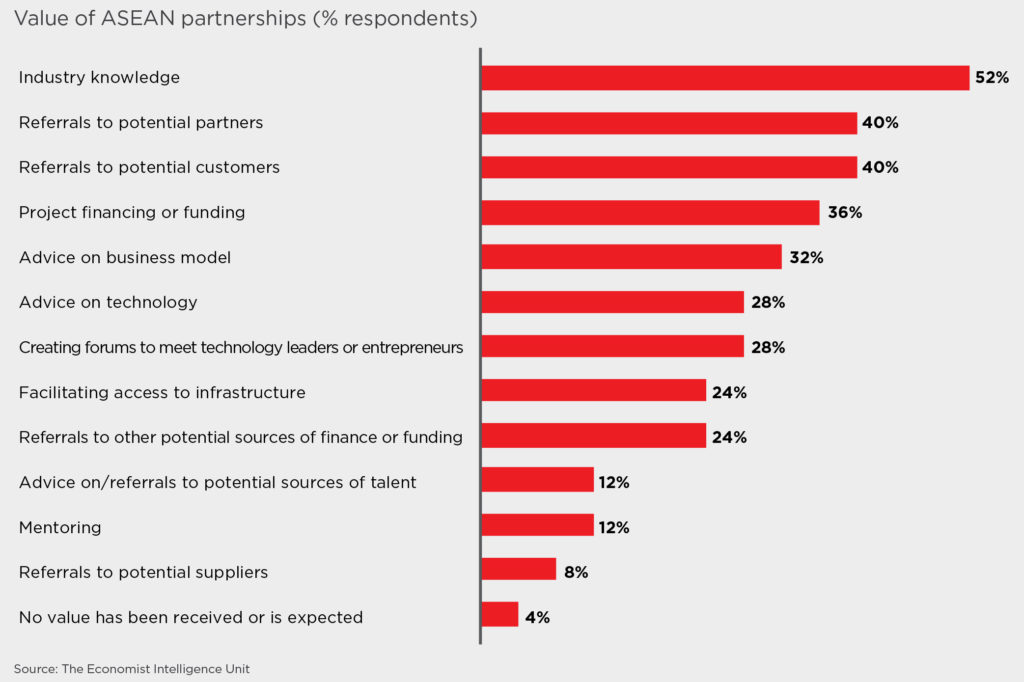

Partnerships in the fintech space are highly valued. A strategic partnership enables companies to gain local knowledge, understand how to do business in a local setup and get familiar with local regulations. The main benefits accruing from a partnership were greater industry knowledge (cited by 52 percent), followed by referrals to other partners (40 percent) and access to customers (40 percent).

Separately, 43 percent of senior executives stated that digital partnerships have enabled their organizations to deliver more innovative products and services. A further 30 percent cited lesser time taken to launch a new product or service, while another 30 percent highlighted the advantage of easier access to new markets. An estimated 48 percent of respondents said their organizations had six or more partnerships, indicating the high likelihood of collaboration. Among financial services executives, 81 percent agree their organizations must make an effort toward leveraging digital partnerships, a call to action for any fintech company looking to expand into the ASEAN region.

Simon Cant, co-founder and managing partner at Australia-based Reinventure stated, “Fintechs need to ensure they have a local partner.” Reiterating the necessity for local partnerships, he added, “There are cultural differences, and numerous geographical and other challenges, which means that local knowledge and local language is critical.”

Challenges

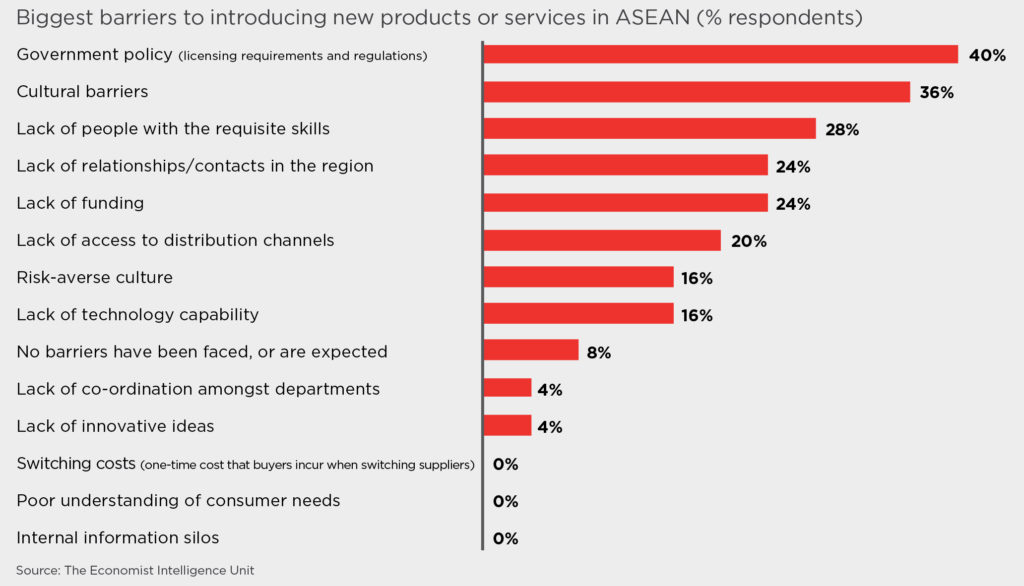

Forty percent of respondents cited licensing requirements and regulations imposed by regional governments as significant obstacles to introducing new products and services in the region. Julian Fenwick, managing director at Governance Risk & Compliance Solutions said “Many people assume it can be done relatively easily, but the culture is different and you have to make sure you have local staff.” Established in 2012 and currently serving 250 clients globally, Governance Risk & Compliance Solutions uses technology solutions to meet local compliance rules. He further added “Old compliance techniques don’t work for new business models, such as fintech.” Apart from regulatory challenges, cultural barriers (36 percent) and a lack of people with the requisite skills (28 percent) are also major hurdles.

Recommendations

The ASEAN region presents diverse opportunities accompanied by myriad challenges, considering the varied socioeconomic and demographic composition of its members—spanning from the small but advanced city-state of Singapore to the Indonesian consumer market of more than 260 million people. In this regard, fintech companies could consider several recommendations.

All ASEAN economies are growing steadily, and fintech companies must be swift in tapping into available opportunities by identifying which country is most conducive for its offerings. In attempting to do so, they must also develop a detailed understanding of its local regulations. Fintech companies must understand that each ASEAN market is unique, and an association with a regtech company could enable it to conduct business smoothly. Likewise, local partnerships can prove to be a boon since local actors understand the local environment and can ease the transition of doing business in another country. Similarly, collaborating with local banks and other traditional financial institutes can also help gain customer access and knowledge. Firmness of purpose is key and the report aptly highlights, “Many markets require time, patience and investment in order to succeed, and local business culture can reward those who stay the course without leaving too soon.”