Growing Health Costs in Asia: How Can Employers Plan Better?

Indonesians wait in the corridor of a public hospital in Jakarta, to get health care. With 160 million members, Indonesia's two years old national health insurance program is the largest national health scheme in the world.

Photo: Bay Ismoyo/AFP/Getty Images

Health costs in Asia continue to increase, exacerbated by an aging population, negative lifestyle changes and legislative influence on health—all of which are prompting organizations to consider less conventional methods of developing an employee benefits strategy.

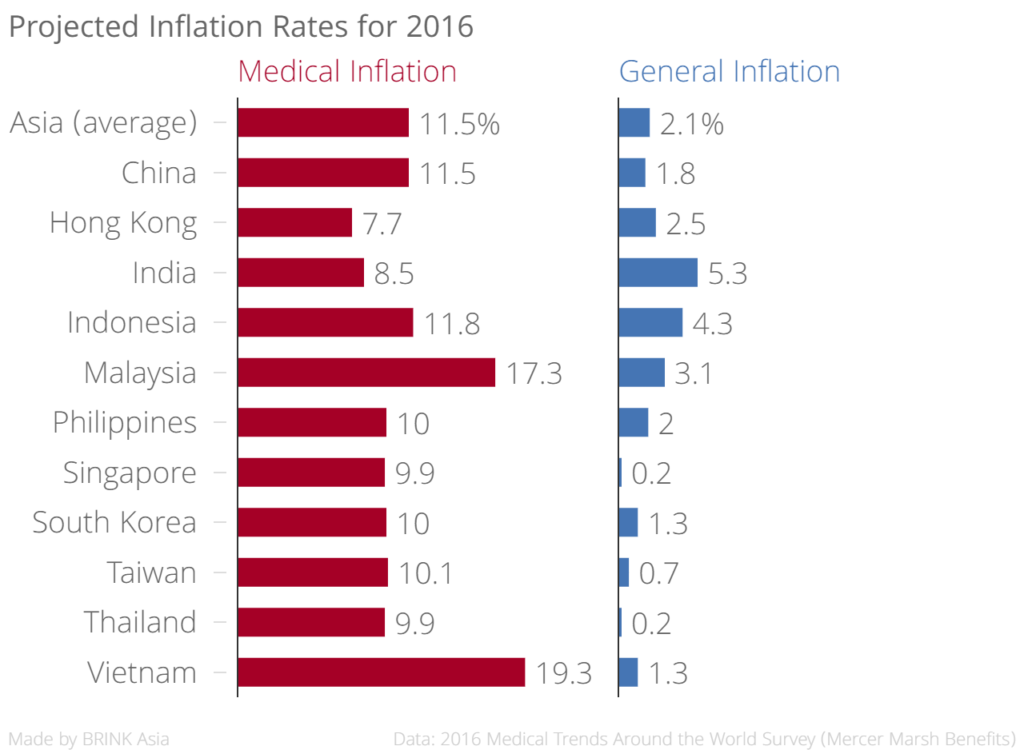

A recent Mercer survey on medical trends reveals that medical costs in 40 countries across the world are set to increase by an average of 9.8 percent in 2016. In Asia, medical inflation is projected to increase by 11.5 percent in 2016, outpacing both general price inflation in the region and the global medical inflation average.

Countries expected to have the most alarming medical inflation rates this year include Vietnam at 19.3 percent, Malaysia at 17.3 percent and Indonesia at 11.8 percent. Drilling down further, a varying distribution of inpatient versus outpatient medical inflation becomes apparent. For example, increasing rates in Malaysia are driven primarily by outpatient costs, which account for 18.1 percent of total costs; in Vietnam, inpatient costs are more prevalent at 22.1 percent. Such disparity invites employers to take a deeper look at what is driving their own increasing costs.

Key Cost-Drivers for Medical Inflation in Asia

An increase in non-communicable diseases is the most prominent driver of employee medical costs in Asia, owing to harmful lifestyle habits, an aging workforce, and the cost of medical technology that enables employees to live longer and therefore remain in the workforce longer.

Additional contributors to cost increase in Asia include expanded employee demands, rising incidence of chronic conditions (such as cancer and circulatory system and respiratory diseases) and the increasing prevalence of infectious diseases.

Surprisingly, inpatient claims costs for cancer and gastrointestinal diseases are trending higher than circulatory system diseases in Asia, whereas outpatient claims costs for respiratory conditions outnumber all other conditions. Factors such as increased air pollution and an increase in infectious respiratory diseases, such as tuberculosis, are likely behind the rising number of claims submitted by employees.

In addition, changes in government health care regulations are playing a part in the issue. New legislation from Vietnam’s Ministry of Health, for example, is expected to increase charges for patients in public hospitals, driving costs up by 30 percent.

Proactively Managing Risks—a Holistic Approach

Employers have traditionally focused on conventional solutions when planning and managing their employee benefits programs. Such solutions include “squeezing” insurers for the best price, or reducing the plan design and co-insurance approaches. Although these tactics do provide some relief from increasing medical costs, the results are short-term and reactionary resolutions, and in the case of reducing the coverage level, there will be a negative reaction from employees.

Rather than focusing on temporary, quick-fix remedies, employers should consider shifting toward a more holistic and integrated approach to employee benefits. Developing a more evidence-based approach that leverages both traditional methods and modern advancements in employee benefits is the way of the future.

Five Components of a Holistic Benefits Strategy

Data Analytics. Employers can gauge the health of their employees by analyzing claims data, but this offers a single lens and is a retrospective view. A better plan is to look at other data to identify risks and anticipate future claims costs. Drawing on correlations between different components of the medical program, such as employee risk profile and reasons for absenteeism, can help employers understand employee health behaviors before they become too costly. The key is to leverage data already collected and track other metrics to further enhance the data set.

Preventive Programs. Employee benefits efforts should include programs that educate employees about how their lifestyle choices have a direct impact on their health. By taking a proactive approach that addresses both biomedical risk factors (like high blood pressure) and behavioral risk factors (such as lack of exercise), employers have a better shot at maintaining and even improving employee health.

Vendor Management. Increases and changes in providers’ fees account for a large part of increased medical costs, with inpatient and hospital fees being the highest contributors. Employers can evaluate their medical network strategy to understand key cost-drivers from providers, and then implement measures to monitor and manage the costs of services and products.

Employee Education: Responsibility vs. Entitlement. Employees have a role when it comes to shopping smartly, making informed choices, and managing medical costs. Employers need to educate their employees on the value of the program, employees’ role in using the program wisely, and that the program is there to protect them from financial loss at the time of medical need.

Total Well-being. Stress in the workplace is also key cost-driver. Employers need to avoid thinking of wellness as purely physical and consider their employees’ financial, emotional and mental wellbeing—communicating a more inclusive definition of wellness.

Overall, the survey revealed that governments across Asia are not providing sufficient health care systems to meet the growing diversity of patient needs, shifting much of the cost burden to the patient. To maintain and even reduce medical costs, employers should work closely with providers to develop more comprehensive benefits strategies that emphasize the importance of total well-being.