How to Win in Retail Banking as Emerging Markets Slow Down?

An employee counts 100-yuan banknotes at a bank in Lianyungang, in eastern China's Jiangsu province. China weakened the value of its yuan currency by 0.51 percent to 6.5646 against the U.S. dollar on January 7, 2016, according to figures from the China Foreign Exchange Trade System.

Photo: STR/AFP/Getty Images

Driving exponential growth in retail banking is going to be challenging across Asian emerging markets (EMs), including China, Indonesia, Malaysia, Thailand and India. The slowdown in the pace of growth is driven by slowing GDP growth (Indonesia, Thailand and China), turning credit cycles (Thailand and Malaysia) and continued volatility in currency and commodity markets.

Notwithstanding the relative slowdown, the absolute scale of the opportunity will still be very large. Our analysis covering 12 leading EMs across the globe estimates that the retail banking revenue pool will grow by more than $450 billion over the next five years. This will be fueled by the extension of access to financial services to an additional 250 million households and the increasing need for financial services from another 90 million households as they transition from the mass market to the mass affluent segment.

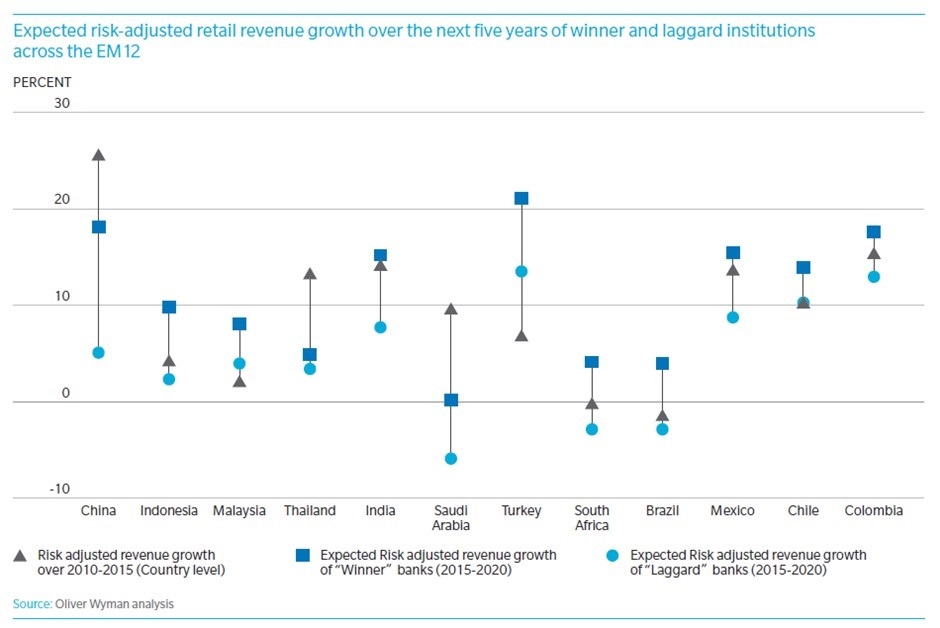

Institutions that make the right play in four key areas of opportunity across these markets will grow at a much faster pace than their peers, often by two to four times. For example, “winner” banks in Indonesia may be able to grow their risk-adjusted retail revenue by 10 percent per annum over the next five years while the “laggards” will struggle to grow more than 2 to 3 percent per annum.

The Four Growth Opportunities

Adoption of digital channels, products and business models. We believe that digital-led / digital-only products and business models will see much greater proliferation across EMs over the next five years. Its pace and impact will be somewhat market-specific; while 15 percent of retail revenue growth in China may come from digital products and business models, the share may be more around 4 to 6 percent for Thailand.

Banks that have been early investors in data infrastructure, big data analytics, development of modular platforms and internal agile management practices will be at a significant advantage when the digital segment starts driving banking revenue pools in “digital-ready” markets across Asia. China is already undergoing such a phase of transformation, with Malaysia, India and Indonesia to follow next.

Untapped opportunity in small- and medium-sized enterprises (SMEs). SMEs drive economic growth in most EMs and represent a significant financial services opportunity; however, getting SME banking right is often difficult, given organizational and operational challenges.

EM banks that get the SME segment right generate significant financial benefits with a typical return on equity (ROE) upward of 20 percent and a well-balanced loan-to-deposit ratio of 80 to 120 percent. Many of their peers languish with less than 10 percent ROE, rough credit cycles and outsized credit exposure relative to their funding mobilization from the segment.

Getting the SME segment right requires organizational focus and development of distinct segment capabilities (for example, digital credit process and new data-based credit analytics) and going beyond traditional banking products to meet emerging and unmet needs of the segment (for example, cash flow volatility loans and cash management solutions).

Sustainable growth in retail credit. Retail credit is expected to remain a major component of retail banking revenue growth, contributing 20 to 30 percent of total growth across markets in emerging Asia; however, a number of these markets have started seeing deterioration in credit quality that often looks poised to get worse, given the negative macroeconomic outlook and alarmingly high debt-to-disposable income ratio in some markets (China, Malaysia and Thailand).

Building next generation risk-management capabilities while pursuing growth initiatives will be key to sustainable performance in retail credit. We see significant opportunities for banks in these markets (particularly those in Southeast Asia) to improve retail credit performance by actively managing key value levers such as pricing optimization, better underwriting and risk expansion, balance retention and attrition management.

We also see an opportunity to develop more robust non-performing loan (NPL) management capabilities including early warning signals, high-limit management in the SME segment and active work out strategies.

Development of an affordable banking proposition. The affordable banking segment includes the unbanked population along with the section of the mass market that is currently underserved by banks. Serving this segment has long been treated as a commercially unviable strategy and is often done for the sake of social good, but near-universal access to mobile phones, rapidly improving digital infrastructure, availability of new data sources and prudent regulatory actions are changing the dynamics of this segment.

We believe that a mobile-led banking proposition delivered via partnership with existing distribution channels (retail stores working as transaction points) and leveraging alternate data sources for managing risk can be a game changer in this segment. Non-bank payment-led models (M-Pesa, WING, TrueMoney, Paytm) have so far created greater impact in this space than banks, but banks have now started focusing on this segment as their core customer segment (BTPN, small finance banks in India). For large unbanked and under-banked markets such as India and Indonesia, this remains an untapped opportunity.

We believe leading banks across emerging Asia need to pursue an agenda on market leadership across these growth areas in order to maintain their market positions. Effective response will lead to accelerated growth in risk-adjusted performance, enabling market leaders to widen their performance gap vis-a-vis lagging institutions.