Is the Financial Sector in Asia Facing a Kodak Moment?

An investor in Shanghai monitors stocks on his mobile phone. Financial institutions in Asia are increasingly focusing on digital transformation to enhance customer experiences.

Photo: Johannes Eisele/AFP/Getty Images

The recent explosion in fintech activity in Asia has created a dilemma for traditional financial institutions, service providers and regulators: whether to collaborate with the fintechs as long-term partners, or to limit collaboration and invest in their own digital restructuring activities.

When traditional financial services providers partner with fintech companies, they usually do it to get access to new or underserved markets, to deliver their services over an innovative platform, to improve customer experience, or to benefit from cost savings and increased productivity.

There have been successful examples of collaboration in Asia such as Active.AI and Axis Bank for chatbots; soCash and Standard Chartered Bank for cash withdrawals in Singapore; and Bambu and Franklin Templeton Investments for robo-advisory platforms.

However, financial services providers and regulators are conservative in approach and tend to be plagued with hierarchical structures, slow decision-making and legacy systems. Fintech companies, on the other hand, are nimble outfits with the ability to execute quickly, but they come with limited resources in terms of team size and capital backing. This cultural and structural mismatch introduces complexities in the relationship between a fintech and the incumbent. The incumbents, on their part, have attempted to bridge the divide by launching incubation and accelerator programs, while regulators have introduced sandbox-based initiatives to encourage new innovations in a controlled environment.

Despite these initiatives, more can be done to facilitate collaboration between fintechs and the incumbents, since fintechs can make traditional financial services stronger. Some additional measures include:

- Publishing business problem statements for fintechs to tackle on an ongoing basis

- Clear awareness of the different stakeholders for each business problem and the point of communication

- A sandboxed environment being made available to fintech companies of any size

- Streamlining internal processes for faster reviews of applications that leverage open banking APIs

Despite the success of many fintech-incumbent collaborations, some incumbents choose to limit collaboration and instead invest in internal restructuring activities to better serve customers and fend off competition. While some of these restructuring efforts can be successful, there are potential pitfalls of this approach as well.

Incumbents and Digital Transformation

To provide better digital experiences to customers and to fend off competition, financial institutions have undertaken internal digital transformation exercises. One aspect of these exercises is to train internal employees on having a digital mindset and a customer-centric approach. Financial institutions have also formed mini “startup” units within their organizations to make these units think and function like startups. Other initiatives include securing key hires from technology companies and startups to facilitate an internal culture change and streamline functions and processes.

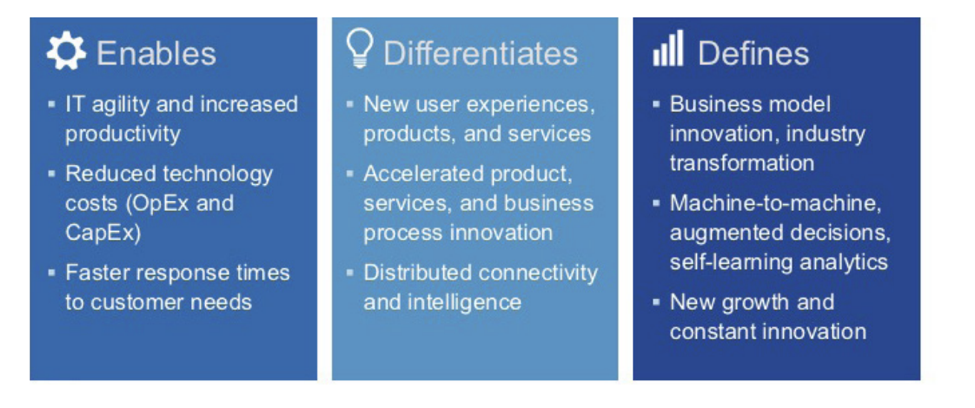

Exhibit: The Stages of Digital Transformation in a Financial Institution

Banks such as DBS in Singapore and Wells Fargo in the U.S. are prime examples of financial institutions that have been quick and early to respond to industry changes and launch internal initiatives. Unsurprisingly, these banks have led in providing superior omnichannel customer experiences and remain at the forefront of digital transformation.

What Should Incumbents Focus On?

Despite the above internal initiatives, can an incumbent afford to stay away from collaboration with fintechs? The answer lies in the ability of a financial institution to answer the following questions:

- Does the incumbent have the necessary skills and resources internally to innovate new products and create new experiences for customers?

- Does it have the ability to quickly test new ideas and concepts?

- Does it have the ability to launch new products in a swift and nimble manner?

Since a majority of financial institutions retain legacy structures and systems, a transformation of systems, processes and thinking is likely to be a slow and gradual process. At the same time, incumbents do not want to be lagging behind in digital innovation, and hence close partnerships and collaborations with fintechs remain the order of the day.

Financial institutions view the biggest technology platforms of the world such as Amazon, Facebook, Apple, Google and Alibaba as the biggest source of disruptors. Adopting a continuous process of swift and strategic partnerships with fintech innovators and adopting an open and collaborative framework in the form of API platforms and sandbox environments are likely to keep financial institutions relevant for customers.

But in the absence of constant innovation and rethinking of products, services, and processes, who would bet against the banking industry facing a Kodak or Blockbuster moment?