Robo-Advisory in Japan: A Need to Push the Envelope

Robo-adviors are poised to shake up the financial services market in Japan.

Photo: Shutterstock

Japan has been at the forefront of innovation in the asset management—and the broader financial services—industry in Asia, with a number of new and incumbent players rolling out robo-advisory services. Robo-advisors are online platforms that offer investment advice based on sophisticated algorithms mapping portfolios that can look at investment performance across asset classes in real time.

While there is vast potential in this area in Japan, the gains made by the robo-advisory industry may be limited if it does not strive to improve investment literacy and enhance accuracy and transparency of information.

Wealth Management Market

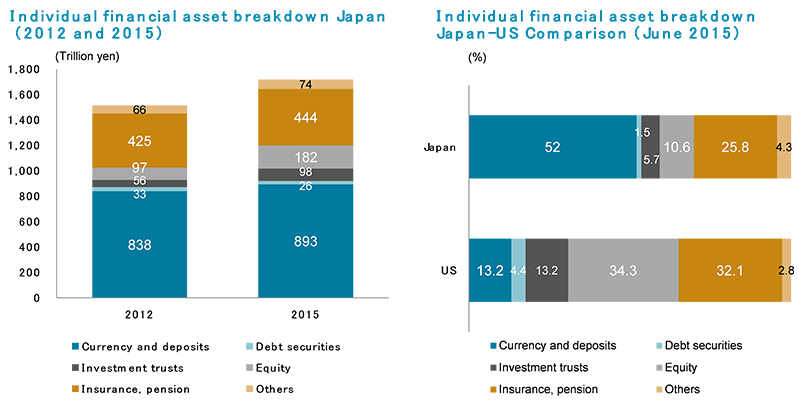

Japan’s wealth management market differs significantly from the global market in several ways. Individual financial assets are managed with an emphasis on security and primarily allocated toward deposits, while potentially highly profitable securities—in particular, equity—are not typically preferred. The asset management emphasis toward savings deposits has persisted through the nation’s deflationary phase, but with the introduction of inflation targets and monetary easing, this approach increasingly makes less sense. This leaves one wondering when the trend will change and what will trigger it.

In January 2014, the government introduced a new initiative to encourage a shift in behavior from saving to investing. The Nippon Individual Saving Account was designed to support the stable growth of household assets while boosting the availability of capital required for economic growth. While a combination of macroeconomic factors—including changes in exchange rates, a rebound in stock prices and an upturn in the economic environment—seems to be leading the market in a more positive direction, Japan’s investment market still differs significantly from Europe’s and North America’s, particularly in areas such as diversity in the composition of individual asset holdings, the investment environment for individual investors and investment literacy.

The Rise of Mutual Funds

Against this backdrop, the growth in capital allocated to publicly offered mutual funds has been impressive. In May 2015, total assets under management topped 100 trillion yen ($8.8 billion) for the first time, driven by an influx of money into open-ended mutual funds. As Sept. 30, 2015, that amount reached 75 trillion yen, up 60 percent from 2012.

Two core factors drove mutual fund growth: increases in channels and products. Channel growth means that the number and type of intermediary players that bring together mutual fund management firms and investors have both increased.

The market was opened to banks in December 1998. After an eventful subsequent period, the formidable growth in banks’ mutual funds’ sales has put it nearly on par with the amount sold by securities firms. As of end-2015, banks’ mutual fund sales, including private placements, had reached 64 trillion yen, accounting for 46 percent of the market. At the same time, banks have started offering a wider range of products.

Further fueling the current surge in low-cost investing, which can bring high if unstable returns, will require raising the financial literacy of the investor, providing novel products and services, and forging new sales channels that harness technology. There is extensive potential here for robo-advisory services to gain a foothold and thrive in the Japanese market.

Technology and New Business Frontiers

Megabanks, startups and dedicated online brokers are all jockeying to leverage their strengths in a way that accords them the most advantageous position. The latest development in the ongoing competitive battle to be first is unfolding around robo-advisor services and technology, with a key point being which customer categories to target.

Historically, the asset management business in Japan has revolved around relatively lower-hanging fruit: customers that have both assets and financial literacy. Moving forward, that will change. It will be important for players to expand the market’s reach to include younger generations in the midst of becoming financially literate and seniors with little technology experience.

Pushing the boundaries of the market and acquiring new customers will be crucial if robo-advisory services are to gain traction and not become just a fleeting phenomenon.

Current robo-advisor initiatives in Japan are largely tailored to support the sales of mutual funds. As easy-to-use, non-face-to-face services, they are garnering interest from investors comfortable with information technology and a degree of financial literacy. Moving forward, further advancements that draw on both asset management options and technology are expected in the following areas:

Diversity of products. Expanding the range of products offered from general, publicly offered mutual funds to a variety of asset classes.

Diversity of services. Online onboarding, portfolio management, reports and alerts. Operation support that is a hybrid approach, harnessing both existing contact centers and face-to-face services.

Automation. Automated reinvestment and rebalancing. Supporting small-value and high-frequency trading.

Accommodating business-to-business (B2B). Pro-level sales support tools developed to offer the advanced features professionals want. Vendor-supplied cloud services and financial institution-supplied white-label service offerings for other financial institutions.

The Road Ahead for Robo-Advisor Services

The essence of financial system services will remain, but with innovation, the inconvenient and irrational elements of the industry will be eliminated. The first touchstone for this will likely be the battle among robo-advisor services.

On the demand side, robo-advisor offerings are expected to play a supporting role, in particular with retail investor asset management in terms of the plan-do-check-act (PDCA) cycle (which in this context refers to setting fund management goals, selecting and purchasing products or services, post-purchase review “checks” and ongoing action).

On the supply side, expectations are high that robo-advisors will yield benefits in B2B via functions that enable support tools geared toward professionals in the asset management arena. Moreover, observers expect robo-advisors to play a role in enabling asset management to evolve into a sounder and more cyclically sustainable market.

In order for the robo-advisor industry to become a more prominent part of the asset management ecosystem, it will need to adapt and offer more services and more information. We expect that these challenges for robo-advisors in Japan’s market will in turn help to supplement investment literacy on the demand side and heighten accuracy and transparency related to information (including price, quality and risk) about asset management products and services. It will also supply technology that will help to solve the incentive problems that interfere with efficient business transactions on the supply side (and the oligopoly of the value chain).