The Impact of Technology on East Asian Economic Prospects

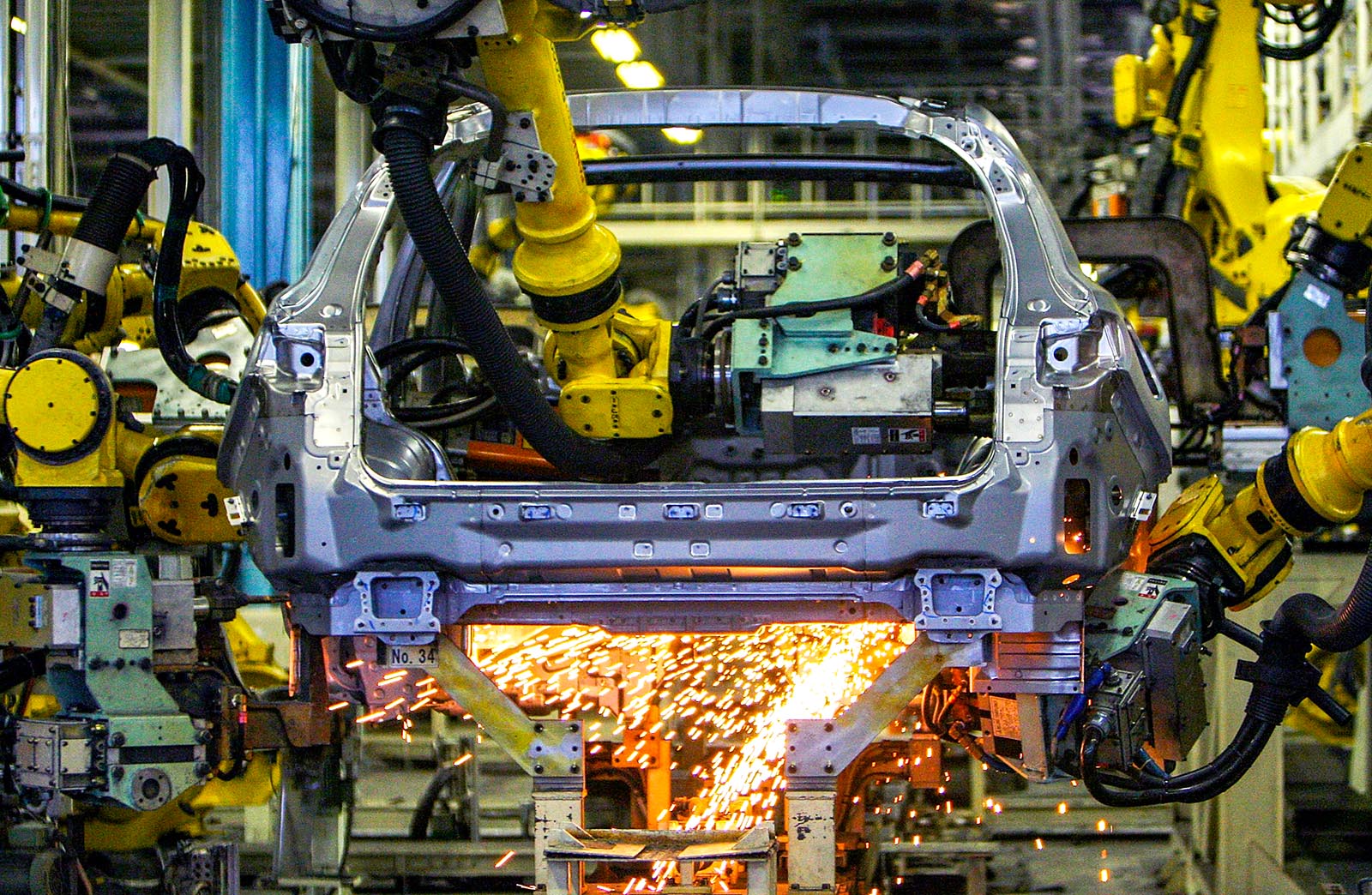

Arm robots assemble parts of a car at an automobile plant in Japan. As ASEAN+3 economies grow, they will have to grapple with the rapidly evolving technological landscape.

Photo: Junko Kimura/Getty Images

As ASEAN+3 economies pursue growth and resilience a decade after the onset of the global financial crisis, one question looms large: Is technology a boon or bane for these states?

The most advanced economies, such as Japan, Korea, and Singapore, are better-positioned than the rest of the region to face the challenges posed by technology. However, the impact of technology on growth and employment does not materialize in isolation. Rather, it manifests itself in interactions with ongoing changes in the nature of cross-border production and trade and shifts in demographics.

The technology-related challenges that emerge for economies across the region will require solutions at the national and regional level.

Today’s new technologies are mind-boggling: artificial intelligence, 3D printing and digitization, among many others. The disruptions they bring about can have far-reaching implications for both growth and employment across all ASEAN+3 economies.

Changes Being Witnessed

In Cambodia, the textiles, clothing and footwear (TCF) sector accounts for about 90 percent of manufactured exports. Automation is threatening to take away jobs from many of the more than 600,000 workers who are struggling to move on from sewing machines to newer, more advanced technology-intensive machines. Currently, there are limits on the extent to which the TCF sector can be automated or disrupted by technology because of the relatively unstructured nature of the work and the low wages of the workers. Therefore, there is a window of opportunity for developing economies with lower-skilled workers and more basic technological readiness to upgrade their skills and capacity. But that shift has yet to happen, and many countries appear unprepared for the Information and Communication Technology (ICT) revolution.

The Philippines has successfully harnessed the ICT revolution to drive its services-centered growth model. This has been driven by the business process outsourcing industry, which accounts for some 40 percent of exports and has created more than one million jobs with wages that are three to five times higher than the national average.

But here, too, technology poses challenges as much as it creates opportunities. First, robotics is threatening to replace simple operators, and there is a need to go from simple call center services to a broader set of more complex services. Second, the country should consider branching out into knowledge process outsourcing in the future, encompassing higher value-added activities ranging from fraud analytics and project management to research and development.

As manufacturing processes become increasingly high-tech, emerging markets will face new challenges maintaining their competitiveness.

Even in larger or more advanced ASEAN+3 economies, technology raises the bar for becoming competitive and staying plugged in. Rapid technological advancements have raised the bar for basic manufacturing, and even more so for moving up the global value chains (GVCs). With manufacturing processes and products becoming increasingly high-tech, it has become more difficult for emerging markets to join GVCs and maintain their competitiveness within GVCs. This challenges economies across the region—from Korea and Singapore to Indonesia and Vietnam—to produce goods ranging from high-end consumer electronics to basic textiles and garments.

How Can ASEAN+3 Countries Meet the Technology Challenge?

In our view, regional economies should strike a careful balance along three dimensions:

- Building capacity for technology absorption quickly, yet managing the pace of technology adoption judiciously

- Recognizing the trade-off between near-term and longer-term economic outcomes

- Balancing support for the manufacturing and services sectors

Take a look at the automobile sector, where even advanced and large economies are challenged. Globally, automobile production is becoming more capital- and technology-intensive. Deployment of technologies such as industrial robots, the Internet of Things in factories, and new techniques such as 3D printing are gathering pace. The end product is changing too: Vehicles are becoming more sophisticated, with more features and integrated digital technology. The scale and depth of adaptation by businesses and workers are not easy to manage.

Travel and tourism are areas in which ASEAN+3 economies from Japan and China to Thailand and Vietnam have made headway combining technology, semi-skilled human capital, and infrastructure and balancing the pace of technology adoption with the priority of continuing to create jobs. So far, the outcomes have been encouraging. China and the larger ASEAN economies, despite lagging more advanced countries in infrastructure and connectivity, have used tourism to spur growth and lift incomes. In Thailand, for example, travel and tourism now account for about one-quarter of GDP. Some projections suggest this could rise to one-third in a decade.

The challenges and opportunities that arise from rapid technological shifts come back to the central issue of human capital development and deployment. Ultimately, human capital uses machinery and tools, designs processes for manufacturing goods and delivering services, and picks up new skills that raise productivity.

Seen from this perspective, apart from improving the overall institutional framework for businesses to absorb and adopt new technologies, authorities should also take steps to maximize the development of human capital and the effectiveness of its deployment. Domestically, this means striking a balance between schooling and technical learning, and putting in place mechanisms to facilitate constant up-skilling or re-skilling. Externally, it means further cross-border mobility of human capital, which may involve measured adjustments to immigration policies.

This piece first appeared on the AMRO Blog.