The Timeline to COVID-19 Herd Immunity May Be Accelerating

A doctor receives Chicago's first COVID-19 vaccination on December 15, 2020, in Illinois. While the vaccine progress has been heroic, it is not a silver bullet that will solve our problems in a month.

Photo: Jose M. Osorio-Pool/Getty Images

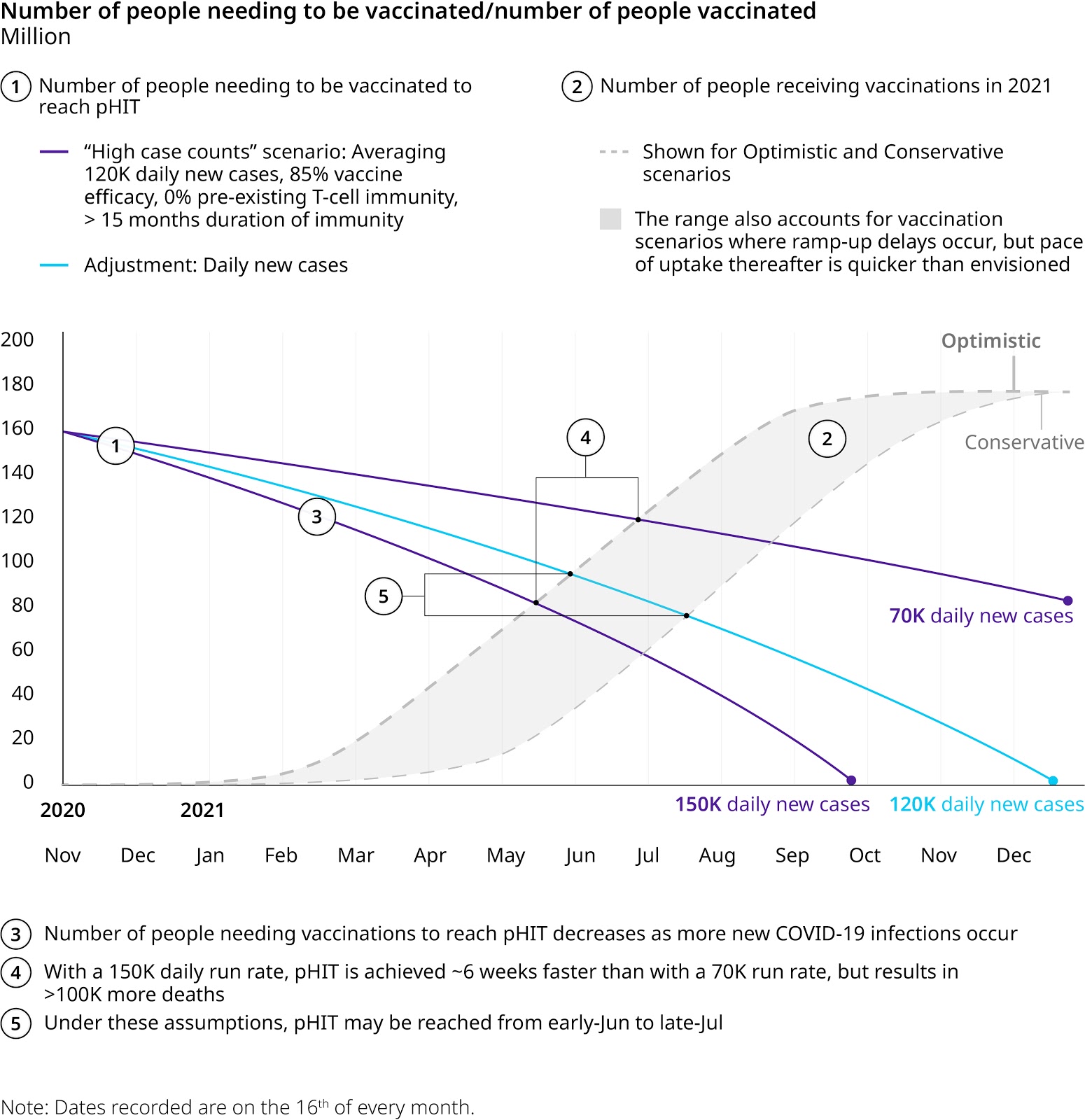

A “return to normal” ultimately depends on case counts and vaccinations: To slow the natural reproduction rate of the virus, we must achieve the “potential Herd Immunity Threshold” (pHIT) or the point where there is enough cumulative immunity present in the population. Daily case counts and the pace of vaccination majorly impact when that threshold is met.

When we wrote Navigating the Long Haul to Normalcy in October, we stated that return to normalcy was plausible in both July and September of 2021, but more likely in September given the inherently aggressive assumptions needed to achieve potential Herd Immunity Threshold by July. Since then, multiple developments have shifted the landscape.

What Has Changed the Timeline to Potential Herd Immunity?

COVID-19 cases surged this fall with very high new daily case rates. Case rates in the U.S. have been breaking prior records for well over a month, with new daily case rates exceeding 100K every day since November 6th and breaching 200K for the first time on December 2nd. Unabated, this level of natural infection will push us toward pHIT much faster, but will come at a significant toll in terms of additional deaths.

Moderna and Pfizer filed for Emergency Use Authorizations and are preparing to distribute first doses. On the bright side, two front-runner vaccines have gathered sufficient data to file for approval with the FDA in late November and have both announced readiness to begin vaccination as early as late December. If the vaccines are granted approval and distribution begins as planned, the timeline to pHIT shortens.

Vaccine efficacy has also exceeded expectations. Both Moderna and Pfizer announced very high efficacy from their initial data (94.5% and 95%, respectively). While it is likely that the final efficacy outside of a carefully controlled clinical trial setting will prove somewhat lower, these efficacy numbers would still exceed expectation and accelerate the timeline to normalcy

These developments have narrowed the possible paths to achieving herd immunity. Our revised analysis suggests we may achieve pHIT in the U.S. as soon as June.

What to Watch For Now

What matters now is how “hot” we continue to run: The figure below shows a range of daily new case rates from 70K (roughly similar to summer surge) to 150K (similar to what we were seeing in mid-late November). On its own, this range of run rates can influence timing to pHIT by ~5-6 weeks, but will come with a heavy price. A 150K daily run rate will result in >100K additional deaths in 2021 compared to a 70K run rate.

Of course, how fast we can produce, distribute and administer the vaccines will also have a significant impact. The figure below examines a band between an optimistic scenario — vaccination begins at the end of December and continues steadily from there — and a more conservative one — vaccination ramp-up is very slow early on and only begins to meaningfully climb well into Q1 of 2021. This band follows the date of the second dose and allows for variation in vaccine production, for example, given the recent announcement from Pfizer, we may see an initial burst of vaccinations in Q1 and then a significant lag until June. It also allows for variation in distribution speed as well as vaccine uptake by the population — surveys over the course of the pandemic have suggested 50%-70% of the population is willing to be vaccinated, but it is unclear how this number will be influenced by recent efficacy news or how quickly that willingness will translate into completed vaccinations. On its own, this range of vaccination speeds can influence timing to pHIT by ~6 weeks.

Note: The graphic shows how three different case count rates affect pHIT timing. The vaccination scenario band represents a range of different vaccine scenarios.

The eventual efficacy of the vaccines and the potential presence of pre-existing immunity — examined at ~5%-10% of the population — also influence timing to pHIT. But these two parameters have a lower impact (about a few weeks each) on the eventual timing.

‘Normalcy’ Will Require More Than a Vaccine

The desperately awaited return of normalcy has drawn nearer due to the recent developments, but it is critical to remember that there is still a long way to go. While vaccine progress has been heroic, it is not a silver bullet that will solve our problems in a month. Moreover, as it is implemented, the sequential vaccination strategy will bring sequential benefits to sub-populations vaccinated.

While the accelerated timeline to normalcy has its benefits, it doesn’t come cheap. This timing relies heavily on daily new case rates that are breaching hospital capacity across the nation and driving the heaviest death toll seen since the start of the pandemic. Our actions will likely slow these daily new case rates down in 2021.

Ultimately, things are likely to get worse before they get better. Faced with overburdened hospital systems and rising death tolls, local governments may rely on a new wave of restrictive measures — new stay-at-home orders went into effect in parts of California on December 7 — that will test the already strained mental and economic state of the population.