Three M’s to Consider as Financial Firms Face Brexit Fallout

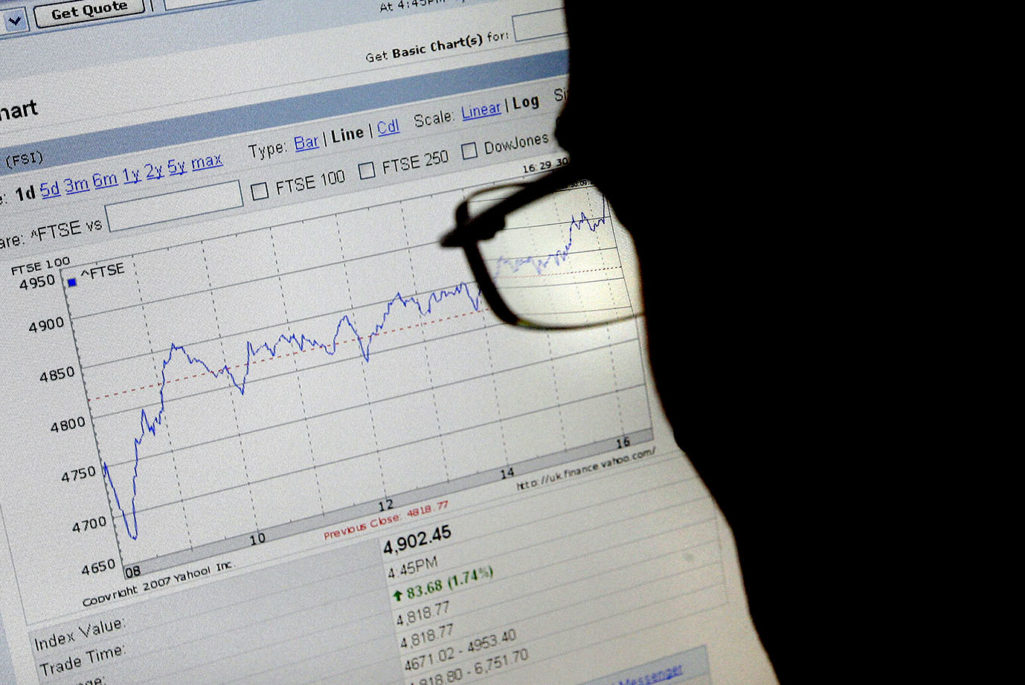

A man looks at a computer screen showing the FTSE 100 share index in London.

Photo: Shaun Curry/AFP/Getty Images

Financial organizations have struggled over the years to adapt to regulatory change, but adapt they did. The impact resulting from the UK’s historic Brexit vote poses problems of a different sort—change is coming, but no one knows what to expect.

It will take at least two years for the UK to work out terms of its “divorce” from the EU. Until then, no one knows what the new ground rules will be. Low interest rates and currency exchange rates that discount the British pound are already affecting financial services firms. If profitability becomes harder to achieve, those companies will start to consider reorganizing.

Reorganizing companies will benefit from ways to structure how those decisions can be made. At Mercer, for example, multinational clients are encouraged to consider three M’s as a framework for determining the strategies and actions that need to be taken: mobilizing (getting organized and setting up a governance structure), mapping (conducting a risk and opportunities assessment and developing a corresponding mitigation strategy) and managing (conducting scenario planning and long-term monitoring to respond to new information).

And for financial services firms—where significant impacts of Brexit are expected—choices will have to be made.

London especially is affected. The ability of UK and EU financial services firms to set up shop in each other’s territory without establishing new corporate entities—so-called passporting rights—have been an important part of London’s growth as a global finance hub. But it’s unclear what shape those rights would take in a post-Brexit negotiation, if they survive at all.

Some managers will opt to keep their presence in the UK, while others will move elsewhere. It’s no surprise that in the face of historically tight governmental rules aimed at reducing operational risk, many financial services firms have already thought through Brexit in terms of evaluating alternative locations for their UK operations.

Those workforce plans now need to be carefully reviewed, since it is likely that restrictions will be placed on EU workers within the UK workforce. Skilled labor from EU countries makes up a large percentage of the UK workforce in the financial services sector, particularly in London.

Less freedom of labor movement makes it all the more critical for talent managers to access smart tools such as workforce analytics and long-term strategic workforce planning to future-proof the organization.

Don’t be surprised if employment costs rise. Attraction and retention strategies should also be reviewed, since the fundamental employee value proposition may have changed.

Even without Brexit, workforce evolution is keeping financial managers busy. We’re in an era of rapidly evolving business models in banking and asset management, with plenty of disruption coming from technology. It is not just traditional financial services expertise that is hard to find in areas such as lending, portfolio management and compliance. Indeed, new skills are needed to meet the demands of e-commerce, digital innovation and Big Data analytics.

Even without Brexit, workforce evolution is keeping financial managers busy.

The UK banking sector is likely to seek changes in banking regulation, particularly as it affects pay. We may see an end to the bonus caps and other EU-sponsored controls, although the Financial Conduct Authority and Prudential Regulation Authority will want to ensure that the direction and spirit of the Financial Stability Board’s requirements continue to be fully met in the UK.

Regardless of what regulatory changes occur, financial businesses will need deeper restructuring strategies. Relocating staff to new locations or creating entirely new centers of operations and trading outside the UK may be a complicated undertaking for those organizations that decide to move some or all of their business.

It’s not just operational issues that financial services firms need to consider in light of Brexit. A significant portion of their revenue is generated from a business that’s likely to be shaken to some degree by Brexit fallout: pensions.

As large employers in the UK, financial services firms are responsible for a significant portion of the country’s pension plans. Since the funding status of traditional defined benefit plans feeds through directly to the balance sheet of plan sponsors as a potential liability, regulated firms are required to hold additional capital to mitigate the balance sheet risk that ensues.

Market volatility and uncertainty in the wake of the Brexit vote will have a major impact on the value of those assets that are set aside to meet pension liabilities, with accompanying variability in capital costs.

And it doesn’t stop there. Defined contribution pension plans, in which the employee rather than the employer bears the risk of meeting future pension needs, will also be affected by market uncertainty as the underlying investments fluctuate in value.

The financial industry’s success rests with its people. As Brexit unfolds, there’s no choice but to be ready and armed to make the right moves for your organization—and your workforce.