What Does Diversity and Inclusion Look Like in Financial Services?

There are fewer women compared to men entering the workforce, and women are hired at lower rates compared to men in all levels, except the senior manager level, according to financial services organizations participating in a survey from Mercer.

Photo: Pexels

In recent years, there has been good progress in the financial services industry in shifting mindsets on diversity and inclusion (D&I). Leaders have moved from looking at D&I as a box-checking exercise to forming effective business strategies that drive real business outcomes.

Diversity refers to the traits and characteristics that make an individual unique. Although diverse representation of underrepresented groups in an organization is important, inclusion — where behaviors and social norms ensure people feel valued and respected — is equally so.

When Women Thrive, Businesses Thrive is a comprehensive study on workforce gender equality and covers different industries, from energy to financial services. The research includes 126 organizations from financial services, representing close to one million employees in a wide geography of countries including Asia, Australia, New Zealand, Europe, Latin America, the Middle East and Africa, and North America.

Women in the C-Suite

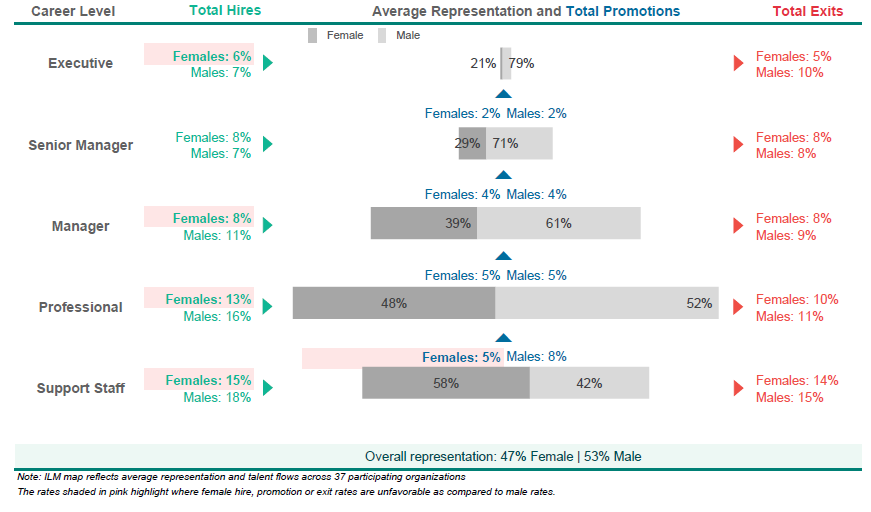

The overall representation of women at an average organization is 47% across all functions and career levels. Women comprise 58% of support staff and 21% of executives. Among financial services organizations participating in the survey, there are fewer women compared to men entering the workforce, and women are hired at lower rates compared to men in all levels, except the senior manager level.

Internal Labor Market Map on Financial Services Organizations

The executive committee of a bank in France, ING France, has eight members, out of which five are women — the CEO, the CFO, the CHRO, the COO and the head of wholesale banking — all of whom have profit and loss responsibility. The talent pool one level below is 30% women. The company doesn’t just recruit horizontally; it fosters a diverse talent pipeline throughout the organization to achieve gender balance on the executive committee.

The CEO of ING Bank and former secretary of state of economic affairs/minister for foreign trade in the Dutch government, Karien Van Gennip, says “Every time we recruit, I make sure to have at least one woman in the top three for each position. What matters is the awareness at manager level, to promote diversity in recruitment and to enable managers to help their team members grow.”

Developing a map, like the one above, using career levels to examine an organization’s representation, hiring, promotions and exits by gender can help identify barriers to achieving a balanced gender representation. Actions such as recruitment, promotions and pay equity within a targeted period can also help organizations achieve gender balance, according to 2020 survey results from Mercer.

Developing Diverse Talent

The survey research also shows a shortage of sponsorship and mentorship programs. Sponsors are senior executives who actively support an employee’s career and advocate for their success in an organization, and mentors are experienced employees who provide guidance and direction to employees regarding their career advancement. Sponsorship and mentorship programs have the potential to level the playing field between men and women in recognizing high-potential talent — those who have the ability, commitment and motivation to advance to a more senior position in an organization. Globally, only 35% of organizations have high-potential programs for women.

Women and underrepresented employee groups need to be represented fairly in formal development programs such as these, especially those intended for leadership development.

Organizations should identify the roles, jobs and parts of the business necessary for advancing peoples’ careers — as well as the people to work with or for.

As Van Gennip advises, “You need to have at least one diverse candidate in the talent pool, and you need to start coaching and mentoring, be a friend, build a network, celebrate each other’s success, be inclusive toward other diverse talent, do not see them as a competitor.”

Business leaders can take action by integrating cultural competencies and inclusive behaviors into job descriptions and performance measures, equipping managers to support D&I by attending training, sharing learning and modeling inclusive behaviors. Equally important are developing new avenues for mentorship to facilitate networking opportunities, sponsoring underrepresented employees or participating in business resource groups. These programs would need to be set up and carried out with the initiative of HR and the support of leadership.

Engaging Men

Men are involved in D&I at 49% of financial services organizations. This is a bright spot — globally, this figure is up 10 percentage points from our 2016 survey. However, this is clearly still too low! Given that men still hold the majority of leadership roles, it is critical to ensure that they are also aware and trained to support women in the organization.

“Eighty percent of leadership positions are held by men, so if we do not identify more men to support us, we will not get there,” says Van Gennip.

Actions range from listening to men’s perspectives to engaging men as change agents, managers and partners in developing solutions.

Balancing Work and Life

We see a link between organizations that have a comparatively small number of women in key organizational roles and the lack of flexible working arrangements.

Workplace flexibility is increasingly important, especially for women, who are still more likely to fill caregiving roles — for both children and other family members.

Seventy percent of organizations in financial services offer a variety of flexible work options (for example, remote working, compressed workweeks, part-time schedules). However, only 45% value remote working as much as in-person working and only 42% of leadership actively promotes the uptake of flexible work options for all employees.

“ING is a digital bank; flexible working conditions are very good. Women at ING feel at home. If you make all people feel included and at ease,” Van Gennip adds, “it is much easier to be at ease at work.”

Critical actions include formalizing flexible work options by auditing existing practices and needs and identifying the gaps in the current remote or blended work arrangements. Organizations can take steps that can deliver enhanced productivity, profitability and employee well-being. They can also explore innovative accommodations for primary caregivers.

Post-COVID Future of Work

Organizations have a unique opportunity to improve D&I through their COVID-19 response efforts. Determine appropriate cost-management actions or refine the prior actions taken; prepare for employees returning to the workplace; and plan for a different future and opportunities for transformation beyond return-to-work.

“In the post-COVID-19 society,” says Van Gennip, “we have to rethink our social contract, our values to achieve a more sustainable and inclusive society. As businesses, we have a role to play to embrace change and make sure that our company is in tune with the expectations of the external world.”

Conducting pulse surveys and virtual focus groups will help organizations understand the return-to-work experience of unique segments. Armed with this information, organizations will be ready to redesign the D&I function and overall strategy in preparation for the next wave of D&I transformation.