Nontraditional Business Risks May Call for a Unique Safety Net

Source: Jimmy Chan / Pexels

Captive insurers of all types registered historic growth throughout 2020 as organizations sought to complement their traditional insurance programs. A captive insurer is a risk financing mechanism where the owner — or parent company — creates a licensed company to provide insurance against future losses. A captive allows parent owners to protect against unique business risks and difficult-to-insure exposures.

As companies continue to grapple with a complex risk climate and a difficult insurance market that has led to increased risk transfer costs, they remain interested in both forming new captives and expanding the scope of existing captives.

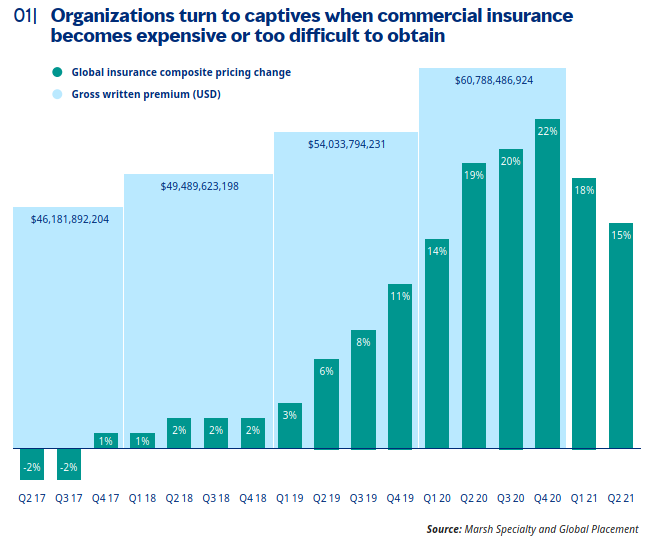

Historically, captive adoption tends to soar during periods of insurance market volatility, as organizations look for tried-and-tested ways to protect their people and operations. Over the years, we have seen a link between captive activity and more difficult insurance market conditions (see Figure 1) as organizations seek an effective way to supplement traditional insurance.

Aside from increases in the total number of captives, 2020 also saw a rise in overall net premium volume, according to Marsh’s recently released Captive Landscape report.

Larger Captives Are Growing

Last year, we saw several existing captives managed by Marsh increase their retention across multiple property and casualty lines. These very large captives — with $20 million or more in total net premium — are typically owned by parents with a market capitalization of $1 billion or more.

The current insurance market was an important contributing factor in this, since many existing types of coverage, or lines of coverage, written by large captives experienced the imposition of higher deductibles and lower limits available through traditional insurance carriers. We also saw large captives increase the number of lines of coverage they write; these types of captives are writing an average of five lines of business.

Large companies can realize significant benefits from their captives, including generating underwriting profits that may total many millions of dollars, the ability to access reinsurance and additional capacity, and the opportunity to provide coverage for difficult-to-insure risks.

Large captive parents tend to have more than one risk-retention entity, and we are seeing increased interest in protected cells. Also known as segregated portfolio companies (SPCs) and segregated account companies (SACs), protected cells are rented out to third parties. While they are typically easier, quicker, and less expensive to set up and maintain than a pure captive, protected cells provide similar benefits, allowing owners to secure many self-insurance advantages and test the waters in the captive environment.

The use of cell captives is increasing as organizations seek the benefits of a captive without having to commit the time and cost associated with maintaining a captive legal entity.

This trend indicates that large companies are using captives as part of sophisticated risk management strategies intended to address their overall risk profiles. Some large companies, for example, have set up multiple captives to write risk in different geographical regions. In fact, Marsh saw a 53% increase in cell captive growth in 2020.

Large Captives Are Expanding Coverage Areas

More than half of large captives — 56% — are writing property insurance, a slight increase from 2019’s 53%. This was the most popular line of coverage written by large captives, during a year when global property insurance prices continued registering quarterly increases.

General/public/third-party liability was also popular among large captives, written by 47%, followed by workers’ compensation, written by 44%.

But large companies are not using their captives solely for traditional coverages. Ten percent of large-company captives, for example, are also writing cyber liability, while another 8% are writing Directors and Officers liability (D&O) coverage, and 5% are writing trade credit. We should note that global financial and professional lines of insurance, which include D&O, registered steep increases during 2020.

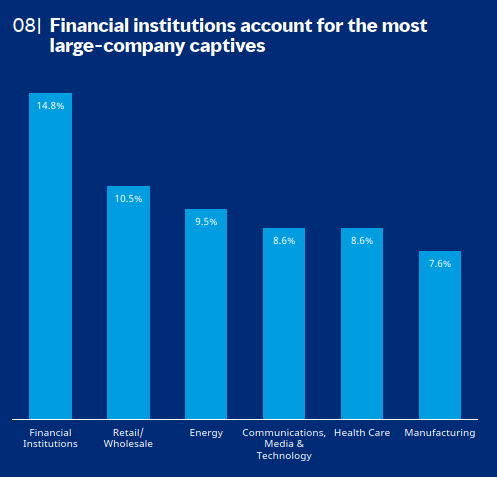

While large companies across a span of industries have set up captives, they seem most popular among financial institutions (see Figure 2). This has historically been the largest industry for captives — with Marsh’s financial institution clients writing more than $28 billion in premium in 2020.

Captives Are Being Used for Nontraditional Risks

From the risks of future pandemics to heightened cyberattacks to the effects of climate change and more, multiple risks are driving greater interest in using captives.

But captives are not only effective in responding to known risks. In a world where the potential challenges related to emerging risks are on many senior leaders’ minds, captives are becoming an option to put aside funds for risks that are still on the horizon.

Captives can help companies facilitate and enhance their approach to environmental, social, and governance (ESG) issues. For example, the flexibility of captives often allows parent organizations to fund for coverage gaps in environmental policies and provide customizable coverage that is in line with companies’ ESG strategies.

Captives are also effective at reducing the costs of employee benefits and offer additional flexibility to help companies manage people risks. Further, parent companies can require their captive to adopt their corporate governance procedure policy, allowing the captive to assist in the organization’s ESG-related decisions. This trend is expected to continue well into the future and Marsh is actively working on ESG principles for its captive owners.

Captives are now proving to be valuable vehicles for insuring nontraditional risks that they have not historically written. Consider cyber insurance: The number of captives writing cyber risk has more than doubled over the past five years.

The growing interest in captives is expected to continue in the years ahead. Many organizations beginning their captive journey will either start small, or with a cell captive, and expand as they start recognizing the benefits of including a captive in their broader risk management strategy.

While recent interest coincides with a more difficult insurance market, a captive entity should not be seen as a temporary solution. Captives demonstrate their value over time, and even during more favorable insurance markets, they often remain an effective way to address both traditional and emerging risks.