How Can Developing Countries Afford to Invest in Infrastructure?

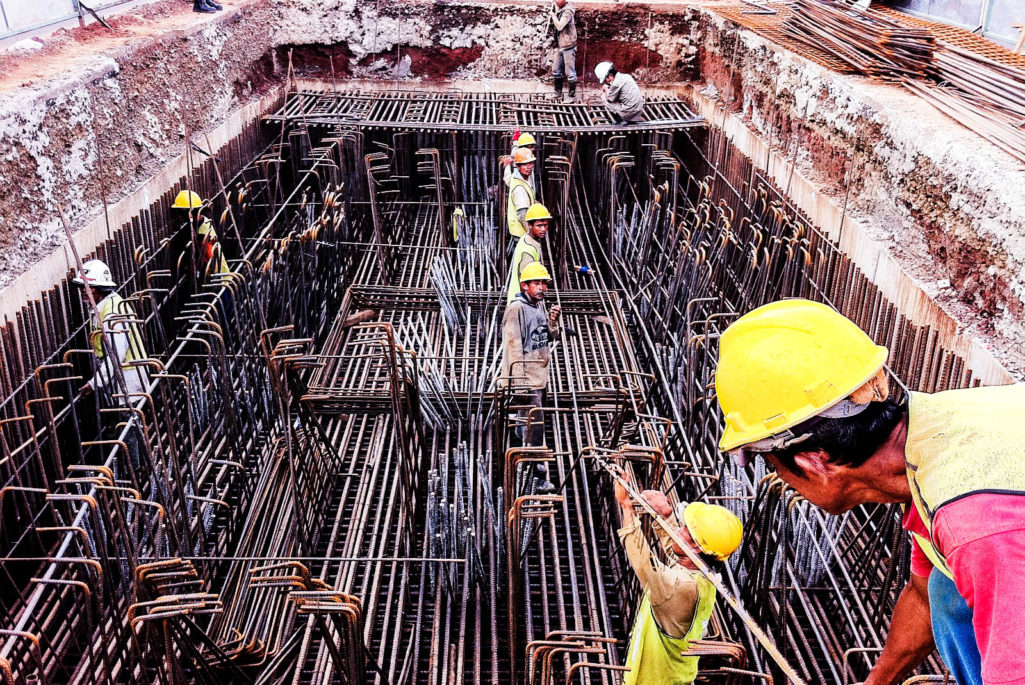

Foundational structure of the Kampung Melayu—Tanah Abang elevated highway in Jakarta, Indonesia.

Photo: Flickr

To maintain current growth rates and meet demands for infrastructure, developing countries will require an additional investment of at least an estimated US$1 trillion a year through 2020. In the Mashreq countries, the required infrastructure investment for electricity alone is estimated at US$ 130 billion by 2020, and an additional US$108 billion by 2030.

These gigantic financing needs will continue to place a huge burden on government budgets. Simply put, they cannot be addressed without private sector participation. Public-private partnerships (PPPs) can help close this growing funding deficit and meet the immense demands for new or improved infrastructure and service delivery in sectors like water, transport, and energy (among others). In countries with diverse and numerous needs, PPPs can fill gaps in implementation capacity as well as the scarcity of public funds.

However, for PPPs to meet their stated purpose, governance is key. In particular, governments need to think carefully about their basic legal and institutional arrangements. It needs to be clear which ministries or local government entities are able and authorized to enter into PPP agreements, approve PPP transactions, and to monitor and regulate the project.

In addition, to ensure the best value for money, governments must have proper procedures to make sure that the PPP bidding process is competitive, objective, and transparent. Project outcomes and public-private relationships tend to be more successful when the rules of the game are fair. A 2010 IFC Survey of PPP investors in Africa found that the “appropriate legal framework for investment” was the primary factor affecting decisions to pursue investment opportunities in a particular country, ranking above even the political and economic stability.

Unfortunately, many public officials in the developing world, including those in the MENA region, often do not have the technical know-how to implement these complex, long-term arrangements. Systemic governance challenges are prevalent, and lack of transparency can open doors to corruption, delays, and inefficiencies.

For public-private partnerships to meet their stated purpose, governance is key.

Our teams are working together as One World Bank Group to address these challenges and increase knowledge of Procurement under PPP. An October 2014 World Bank workshop in Beirut, Lebanon financed by the Iraq Technical Assistance and Capacity Building Fund brought together contributors from across the world to share knowledge about how to manage and execute procurement for PPP projects. Led and facilitated by the Governance Global Practice, the event combined many different angles of the World Bank’s global knowledge. The event began as a request from the Kurdistan Regional Government (KRG) of Iraq, but eventually grew to include participants from other parts of Iraq, Lebanon, Washington, Sri Lanka, India, Pakistan, and Yemen.

Recognizing that procurement under PPPs is extremely complex, participants aimed to better understand what a public-private-partnership is, and what kind of policy, legal and institutional frameworks could be put in place to ensure that PPPs are executed well. Presenters shared multiple case studies on private participation in Water and Energy projects in other low and middle—income countries, including key success factors, and described the process for developing, appraising, and implementing a PPP procurement.

These issues are particularly relevant in the MENA region. Despite its vast needs, MENA has consistently ranked below other regions in the value of private investments in infrastructure. In recent years, the situation has started to shift. The Arab Spring exposed new opportunities to revamp traditional state-business relationships in the region and to break away from old systems of cronyism. Countries like Jordan, Oman, Saudi Arabia, and Morocco have successfully implemented PPP projects, and others like Egypt, Iran, Iraq and Lebanon are actively pursuing more private participation. Unfortunately, the current environment has not been fully conducive to attracting private investors to the region. Uncertainty and insecurity have made it more difficult to establish adequate risk management frameworks and secure the long-term commitments that PPPs need.

However, this is an area where the World Bank can continue to play a critical role. And it’s not just through its financing. By facilitating public-private cooperation and sharing global knowledge, the Bank can help to close the infrastructure gap in the KRG and beyond, while promoting the good governance that will be needed to address it.

This article appeared on the World Economic Forum blog and is used with permission.