In Sub-Saharan Africa, Tax Revenue as Share of GDP Lags Behind Other Regions

Sub-Saharan Africa is facing a confluence of crises from rising debt, uneven recovery from the COVID-19 pandemic and increasing frequency and severity of climate shocks. In its annual Foresight Africa report, the Brookings Institution highlights the low levels of tax raised, contributing to deteriorating public finances.

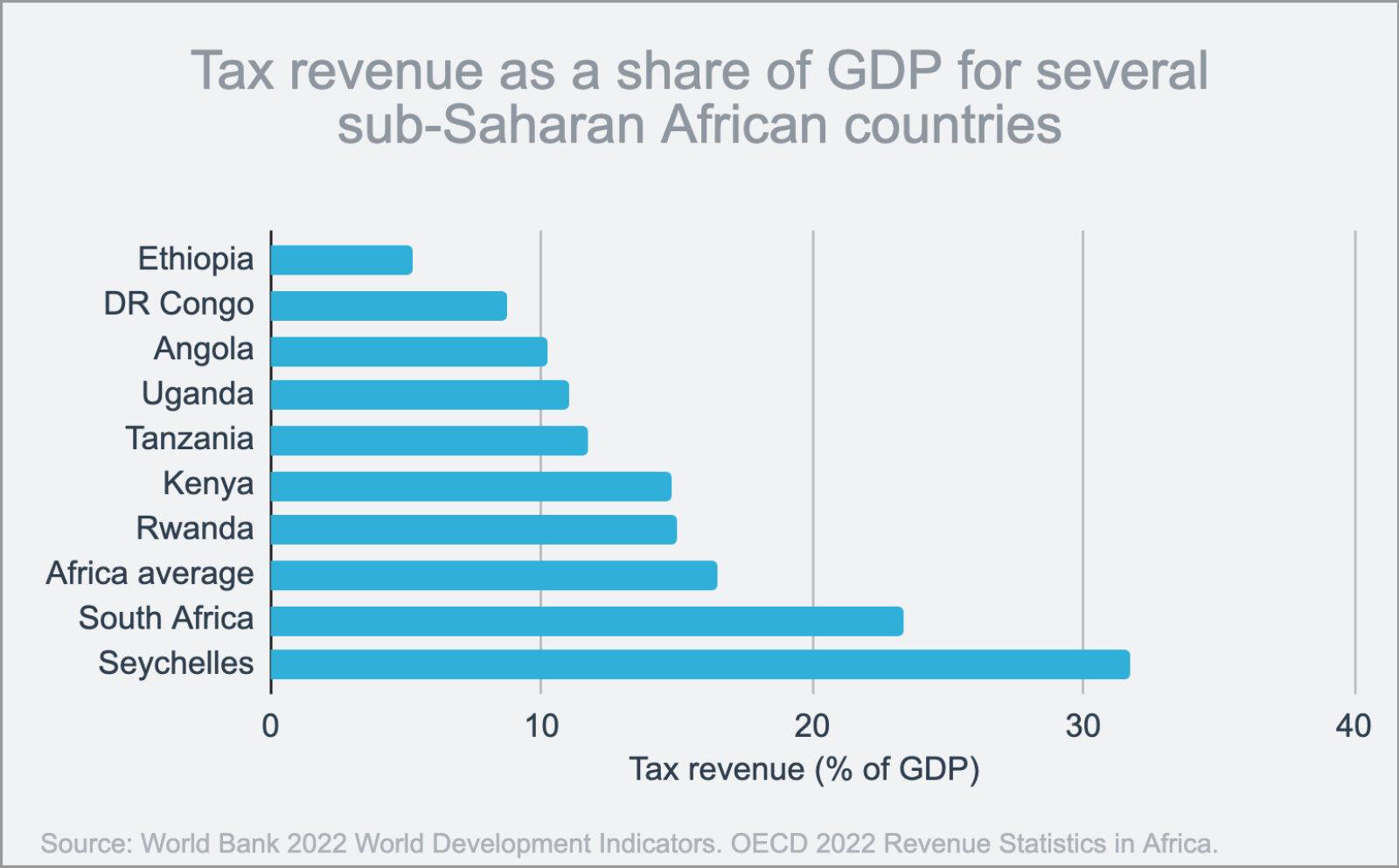

Africa’s average tax-to-GDP rate of 16.5% is lower than other regions: Asia and Pacific (19.1%), Latin America and the Caribbean (21.9%), and OECD countries (33.5%). By the report’s estimates, several countries in SSA bring in significantly lower tax revenues compared to GDP, with Ethiopia at the lowest end around 6%.

The authors recommend “strengthening tax administration and expanding tax sources to real estate, sugary products, and eventually carbon” as opportunities to significantly raise domestic revenue. They also recommend more targeted, technology-enabled approaches to social welfare programs.