Balancing Fintech Risks and Opportunities in the Asia-Pacific

Post office employees help customers open new post office bank accounts with India Post Payment Bank. While developing Asia has evolved rapidly, its financial systems are still relatively less inclusive.

Photo: Diptendu Dutta/AFP/Getty Images

This is the fourth article in a weeklong series on fintech.

The Asia-Pacific region continues to embrace advancements in digital technology that are shifting financial services from a traditional banking approach toward decentralization and disintermediation of economic transactions. Fintech has accelerated the leveraging of mobile Internet access, cryptography, distributed computing, big data, and artificial intelligence. This has ushered in innovative applications across services, such as payments, saving, borrowing, risk management and financial advice.

Financial Innovation in Asia

While developing Asia has grown rapidly, its financial systems are still relatively less inclusive. The rapid spread of fintech offers great opportunity to reduce the cost of financial services and promote access to finance, hence profitably boosting financial inclusion and enabling large productivity gains. The developments have also created new challenges for policymakers and regulators to understand disruptive forces in financial products and services, as well as to identify risks.

Digitization has been accompanied by decentralization and disintermediation. Distributed ledger is an example of decentralized services, and its applications include crypto-coins and smart contracts. New technology-driven business models, such as P2P platforms and robo-advisers, have also supplanted some traditional financial intermediaries, posing distinct challenges for incumbents and regulators.

Asian economies—particularly China, Japan and Korea—have become the leading players in global fintech innovation. In 2018, East Asia became the most active area in the world for filing fintech patents, while China, India, Japan, Korea and Taipei,China, contribute a combined 72.6 percent of fintech patents globally. China leads globally in terms of patent filing, and its share of global patents increased from 30 percent in 2013 to 56.2 percent in 2018.

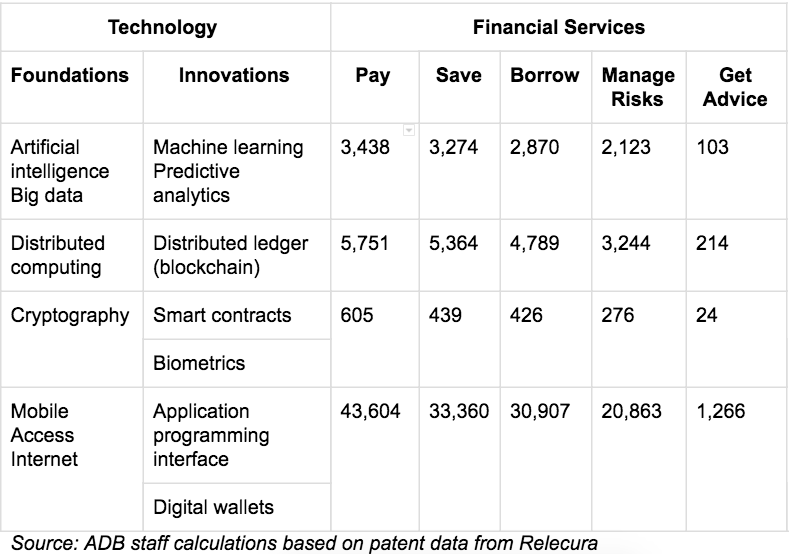

The application of mobile Internet access to payment services is the most innovation-active area, while the use of artificial intelligence, big data, and distributed computing to transform traditional banking services is also popular. Based on the analytical framework of fintech proposed by the IMF in 2017, which includes technology and financial service dimensions, the patterns of fintech innovation between the world and the Asia-Pacific sample are similar.

Payments technology is still growing strongly after decades of development. In recent years, much attention and investment has been drawn to Asia, where mobile payments could help many people, including those in rural areas, access affordable financial products and services—transactions, payments, savings, credit and insurance.

Besides mobile payments, more recent high-growth fintech segments include P2P lending, savings and investment advice. In Asia, except for patents related to cryptography technology, other categories make up more than 50 percent of the global share of fintech patents.

Exhibit 1: Number of Fintech Patents in Asia-Pacific

Fintech innovations are emerging not only from technology startups, but also from manufacturers, large commercial banks and incumbent computer and software companies.

Large tech companies look suited to entrench their positions and create competition for fintech startups. Payment services, as the most mature category of fintech services, gather a large amount of customer data that can be used by providers of payment services to leverage their positions. Firms with an established place in the market, such as Alibaba and Tencent in China, have a strong incentive to lock in customers and use payment services as the starting point to sell other services.

Implications and Challenges

Based on these trends and developments in the Asian fintech space, the implications and challenges related to financial innovation in the region include the following.

- Fintech has the potential to improve and promote more inclusive finance in Asia. Meanwhile, it will transform the entire financial system, from money to infrastructure to fundraising, which requires careful analysis of underlying risks to financial stability.

- Fintech brings industry concentration in a market dominated by a few large companies. Competition policies and better allocation of resources are needed to avoid the monopolistic tendencies of technology giants and prevent abuse of market power.

- With machine learning and predictive analytics based on big data and artificial intelligence being applied to various financial services, data are more vulnerable to security breaches. Cybersecurity, privacy, know your customer and consumer protection issues associated with fintech are critical.

- As changes in the financial sector accelerate toward the digitization, decentralization and disintermediation of economic transactions, money laundering, terrorist financing and competition issues also require actions from regulators.

Key Policy Issues

Central bankers, regulators, government agencies, and international financial institutions in the region are faced with three key policy issues.

Managing technological innovation to promote greater financial inclusion. New technologies have dramatically mitigated asymmetric information situations and reduced transaction costs to provide better financial services to underserved populations and companies. Despite the various technological advancements, 2 billion out of the world’s 7 billion do not have access to financial services, and half of them are in Asia. How can it be ensured that fintech innovations assist SMEs and people currently excluded from financial services, helping them to enjoy the growth benefits of the digital technology? How can digital infrastructure be developed to reach the remotest communities?

Developing the ecosystem to support the creation, diffusion and scaling up of technology and innovation. The rationale for government interventions largely stems from the idea that private actors will undersupply innovation. This argument leads to the assumption that subsidizing the private sector in some way will help solve the problem. From a Schumpeterian perspective, the policy response can be led by developing national innovation systems that form an environment necessary and sufficient to forge a strong relationship between firms, public labs, government ministries, financial players, patents and educational systems.

In the case of fintech, early evidence suggests that the private sector has provided enough innovation, with little need for government subsidy. But it is evident that strong economic environments and institutions play important roles in forging links between financial and technology firms. What sort of institutional support, guidelines on contract enforcement, competition policy, or market structure would encourage the creation of these linkages?

Strengthening the role of central banks and financial regulators in managing risks and developing the regulatory environment to protect consumers and balance innovation and financial stability. At the macro level, technology can be a transmission mechanism for contagion as well as an important source of systemic problems. At the micro level, poor governance or process control can increase the risk of direct disruption to financial services provision. There are also operational risks, such as susceptibility to cyberattacks and reliance on common online platforms.

In this context, what role do central banks and financial regulators have to play? And how can governments protect consumers against cybercrimes and fraud; prevent illegal activities, such as money laundering and terrorist financing; enhance cybersecurity to prevent cyberattacks and hacking; protect personal data and privacy; and balance innovation and financial stability?

Continuing Growth

Identifying the role of international financial institutions and regional cooperation in addressing challenges and vulnerabilities is of paramount importance. Moving forward, a key question is how all stakeholders cooperate and collaborate to support the campaign for inclusive finance through the channels provided by new technologies.

It is equally important for all stakeholders to collaborate in addressing the challenges these new technologies are presenting by putting in place the soft and hard infrastructure needed, enhancing data privacy and consumer protection, and tracking fraud and other illegal activities that are increasingly more transnational.

The growth in Asia’s fintech sector continues unabated, but these questions must be addressed sooner rather than later.

*This is an abridged version of a piece that first appeared on the Asian Development Bank’s Development Asia platform.