Can the EU Successfully Build a Hydrogen Economy?

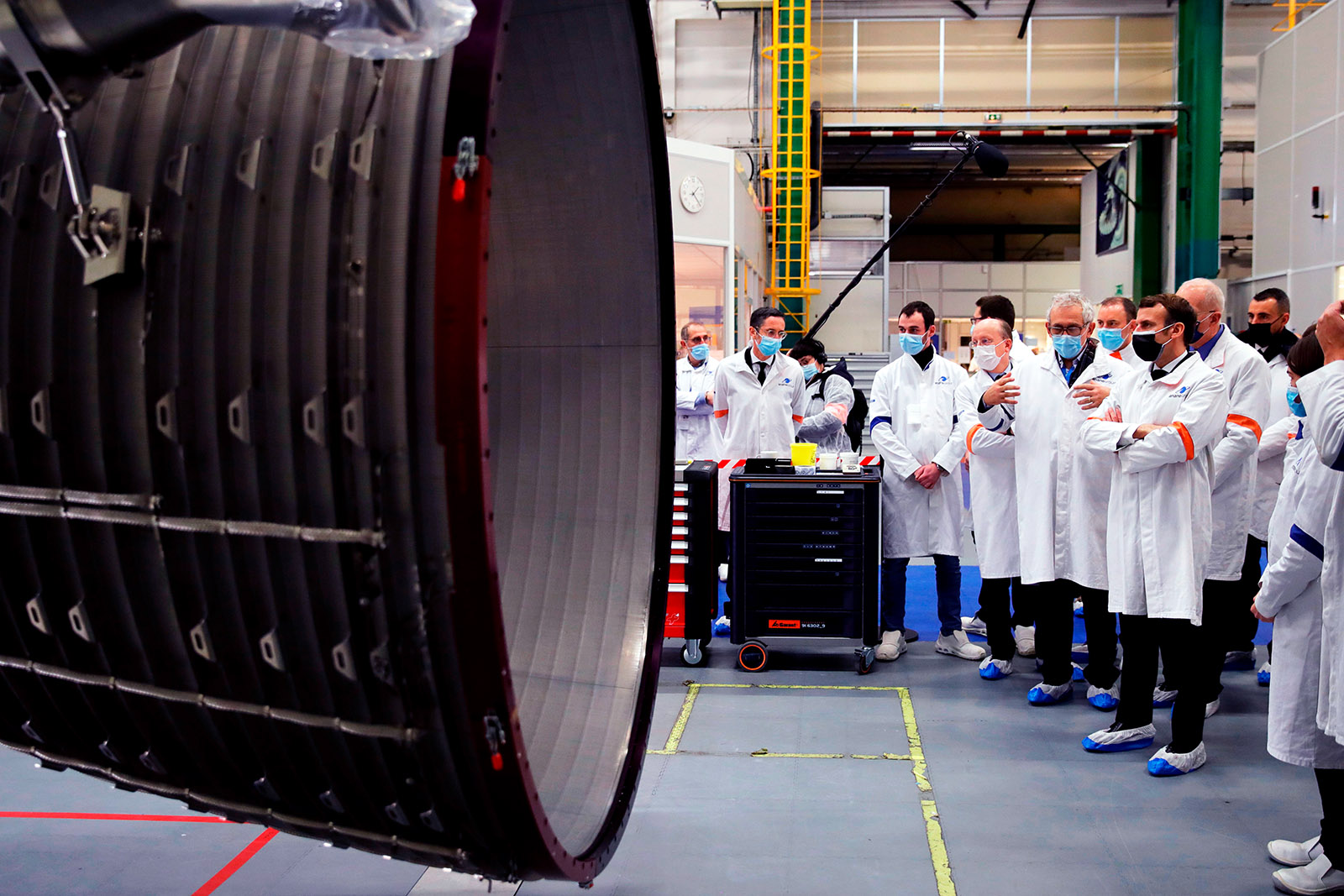

French President Emmanuel Macron visits an industrial site, which is getting financed to develop clean hydrogen projects, on January 12, 2021. Achieving climate neutrality in 2050 is front and center of the EU's strategy — and hydrogen is a big piece in that puzzle.

Photo: Christophe Ena/POOL/AFP via Getty Images

The EU is currently leading the world in the development of hydrogen technology.

As part of our occasional series looking at the emergence of hydrogen as a leading clean fuel of the 21st century, BRINK spoke to Constantine Levoyannis, the head of policy at Hydrogen Europe, an association of industry and academia, to understand the policy priorities of the EU in its efforts to build a hydrogen economy.

Energy System Integration Is a Priority

CONSTANTINE: The EU’s new hydrogen strategy was published last year on the same day as the European Commission’s report on its energy system integration.

Energy system integration is a new concept that has emerged the last couple of years, the concept being that we need to better connect the sources of production with the end users, using new electricity infrastructure on the one hand, but also making sure we make best use of the existing infrastructure that Europe has today.

With the advent of the EU’s Green Deal and the climate emergency we are facing, the task of achieving climate neutrality in 2050 is now front and center of the EU’s overall strategy. And hydrogen has emerged as a big piece in that puzzle.

BRINK: Which parts of the hydrogen economy is the EU looking at most closely?

CONSTANTINE: The current priority is decarbonizing heavy industry or strategic industries, such as refineries, cement and petrochemicals. These offer a strong business case for hydrogen. “Green steel,” for example, is currently a very hot topic. Alongside the heavy industry, you also have the heavy duty transport segment as well.

We cannot currently decarbonize those sectors through electrical solutions. You need higher energy density to be able to efficiently and effectively decarbonize these heavy industrial segments, which is why hydrogen is a good solution. And when you burn hydrogen, there are no emissions, which is the unique selling point of hydrogen.

Batteries Versus Hydrogen Fuel Cells

When it comes to other forms of transportation, however, it’s a shame that we seem to have hydrogen fuel-cell vehicles for passengers ruled out at the moment.

We are using raw materials and rare earths that are sourced from China or from different parts of Africa to develop battery technology in Europe. We need to see the hydrogen fuel cell option in passenger cars as complementary to the use of batteries — not against it. Europe is a leading continent in the production of fuel cells and hydrogen technology.

And we shouldn’t forget about heating as well. There’s a big push for the use of heat pumps to decarbonize building stock, but there are also fuel-cells solutions that can use stored hydrogen from the summer and be reconverted into electricity in the winter to heat homes in certain areas. That shouldn’t be ruled out as an option.

Building a Hydrogen Grid Is the Long-Term Goal

BRINK: One thing that seems to be causing a lot of excitement is the idea of hydrogen as an energy carrier. How close is the EU to building the infrastructure that would be needed for this?

CONSTANTINE: On the one hand, you need to build the electrolyzers. And there’s clear support from the EU for production technologies like electrolyzers to ramp up. There’s a target in 2024 to have achieved six gigawatt capacity across Europe and 40 gigawatt capacity across Europe in 2030. That translates to one million tons of renewable hydrogen in 2024 and 10 million tons in 2030.

The EU will need to repurpose its gas pipelines, so that we can transport the energy where it needs to go and facilitate that hydrogen market that we envisage.

There’s also been a lot of focus on the existing gas infrastructure, and to what extent that could be used to transport hydrogen in the future. It will vary from country to country. In the Netherlands, for example, they’re already repurposing and converting their gas pipelines for hydrogen use.

There’s going to be a phased approach to hydrogen grid development in the EU. It’s clear we don’t have a market today, but what we would like to achieve is a hydrogen market in Europe that is akin to the one we have in natural gas.

Turning Gas Pipelines Into Hydrogen Pipelines

BRINK: One of the key obstacles to scaling hydrogen at the moment is that most hydrogen is currently created by using fossil fuels.

CONSTANTINE: In the short term, hydrogen production will need to be quite close to the demand. So take Germany, for example: You have wind in the North Sea to generate the energy that is transferred via an electricity cable onshore to an electrolyzer. This will produce hydrogen and feed into industries close to the electrolysis.

So there is this concept of industrial clusters and hydrogen valleys. With hydrogen valleys, there are numerous different consumers located in a single area, such as ports.

Then, as volumes begin to increase, you can envisage more long-distance transportation of hydrogen. More than 70% of the hydrogen cost depends on the electricity cost, so we need to leverage those areas in Europe where you can cheaply produce renewable energy, such as wind in the north and solar in the south.

The EU will need to repurpose its gas pipelines, so that we can transport the energy where it needs to go and facilitate that hydrogen market that we envisage.

BRINK: How does the EU’s advance into hydrogen compare to Asia?

CONSTANTINE: As a continent, we are in the lead at the moment when it comes to the technology race on hydrogen. But we are in danger of letting that slip because the Chinese are catching up quickly, and the Japanese, the Americans and the Canadians, too.

We need to act upon that ambition, and to do that, we need to use that infrastructure that makes us unique. The United States and other parts of Asia and Canada cannot boast what Europe can in terms of an integrated infrastructure as we do in the case of gas in Europe.

And at the same time, the European Commission has clearly stated that renewable hydrogen is a massive priority that is in line with the EU’s long-term climate objectives.

The Challenge of Additionality

One of the barriers to renewable hydrogen investment at the moment is the principle of additionality, which requires prospective renewable hydrogen producers to prove that the electricity they use for their hydrogen production is sourced from an additional source of electricity.

But this poses significant challenges — the time taken to invest in new renewable electricity generation assets (e.g., offshore wind, which is up to seven years) is much longer than the time needed to construct an electrolyzer (less than two years). Until new electricity capacity is available, electrolyzer project developers have a very low incentive to build, as the main demand driver is precisely the renewable character of the hydrogen and its contribution toward achieving the binding targets set by the EU for renewables. Moreover, the methodology for defining this principle of additionality is not clear yet.

It should be the responsibility of all relevant players across the energy system to contribute to decarbonization and show additionality, not just H2 producers. But the revision of the EU’s renewable energy directive will be published in the second quarter of this year, probably June or July. That will be an important moment in the development of a hydrogen economy in Europe.