Digital Hong Kong: Even Senior Residents Are On Board

A general view from Victoria Peak shows Victoria Harbor and the skylines of the Kowloon district and Hong Kong island. The government has actively encouraged digitization, but a collective effort is necessary to establish Hong Kong as a front runner among smart cities.

Photo: Anthony Wallace/AFP/Getty Images

Hong Kong is poised to be a future digital leader. It boasts access to a diverse talent pool, a strategic location within the Greater Bay Area and an open Internet infrastructure. Despite these obvious advantages, a recent report commissioned by Google highlights that only 34 percent of Hong Kong businesses maintained a web presence and only 8 percent received online orders.

The government has actively encouraged digitization, but a collective effort is necessary to establish Hong Kong as a front runner among smart cities. “While the government’s smart city plans for Hong Kong are highly commendable, efforts made thus far are still a ‘work in progress’ and yet to be fully recognized by consumers and much of the business community,” the report says.

The Business Community’s Outlook

Although Hong Kong residents ranked their city to be in the middle of the pack as a “smart city,” the corporate sector in Hong Kong held a more conservative outlook, ranking the city as least smart among six regional neighbors. This sector is actively seeking to participate and avail itself of the commercial opportunities that digitization presents—benefitting both their businesses and the city.

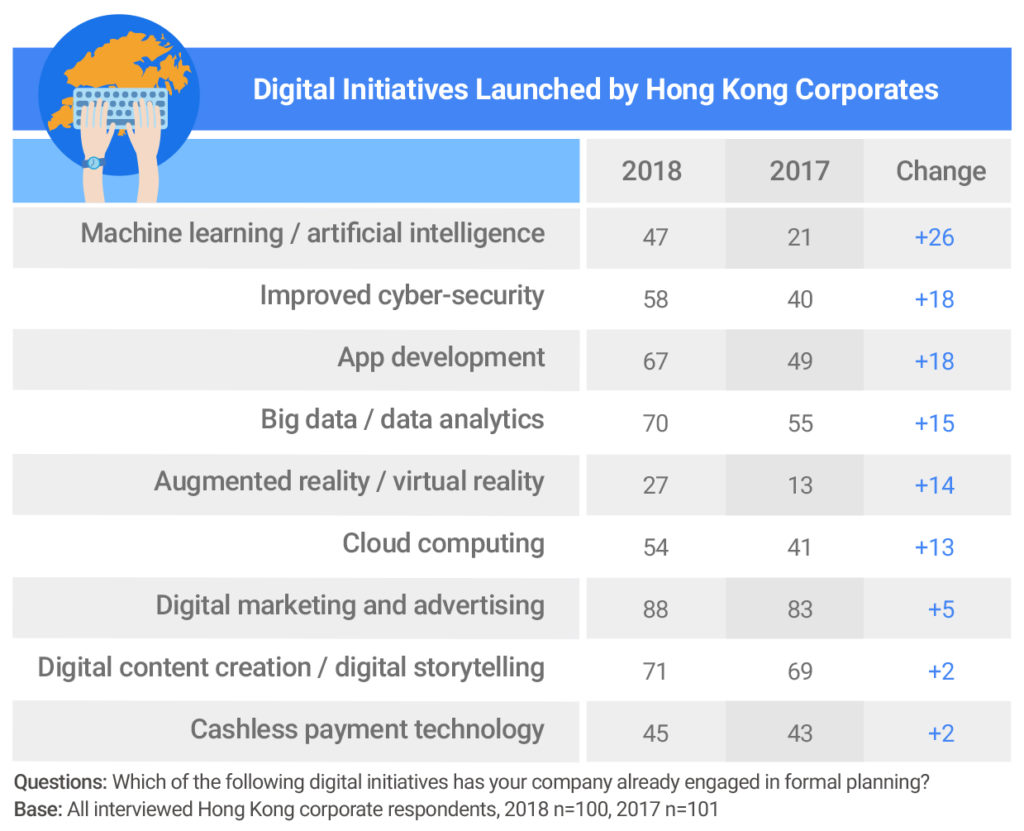

In a positive development, 67 percent (compared to 48 percent in 2017) of respondents were enthusiastically researching current digital technologies relevant to their sphere. Furthermore, 73 percent of the corporate sector now expects fast and even rapid embrace of technology in their organizations. In fact, this year, 85 percent of corporates have increased their digital investment, and 90 percent foresee investing even more in the coming two years. The areas that have seen stellar improvements include machine learning and artificial intelligence, improved cybersecurity and app development.

SMBs Must Participate Actively To Boost Digitization

Small- and medium-sized businesses (SMBs) must keenly embrace digitization to bolster growth. Although its benefits are evident, only 50 percent of SMBs agree that digitization will be a key aspect of their future. Currently, digitization for Hong Kong’s SMBs has been primarily focused on systems automation, as it enables cost reductions and increased profitability. SMBs in the Chinese industrial cities of Shenzhen and Guangzhou are also witnessing the effects of digital disruption, and a growing majority now accepts digital adoption as being fundamental to their business expansion goals. Respondents from these cities have prioritized investing in cashless payment technology and using big data, with a keen focus on enhancing customer experiences and customer acquisition.

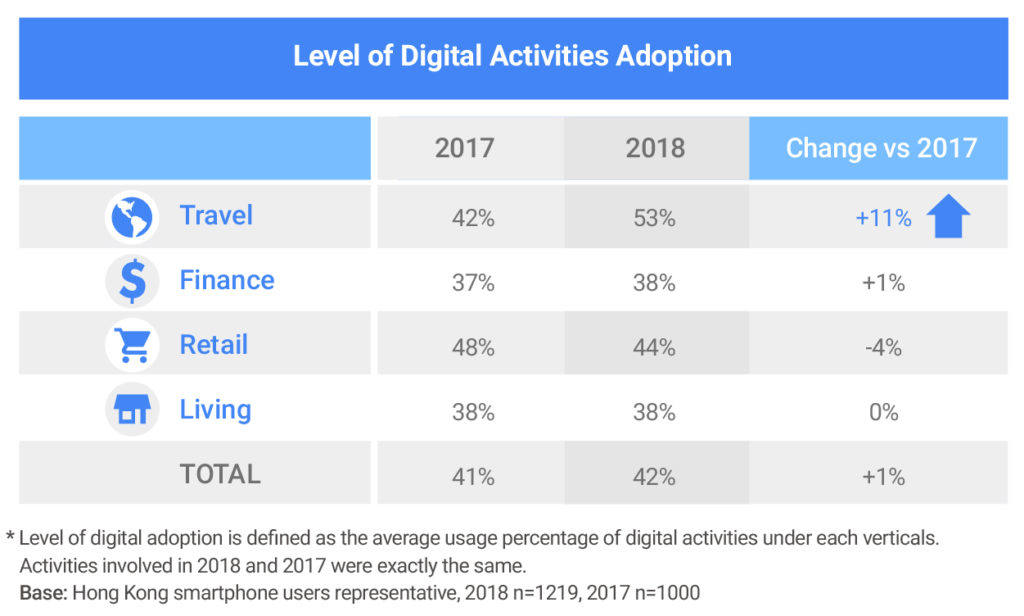

Faster Digitization Progress in Travel

Digitization in travel has registered the most progress, witnessing an increase in digital engagement by 11 points year-on-year—a shift driven primarily by smartphones. In fact, 98 percent of consumers search for information online prior to travelling, and 66 percent do so on a smartphone. It enables users to check in for flights, manage loyalty programs and navigate during trips. The report highlights, “of the more than 70 initiatives included in the Hong Kong government’s Smarter City Blueprint, smarter travel featured heavily.” In the case of air travel, shorter waiting times and a seamless travel experience are top priority for both business and leisure segments. The Hong Kong International Airport, too, has adopted several measures in this regard, such as smart luggage tagging and facial biometrics. Consequently, there are fewer queues and faster check-ins. Augmented reality in a mobile app will also soon help travelers find their way.

Digitization in Personal Banking

The personal banking sector has made significant strides toward encouraging users to adopt digitization. Currently, 57 percent of Hong Kong residents have used a smartphone to make a payment and 44 percent reported making a peer-to-peer money transfer using a smartphone—an increase of 11 percent year-on-year. HSBC bank’s PayMe app is widely used and boasts a user base of one million customers. Besides providing convenience to users, apps like PayMe enable financial institutions to collate valuable data that can be used to gauge user preferences and trends. In effect, it will enable such organizations to better serve their customers.

Although users have responded positively to online engagement, a large chunk is still in favor of offline options on account of the availability of customized products and services, including better after-sales service. When considering financial products, consumers tend to pose more questions and demand follow-up support. In this regard, in-person consultation (49 percent) and having a contact to follow up with (53 percent) were highlighted as key advantages of offline application—especially when customers were applying for complex financial products like mortgages and insurance.

Digitization in Retail

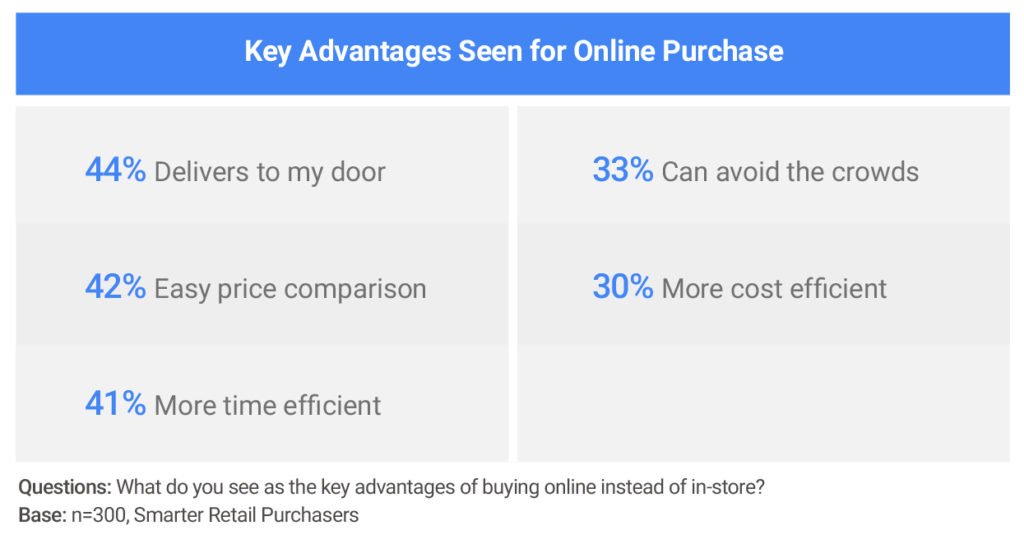

Online shopping is considered a convenient channel, allowing for an efficient experience with easy delivery and price comparisons. In Hong Kong’s case, online to offline (O2O) commerce is of particular importance, considering its potential to leverage the city’s retail density, traditional consumer preferences, and leading smartphone penetration. In an interesting trend, Hong Kong residents displayed a tendency to make purchases via an app or website but chose to collect their items in-store. Therefore “click and collect” represents a crucial element in the O2O ecosystem, with in-store pick-up volumes exceeding delivery volumes. Hong Kong’s e-commerce sector is, however, associated with poor product variety, “reflecting a growing expectation that consumers should be able to get everything they need in one go,” the report says.

Going Forward

Ensuring Hong Kong’s long-term competitive advantage will require the participation of multiple stakeholders, such as the corporate sector, SMBs and the general public. Surprisingly, the demographic registering the highest digital engagement level constitutes a major chunk of Hong Kong’s population—residents aged between 55 and 64. This is a promising trend illustrating how the impact of digitization on quality of life can generate positive momentum. One senior Hong Kong resident aptly stated, “I have started to use a mobile payment app lately. You can sometimes forget about bringing your Octopus card, but you’ll always bring a smartphone, so mobile payment has become very convenient now.”