Energy Recalibrated: Three Ways to Thrive in the New Normal

A view of a Chevron refinery on March 3, 2015 in Richmond, California. With oil prices holding steady at rock-bottom levels, energy company executives need to go beyond their comfort zones to build up resilience in the extraordinary times they now operate in.

Photo: Justin Sullivan/Getty Images

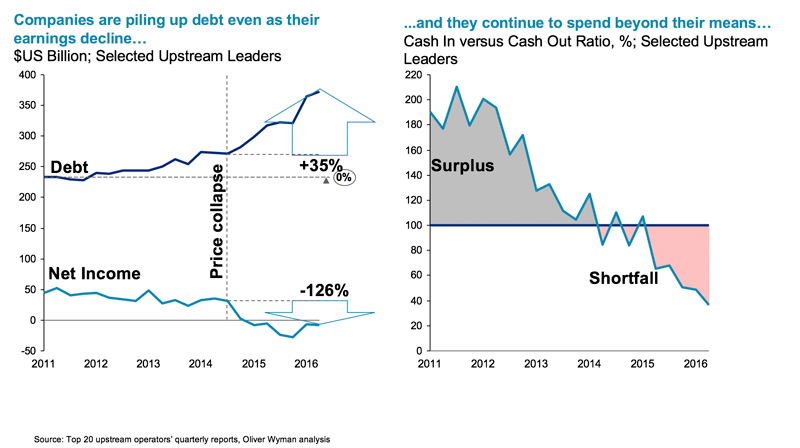

Energy company economics are under attack. Companies are spending beyond their means, piling up excessive debt and destroying shareholder value. Many have swung from operating with surplus cash to making due with shortfalls. Balance sheets that once served as shock absorbers have been wiped out, risking the ability of many companies to perform for years to come.

Energy companies have emerged on top of volatile boom-and-bust commodity cycles before by raising new capital, tearing up and renegotiating supplier contracts, reducing permanent headcounts and temporarily cutting capital budgets and dividend programs, but this rout is different.

It’s been more than 24 months since West Texas Intermediate oil prices tumbled from a high of $106 to a low of $27 in the first quarter of 2016, and it’s unlikely that prices will bounce back any time soon, even if OPEC pulls back on production.

Energy company executives need to go beyond their comfort zones to build up resilience in the extraordinary times they now operate in. The industry has been recalibrated; now companies need to revamp in order to continue to thrive in it. Here are three ideas for steps to start with:

Stop throwing good money into bad projects. Find creative ways to free up capital. Reexamine strategic and financial plans. Tighten working capital and shed non-core assets that can be operated without needing to be owned.

Swap financial for operational risks. Focus on becoming efficient, reliable and profitable operations. Don’t grow your oil reserves to provide shareholders exposure to their underlying commodity when it is no longer valued by banks and rating agencies. Explore physical and financial ways to optimize your supply chain and take advantage of the fact that the forward price of oil is now higher than the spot price to boost returns.

Hedging is no longer optional. Stable performance is especially valuable now that most energy companies are operating with razor-thin margins for error. Use hedges to survive, recover, sustain and grow long term. Tap into proprietary information to both dampen the downside (similar to buying insurance) and take advantage of the asymmetric upside that could result with an unexpected oil price rally.

Volatility doesn’t always need to imply vulnerability, but it will for those companies that remain higher-cost producers stuck in the past.

Instead, energy companies owe it to themselves—as well as to the industries and consumers that count on them—to manage risk more proactively, take action and embrace tough decisions.