For Utilities Under Pressure, Smart-Home Services Offer a Way Forward

A Nest thermostat being adjusted. Nest was bought by Google for $3.2 billion, taking the latter further into the home ecosystem. Utilities can battle disruptive ’newcomers’ by offering similar smart home services of their own.

Photo illustration: George Frey/Getty Images

Digital disruptors have rewritten the rules for a broad swath of industries, from transportation to hospitality. Now, it’s energy’s turn, as utilities struggle with falling demand and lower prices, as well as a push on the part of regulators for innovative ideas, such as smart grids, energy efficiency, and home energy production.

In Europe and North America, utilities have been cutting costs to maintain profit margins, but there’s only so far cost-cutting can go.

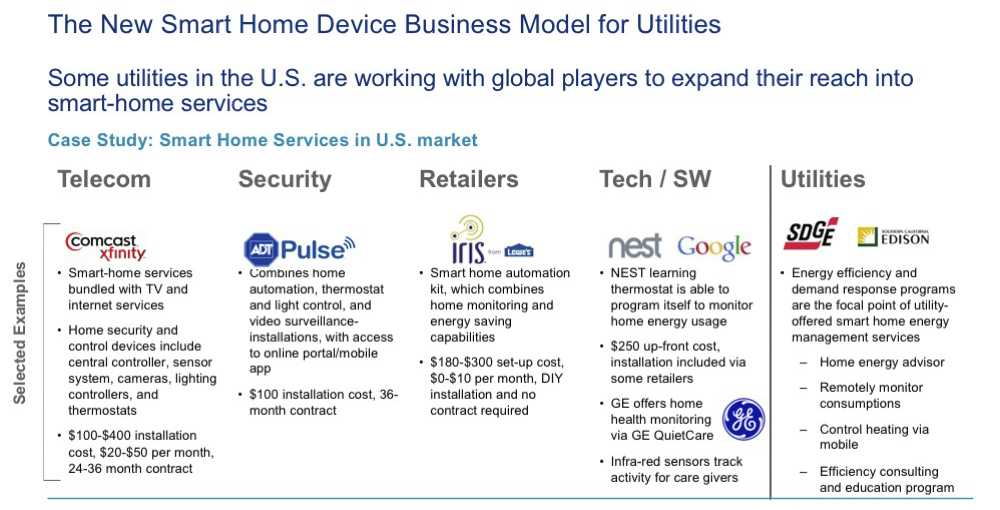

To date, tactics to boost utilities’ fortunes have included selling home appliances for lighting and temperature control. British Gas was a first mover in this business, launching a separate unit in 2007 and acquiring companies with expertise in solar cells, smart meters and heat pumps. But most utilities have limited competitive advantage over traditional retailers and digital players in this area. If they cannot ensure product quality and maintenance, the new business could damage their reputation and increase operating costs.

Ramping Up ‘Smart-Home’ Services

A better move is to branch out into smart-home services. Customers are increasingly interested in this kind of proposition, which can include energy management, home security and entertainment, an Oliver Wyman survey shows. Bundled energy solutions—such as a domestic heating package, intelligent tariffs and energy consultation—all influence more than 30 percent of respondents in their choice of utility, according to the survey, which was conducted in Germany.

In 2015, the smart-home business had a value of $47 billion globally, and it is expected to grow at 14 percent a year between 2016 and 2022. But utilities need to move fast. New entrants, especially global tech players, are moving into the business with packages that leverage their digital technology.

Smart-home services start by helping customers heat and cool their buildings for maximum comfort at minimum cost. Instead of paying for energy use, for example, the customer might pay a monthly flat fee to maintain their home at a constant temperature of 23 degrees Celsius (73.4 degrees Fahrenheit). Southern California Edison (SCE) uses smart thermostats and bill estimation services to help customers use energy more efficiently. SCE even offers $200 rebates to customers that let it shut down their air conditioning during peak demand periods.

The Search for New Value

Smartphones and apps are opening the way to an intriguing range of new services. Enel in Italy just launched a product that lets customers know in real time which rooms at home are consuming more energy and which are consuming less. The customer can then remotely enable or disable devices connected to smart sockets. The app communicates with motion sensors placed in rooms and at doors and windows that allow people to see what’s going on while they are away—whether their children are sleeping, for example. In some cities, the app can also order food as well as provide travel and weather updates.

This array of services also points to a wider range of competitors, who can combine energy services with extras from their own special capabilities. Intel’s Care Innovations unit offers home health monitoring, based on infrared sensors that track a resident’s movements. Home security company ADT Pulse adds video and sensor surveillance, which can be monitored online and on a smartphone and can generate alerts for authorized access (children returning from school) or non-authorized access (burglars). Comcast’s Xfinity brand includes TV and Internet service in a bundle.

Maintain Control

Energy utilities have an advantage over newcomers through their connections to people’s homes and the vast quantities of data they collect on consumer power use. But to offer attractive packages, they will need to team up with firms that provide complementary skillsets, such as telecoms, automated building firms, software designers and data analytics providers. When they do this, utilities must retain control over the new offerings by acting as the main orchestrators and first movers. They should offer end-to-end integrated services and examine carefully the customer experience from product choice to aftersales.

If utilities don’t move quickly, they could lose their relationships with customers, as other players seize the initiative and aggregate various single services into packages.

Preliminary market analyses indicate that smart-home services could increase utilities’ operating margins substantially anywhere from 11 percent, to 18 percent. At the same time, customer attrition could fall between 3 to 5 percent. We do not expect a major transformation, but rather incremental changes driven by pilot projects starting in the coming months.

To set the process in motion, utilities should consider creating dedicated units to design and test out new solutions or try open innovation models. Medium-sized utilities could combine resources if they don’t have the scale to compete with tech giants or larger rivals.

One thing is certain: Disruption is coming, and utilities need to act. They are about to find that conducting normal business consists of constant innovation.

This piece will also appear in the upcoming Energy Journal from Oliver Wyman.