Global Insurance Pricing Increases Moderate Again in Third Quarter 2022

A United Airline plane is parked at a gate at LAX on February 09, 2022 in Los Angeles, California. LAX and other airports were the target of pro-Russian hackers. Cyber insurance pricing is rising as cyber crime continues to increase.

Photo: Alexi Rosenfeld/Getty Images

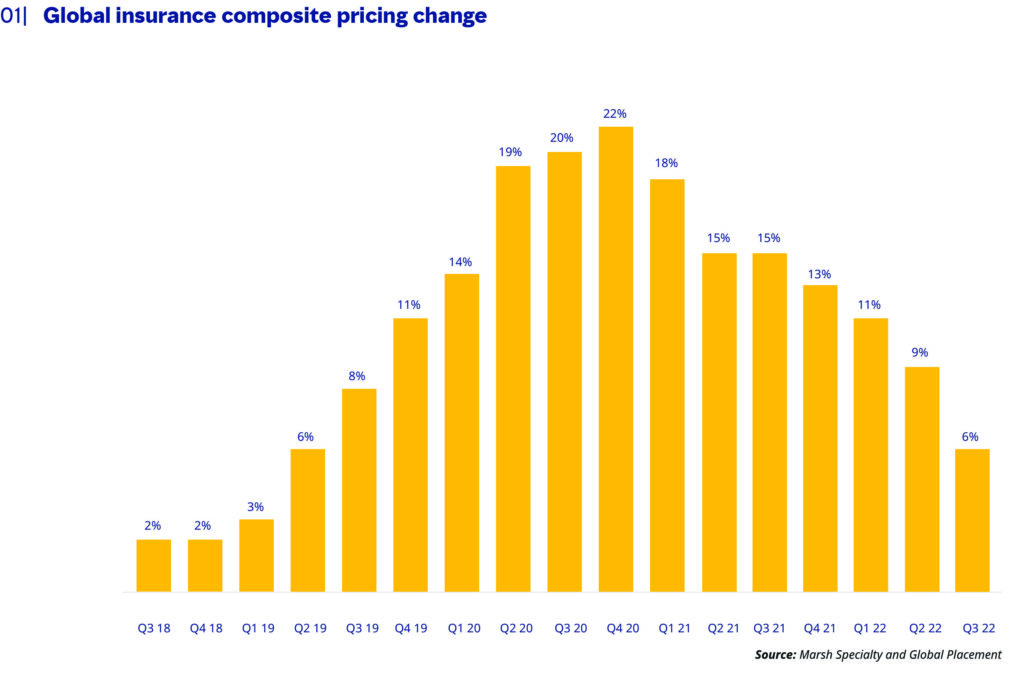

Global commercial insurance prices increased 6%, on average, in the third quarter of 2022, compared to the 9% increase seen in the second quarter. It was the twentieth consecutive quarter of rising average pricing in the Marsh Global Insurance Market Index. Increases peaked in the fourth quarter of 2020 at 22% and have generally slowed or remained flat since (see Figure 1).

Cyber insurance continued to be challenging from both a pricing and a coverage perspective. However, while cyber insurance pricing continued to rise significantly, the pace of increase slowed in the quarter, to 48% in the U.S. and 66% in the U.K., compared to 79% and 68%, respectively, in the prior quarter.

Regionally, composite pricing for the third quarter increased by 5% in the U.S., 7% in the U.K., 6% in Continental Europe, 5% in Latin America and the Caribbean, 2% in Asia, and 5% in the Pacific.

Pricing in financial and professional lines decreased, excluding cyber. This is the first edition of our quarterly index that presents the cyber data separately from financial and professional lines data, giving a clearer picture of both.

Globally, property insurance rates increased by +6%, casualty insurance rates increased by 4%, financial and professional lines insurance rates decreased by 1%, and cyber insurance rates increased by 53%.

In US, Financial and Professional Lines Pricing Decreases

Overall pricing increases in the U.S. in the third quarter averaged 5%, compared to 10% in the second quarter.

Pricing in financial and professional lines decreased 6%, on average, in the quarter — compared to the second quarter increase of 21%. Directors and officers (D&O) liability coverage pricing in the quarter fell by 9%, on average, for publicly traded companies. New capacity and insurer competition drove the decline, which followed a 6% average drop in the second quarter.

Adverse judgements and ERISA 401K plan excessive fee litigation remained challenging for fiduciary insurance markets; insurers expressed concern regarding the product’s pricing unpredictability.

There were signs of the cyber insurance market stabilizing, with more insurers entering — thus increasing competition.

Average property insurance pricing in the U.S. increased 8% in the quarter, compared to 6% in the second quarter as the total insured values increased 8%. The third quarter had ended before Hurricane Ian struck.

Valuation remained a focal point for property insurers for nearly every policy written, due largely to concerns about inflation, supply chains, labor shortages and losses in which adjusted loss amounts were well above the reported values.

Cyber insurance pricing continued to be affected by the increase in frequency and severity of losses, although average pricing increases declined in the quarter. There were signs of the cyber insurance market stabilizing, with more insurers entering — thus increasing competition.

Casualty insurance pricing in the U.S. increased 3%, on average, in the third quarter, compared to 6% in the second quarter. Insurers carefully monitored areas including inflation, court systems reopening following pandemic-related closures, increased numbers of vehicles on the road, and recent hurricanes.

UK D&O Pricing Declines

Average insurance pricing in the third quarter of 2022 in the U.K. increased 7%, compared to an 11% increase in the prior quarter.

D&O liability insurance pricing declined in the 5% to 10% range, on average, with large multinational companies typically seeing substantial decreases.

Property insurance pricing increased 6% year-over-year, the same as in the second quarter, and was generally less volatile for clients than it had been for several quarters. Insurers focused on claims inflation trends by increasing rating if exposure bases were not, in their view, appropriately reassessed.

Casualty insurance pricing increased 4%, the same as in the second quarter. Electric vehicles continued to affect the auto liability insurance market. Insurers noted that damage repair costs are approximately 25% higher for EVs than for cars with internal combustion engines.

Property Insurance Pricing Increases in Asia

Insurance pricing in the third quarter in Asia increased 2%, on average, compared to 3% in each of the prior two quarters.

Property insurance pricing rose 2%, on average, the sixteenth consecutive quarter of increases. Insurers remained concerned about global inflation, focusing on the appropriate declaration of declared values. The political violence market showed signs of contraction, with insurers reviewing aggregate exposures and pricing adequacy.

Financial and professional lines pricing increased 5%, on average, compared to 13% in the second quarter. D&O pricing continued to moderate, with average increases in the 5% to 10% range across the region.

Regional Highlights

Other regional highlights in the second quarter included a 5% pricing increase in the Pacific region, on average. It was the seventh consecutive quarter in which the pace of increase moderated. Severe floods in Queensland and New South Wales earlier in the year — with estimated insured losses greater than $6 billion Australian dollars ($4 billion) — heightened insurer focus on storm/flood risk mitigation, deductible adequacy and sub-limits.

Continental Europe experienced a 6% average increase in overall composite insurance pricing, the same as in the previous two quarters. Financial and professional lines pricing rose 6% in the third quarter, on average, with D&O pricing generally flat to low-single digit increases.

In the Latin America and Caribbean region, composite pricing rose 5%, on average, the same as in the prior quarter. Casualty pricing rates increased 4%, on average, the second consecutive quarter of increase.