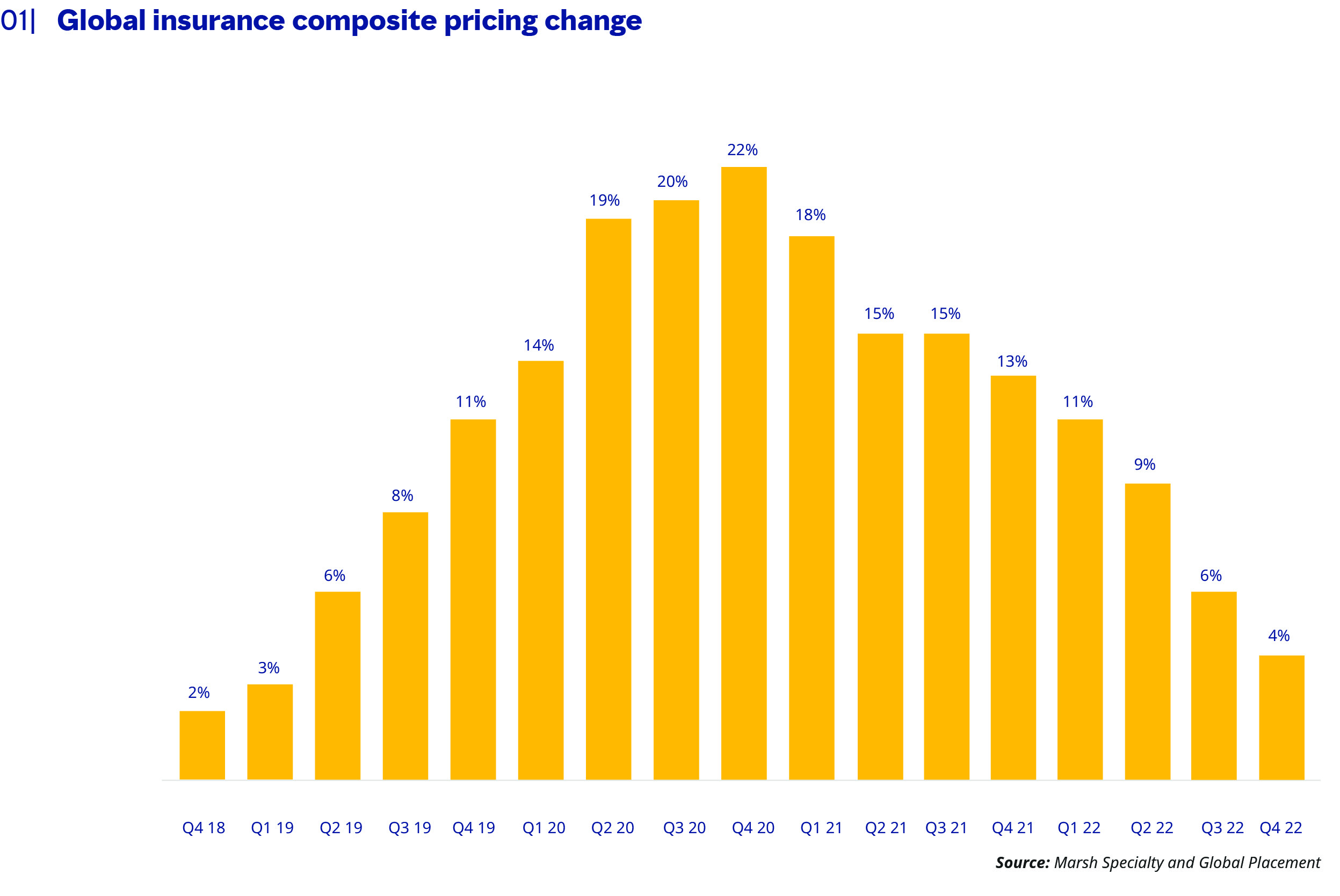

Global Insurance Pricing Increases Slightly in Fourth Quarter of 2022

Buildings stand shrouded in fog at The Bund in Shanghai, China. Insurance pricing in the fourth quarter in Asia increased 2%, on average, the same as in the prior quarter.

Photo: Zhe Ji/Getty Images

Global commercial insurance prices increased 4%, on average, in the fourth quarter of 2022, a decline from 6% in the third quarter. It was the twenty-first consecutive quarter of rising average pricing in the Marsh Global Insurance Market Index. Increases peaked in the fourth quarter of 2020 at 22% and have generally slowed since (see Figure 1).

Property insurance pricing increased 7%, on average, compared to 6% in the third quarter and was the only one of the four main coverage lines to increase.

The property insurance market is likely to remain challenging throughout 2023 due to the high cost of catastrophe (CAT) losses and the impact on insurers of higher reinsurance pricing.

Cyber insurance remained challenging; however, while average pricing again increased, the pace slowed in the fourth quarter to 28% in the U.S. and 34% in the UK, compared to 48% and 66%, respectively, in the prior quarter.

Regionally, composite pricing for the fourth quarter increased by 3% in the U.S., 4% in the U.K., 6% in Europe, 7% in Latin America and the Caribbean, 2% in Asia and 5% in the Pacific region.

Globally, property insurance rates increased by 7%, casualty insurance rates increased by 3%, financial and professional lines rates decreased by 6% and cyber insurance rates increased by 28%.

To manage the market challenges, many organizations are looking at a range of options, including the increased use of captives and alternative capital.

In US, Property Insurance

Overall pricing increases in the U.S. in the fourth quarter averaged 3%, compared to 5% in the third quarter.

Property insurance pricing in the U.S. increased 11%, on average, in the quarter, compared to 8% in the third quarter. Pricing was influenced by challenges in the reinsurance market during the January renewals.

The bifurcation in property insurance renewal results continued as risks with limited named windstorm exposure and stable capacity from the incumbent insurer typically experienced better results. Generally, clients that experienced higher increases were affected by losses and/or had locations in CAT zones, such as the Gulf of Mexico and the Atlantic coast.

Pricing in financial and professional lines decreased 10%, on average, in the fourth quarter, compared to a decrease of 6% in the third quarter. Directors and officers (D&O) liability coverage pricing in the quarter fell by 14%, on average, for publicly traded companies.

D&O pricing was influenced by increased competition from insurers, additional capacity and an increased appetite to write more business given the slowdown in IPO and special purpose acquisition companies (SPAC) deals.

Cyber insurance pricing increases moderated to 28%, on average, driven by increased competition and the adoption by many organizations of favorable cybersecurity controls. Claim frequency declined in the quarter while severity remained high.

Casualty insurance pricing in the U.S. increased 1%, on average, in the fourth quarter compared to 3% in the third quarter. Workers’ compensation continued to positively impact overall casualty lines pricing; excluding WC, casualty pricing increased 3%.

UK D&O Pricing Declines

Average insurance pricing in the fourth quarter of 2022 in the U.K. increased 4%, on average, compared to a 7% increase in the prior quarter.

D&O liability insurance pricing declined in the 10% to 15% range, on average, with large multinational companies typically seeing substantial decreases. Program savings were largely driven by reductions in excess layers.

Property insurance pricing increased 6% year-over-year, the same as in the prior two quarters and was generally less volatile for clients than it had been for several quarters. The property market was competitive for low- to medium-hazard industries. Pricing challenges remained for organizations with major losses or a challenging occupancy or process, such as food production, warehousing or waste recycling.

Casualty insurance pricing increased 4%, the same as in the prior two quarters. Pricing was influenced by existing long-term agreements, remarketing exercises and restructuring of programs.

Property Insurance Pricing Increases in Asia

Insurance pricing in the fourth quarter in Asia increased 2%, on average, the same as in the prior quarter.

Property insurance pricing rose 2%, on average, the seventeenth consecutive quarter of increase. Insurers remained concerned about global inflation, focusing on the appropriate declaration of declared values. Renewal results again favored clients with exemplary claims performance and strong risk management practices.

Regional Highlights

In the Pacific region, pricing increased 5%, on average, the eighth consecutive quarter in which the pace of increase moderated. Underwriters continued to focus on CAT perils and, in light of global inflation, valuations.

Continental Europe experienced a 6% average increase in overall composite insurance pricing, the same as in the previous three quarters. The impact of Hurricane Ian and other CAT losses created uncertainty around capacity and put upward pressure on pricing.

In the Latin America and Caribbean region, composite pricing rose 7%, on average, compared to 5% in the two prior quarters. Casualty pricing rates increased 8%, on average, the third consecutive quarter of increase.