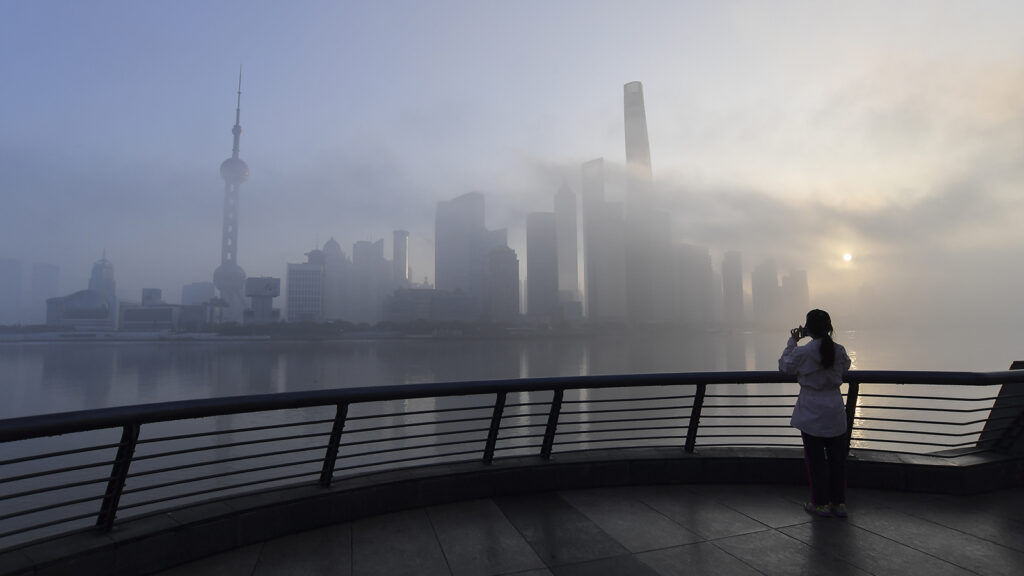

Destruction left in the wake of Hurricane Ian in Fort Myers Beach, Florida.

Photo: Win McNamee / Getty Images

Hurricane Ian has exposed major vulnerabilities in Florida’s home insurance market. Premiums have skyrocketed, and several insurers have gone bankrupt. This is likely to be reflected in other U.S. states impacted by climate change, where it will get harder to purchase home insurance — and therefore mortgages. BRINK spoke to Mark Friedlander, the director of Corporate Communications at the Insurance Information Institute.

Even before Hurricane Ian struck, Florida’s property insurance market was in great turmoil. Firstly, we have an excessive level of litigation in Florida. Last year alone, more than 107,000 property claim lawsuits were filed in Florida — that is 81% of all the property claim lawsuits filed in the U.S.!

Already in a Dire State

Secondly, unscrupulous roofers have been persuading homeowners to sign what is called an assignment of benefits (AOB) to the contractor. An AOB gives full rights of the claim to the contractor, who could bill your insurance company for an excessive rate for a roof replacement that in most cases would not have even been considered a legitimate loss. The contractor can also sue your insurer without your knowledge if the insurer rejects the claim, which happens frequently.

These two factors have put at least six Florida property insurers out of business this year and placed 27 other home insurers on what’s called the Florida Insurance Regulator’s “watch list” because of their poor financial health.

Then we get Hurricane Ian, which we are projecting to be the second-largest catastrophe loss in U.S. history. More than $60 billion in insured losses are anticipated. The only larger event on record is Hurricane Katrina back in 2005, and that was about a $90 billion insured property loss event in today’s dollars. So that gives you some perspective of the scope of Ian’s devastation and the impacts it will have on the property insurance market in Florida.

BRINK: And how much have premiums risen because of these issues?

FRIEDLANDER: The average cost of home insurance in Florida is currently $4,231, nearly triple the U.S. average. And in terms of spikes year over year, we’re looking at 33% increases on average across Florida this year — versus 9%, which is the U.S. average.

And most likely, we are headed somewhere between 40 and 50% average increases for next year, based on the litigious environment combined with a large catastrophe claim event.

Hard to Get Home Insurance in Florida

BRINK: So what does all that do to the property insurance market in Florida? Will it mean that people are just not going to insure their houses, or stop buying houses?

FRIEDLANDER: It is very difficult to shop for home insurance coverage in Florida right now. There are very few options because not many insurers are writing new policies. So homeowners are having to rely on the state’s insurer of last resort, Citizens Property Insurance Corporation, which is supposed to be the backstop only when there are no other options.

Citizens has grown to over a million policies, and it is in an adverse risk position because it is regulated to sell insurance at rates below the private market. In other words, they are essentially selling insurance coverage at a loss. This year, the Florida insurance regulator only allowed the provider to implement a 6.4% rate increase for renewals, whilst the private market is averaging 33% increases statewide. If a private insurer was only allowed to implement 6.4% premium increases in the current market, they would go out of business. That is not an actuarially sound approach in this very treacherous environment.

BRINK: So does the taxpayer end up footing the bill?

FRIEDLANDER: Eventually, yes. At the moment, we are hearing that Citizens will be in a good financial position to pay claims for Hurricane Ian. But what happens if its reserves are depleted? Every consumer in Florida pays for that in the form of surcharges. That means if you’re a homeowner, a condo owner, a renter that has insurance or a driver who has auto insurance, you would see multi-year surcharges on your insurance bills to replenish the funds of Citizens.

Fortunately, Citizens is in a position not to fail. Unlike a private insurer that would deplete its reserves and then go defunct and be declared insolvent, Citizens always has the state-regulated backstop plan where it is allowed to implement surcharges to all Florida consumers.

Real Estate Prices in Florida Likely to Nose Dive

BRINK: Given that these hurricanes may well grow in intensity and keep hitting Florida, what’s the long term prognosis for this market?

FRIEDLANDER: Florida’s insurance market will continue to trend downward, meaning we will most likely lose more of the struggling, small regional insurers, making it a tighter market and much more difficult for not only homeowners to find insurance coverage, but to afford insurance coverage.

Eventually, the insurance market is going to negatively impact what has been one of the most robust real estate markets in the U.S. Real estate values are going to nose dive because people either can’t afford the insurance to financially protect their home or because they can’t even find insurance in the first place.

We’re hearing about new homebuyers across Florida having trouble closing on their purchases because they cannot find an insurer to sell them a policy. So it is a real crisis that we’re facing.

It’s Not Just Florida

Louisiana is in a similar position to Florida for different reasons. Seven named tropical systems struck Louisiana during the 2020 and 2021 hurricane seasons, including two major Category 4 hurricanes. Insurers have incurred massive losses. This has caused havoc in the Louisiana property insurance market, and it is in a similar state of turmoil to Florida. However, it’s a much smaller market, so not as many homeowners are impacted as in Florida, but it’s still a big problem for many residents of the Bayou State.

Nine smaller regional insurers have failed in Louisiana in just the last 16 months. And the market has become extremely tight to the point where virtually no private insurers are writing new business right now — especially in communities in the southern half of the state that are most prone to hurricane impacts.

As a result, the state’s backstop insurer, Louisiana Citizens Property Insurance Corp., has grown almost fourfold since the beginning of the year. The big difference with Citizens of Louisiana is that they are mandated by the state to charge rates at a minimum 10% higher than any private insurer. In fact, the Louisiana insurance regulator just approved a 63% statewide average rate increase for Citizens. This will most likely lead to many more Louisiana homeowners being unable to afford coverage.