In Utilities, You Don’t Have to Buy Big to Score

There are more than 100 potentially lucrative small utility acquisition opportunities throughout the U.S., with more small natural gas utilities than electric.

Photo: Scott Olson/Getty Images

The utility business in the United States is a good business to be in—just ask Canada’s AltaGas, which agreed to purchase WGL Holdings in a deal valued at $6.4 billion at the end of January. The reasons are straightforward: Electric and natural gas utilities represent attractive infrastructure businesses; they are supported by a constructive, improving regulatory environment; they generally follow focused business strategies; they offer significant opportunities to expand their rate base; and they offer growth upside with continued low natural gas prices. Solid and predictable cash flows and earnings growth often follow.

If $6.4 billion seems pricey, potential buyers can check out more modest options among smaller operations. Despite competitive acquisition prices, smaller utilities continue to represent a yet-to-be-fully-realized investment opportunity.

Oliver Wyman projected in 2012 that the acquisition potential in the smaller utility segment was about $30 billion. Today, Oliver Wyman estimates the opportunity to be worth around $15 billion, capable of delivering annual earnings exceeding $700 million. But buyers will have to pay to play as utilities in general have continued to be hot takeover targets including 2016’s eight big transactions totaling $75 billion.

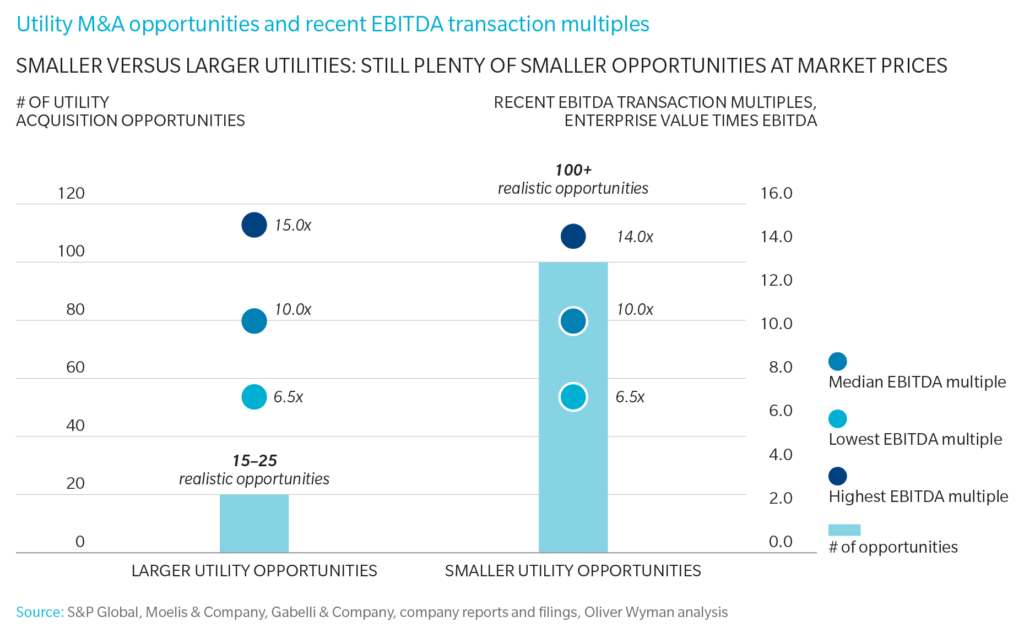

Oliver Wyman believes that there are more than 100 potentially lucrative small utility acquisition opportunities throughout the U.S., with more small natural gas utilities than electric. Some are whole companies, others are unloved or orphaned among big corporate parents, while still others represent carve outs and unique situations. Sure, a buyer can still consider mega-deals, but going forward, there are only about 15 to 25 realistic options to consider—a narrow menu that will almost assuredly command premiums. Additionally, some of these larger deals will also be fraught with negotiation, approval and management risks.

Achieving synergy savings and earnings growth projections is often challenging with mega-deals, especially those deals involving a difficult regulatory approval process. With smaller utilities, focusing on growth and improving performance is much easier. Our updated analysis shows that these often less complicated takeovers are more likely to yield incremental rate-base growth and significant improvement in earned return on equity. The same cannot be said about mega-deals where improvement in performance is much more difficult to achieve, given the scale and complexity of the business.

The current opportunities to invest profitably in utilities represent predominantly a U.S. phenomenon. Smaller utilities and operating companies are a unique feature of the U.S. market, driven by the state-level regulatory structure. Supportive state-level regulators open up opportunities for investors to consider U.S. acquisitions. Globally, investors tend to buy smaller utilities only opportunistically. A few large utilities tend to dominate markets in many countries. Where smaller opportunities do exist, the market or regulatory environment may not be as supportive of acquisition initiatives.

What Should a Wannabe Utility Buyer Do?

For larger utilities, a small utility acquisition program should be an important part of their development strategy. To have the best chance of success, attention must be paid to certain critical elements:

- Knowing the locals well: Larger utilities should develop a thorough understanding of potential smaller utility targets, including both local and parent management.

- Laying the groundwork with regulators: Larger incumbents can set the table by understanding customer, business, and regulatory issues facing targets and informally testing the waters on potential ratepayer benefits that could be offered.

- Building internal acquisition capabilities: Smaller acquisitions demand time and thinking. A capable and dedicated business development team can make small deals work.

In the acquisition game, utilities generally have a competitive edge over infrastructure funds, private equity firms, and other energy companies. However, Oliver Wyman believes nonutility buyers can also be successful by using the following tactics:

- Developing targets proactively: Funds and private equity firms cannot just wait for the next teaser or auction. If private money is serious, it must do its homework and devote some “boots on the ground” time.

- Going where they aren’t: There are markets where a new nonutility face is welcome—for customer, rate, business, regulatory, or local job creation reasons.

- Paying market or more: Funds and firms may have to pay market or more. The key to keeping investors happy is superb pre-acquisition planning and analysis plus a focus on putting in place the right management team post-acquisition.

- Thinking creatively and differently: A smaller deal flow requires new thinking.

- Benefiting from improving exit options: The lower risk, more stable cash flow infrastructure market will continue to represent solid investments even if interest rates tick up.

While large utilities will continue to attract lots of suitors, the universe of small targets should not be overlooked. Small utilities are indeed worthy of a buyer’s time, money and effort.