Managing the Financial Risk of Infrastructure Decommissioning

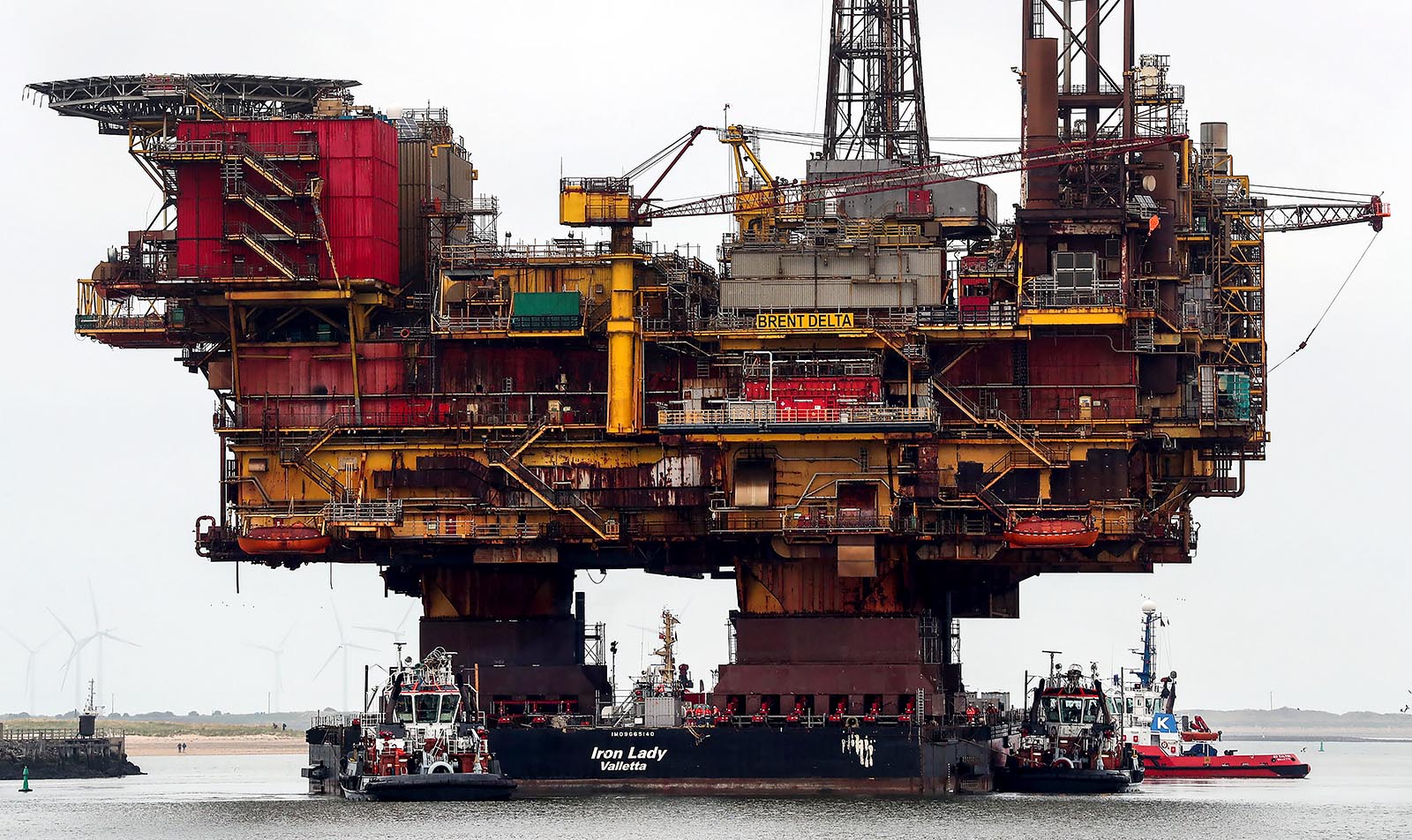

Shell's Brent Delta drilling rig is towed up the River Tees in England for decommissioning in May, 2017. Hundreds of such assets in Europe, Asia and the Gulf of Mexico will require decommissioning over the next 20 years.

Photo: Scott Heppell/AFP/Getty Images

After some 40 years of development and production, many oil and gas fields in the North Sea are approaching the end of their useful life. This is a trend seen globally; hundreds of assets in Asia and thousands in the Gulf of Mexico will also require decommissioning over the next 20 years. It has created an increased focus on the decommissioning and abandonment of infrastructure—specifically, how to close shop safely and economically on existing wells, platforms, pipelines, and other equipment.

Many of the technical challenges posed by oil and gas field decommissioning are unique to that industry, but the same broad issues also face nuclear power, mining, and, indeed, any industry where the operator faces future liabilities to disassemble/shut down infrastructure and rehabilitate the environment. A failure to plan now for decommissioning and abandonment could constrain the ability to invest and dampen joint venture partners’ appetite to engage. Because oil and gas showcase these issues well, they’re the focus for this article.

Global Problem

The drop in oil prices from their 2014 peak accelerated the issue of decommissioning for many oil and gas fields, while others had already seen their life extended a number of times and so are now “due” to come down. Western Europe—primarily the UK and Norway—is the first major region outside of the Gulf of Mexico to see oil and gas decommissioning on a large scale. An assessment by Douglas-Westwood estimated that $105 billion will likely be spent on decommissioning activities in Western Europe by 2040.

In the North Sea alone, it’s estimated that more than 17 billion pounds ($23.4 billion) will be spent on decommissioning work in just the next 10 years. The largest share (47 percent) of that spending relates to well plugging and abandonment costs. Only about 1 percent will be used for recycling and disposal, although that will be the most publicly visible part of the process.

The Asia-Pacific region also faces a monumental decommissioning challenge in coming years.

“Decommissioning in Asia-Pacific appears to be a mammoth task for which the various stakeholders are largely unprepared,” warned a report by Wood Mackenzie. The report estimates that the decommissioning of about 2,500 platforms and 35,000 wells in the region could cost as much as $100 billion.

Potential Risks and Liabilities

Decommissioning is a complex process due to both the number of unknowns—for example, fiscal, regulatory, technical, and social hurdles—and the variety of legal frameworks and jurisdictions involved. On the risk and liability side of the sheet, it can be useful to see decommissioning in the following three aspects:

1) Financial provisioning for known future liabilities

One way to think about the economics of decommissioning is to compare them to unfunded pension liabilities:

- Both are a known liability—they should therefore not present a surprise or unexpected catastrophe to any company or government.

- Both have some measure of uncertainty around the total liability. For example, there are many projections of the “final” cost of decommissioning in the North Sea. A 2017 report from the UK-based Oil and Gas Authority (OGA) estimated the range between 44.5 billion pounds and 82.7 billion pounds. And yet, with goals around cost containment based in part on innovations, the OGA target is set much lower, at 39 billion pounds.

- Both have uncertainty around timing. For the energy industry, the timing of decommissioning rests on field economics (reservoir productivity and oil price). Over time, we have seen reservoir productivity exceed expectations, as technology extends anticipated life expectancy. However, deteriorating field economics have also led to the acceleration of cessation of production.

Many operators plan to rely on other portfolio assets to fund their future decommissioning costs. The challenge with this approach is that asset performance is correlated with the timing of decommissioning. Thus a low oil price could bring forward decommissioning at exactly the same time the company has the least ability to fund major capital expenditures.

The high costs of decommissioning energy infrastructure will be borne not just by infrastructure owners, but by shareholders and taxpayers.

This is similar to the challenge that the pension industry faced—there was a recognition that the amounts set aside by companies for future liabilities were inadequate when assessed on a consistent basis. Hence, the significant focus on pension liability valuation and funding. For their part, pension liabilities typically involve an extended period of time over which they will be paid and depend, in some measure, on such items as the return rates of underlying assets and the longevity of pensioners and their beneficiaries.

2) Risks associated with the act of decommissioning

As might be expected, the very act of decommissioning carries risks. The well and plug and abandonment (P&A) phase—typically the costliest stage of decommissioning—generally carries the greatest uncertainty, due to the unknown nature of subsurface conditions and the impact these can have on the timing, and therefore cost, to P&A the wells.

Throughout the process, operators must be aware of the potential for hydrocarbon release, the challenges of the marine environment, extreme weather, worker safety, and other risks. There are also legal and regulatory risks to contend with, which often vary according to the country whose waters a platform or pipeline is in.

3) Post-closure liabilities

Post-decommissioning liability for license blocks varies significantly by geography. On the UK continental shelf, for example, the license holder has liability in perpetuity. This legacy liability creates challenges for all operators but most notably for private-equity-backed entities that ultimately seek a clean exit from the investment.

Financial Planning Is Essential

Any approach to decommissioning tends to require the disbursement of significant sums of money over a relatively short time frame but with a long tail. If carried out without appropriate financial planning and in isolation from other business priorities and decommissioning projects, the disbursement plan of a decommissioning project can put pressure on the operator’s cash flow, be highly sensitive to timing, and leave little control to the operator.

Three elements can help optimize an operator’s decommissioning activities, in line with its wider business initiatives:

Advance funding – As may be the case with pension liabilities, advance funding can dramatically reduce the potentially adverse financial impact of decommissioning and offer an increased level of security and flexibility to an operator. One way this is accomplished is by diversifying the sources of revenues. Advance funding can also reduce both timing risk and the pressure on an operator’s cash flow by building up an independent asset reserve.

Portfolio consideration – Considering the decommissioning of an asset as part of a portfolio provides an operator with an increased level of flexibility when it comes to managing the portfolio’s cash flows. For example, cash flows of assets to be decommissioned at later dates can potentially be used to fund the more immediate decommissioning needs of assets. Timing this becomes less of an issue as there is a longer cash-flow profile, and an operator’s control of the financial aspects is significantly reinforced.

Exit strategies – The increased flexibility from advanced funding and portfolio management helps operators better define their decommissioning approach and select the best exit strategies. For example, in exchange for a lump sum, it may be possible to transfer the liability for meeting future remediation costs to an insurer, including a captive insurer. Finally, any excess in advance funding could possibly be used for alternatives to pure decommissioning, such as facilitating an asset sale or developing a technological upgrade.

Conclusion

Whether from oil and gas fields, nuclear power plants, or other mega-projects, the high costs of decommissioning will be borne not just by infrastructure owners, but by shareholders and taxpayers. It is essential that planning—including financial strategies—get underway with due speed and are efficient, reviewed often, and based on a robust long-term view.