Many Countries Have Unsustainable Pension Systems. These Reforms Can Help.

Police officers in riot gear line up behind a demonstrator during a protest against proposed pension reforms outside the congress in Buenos Aires. Argentina's pension system ranked bottom out of 34 countries in a new ranking.

Photo: Eitan Abramovich/AFP/Getty Images

Most countries are grappling with the social and economic effects of aging populations, as retirement-income systems come under pressure from declining birth rates and increasing longevity. Yet any comparison of different pension systems around the world is not straightforward. “Retirement-income regimes are diverse and often involve a number of different programs,” according to a recent OECD report. “Classifying pension systems and different retirement-income schemes is consequently difficult.”

Addressing this complexity has been at the heart of the Melbourne Mercer Global Pension Index (MMGPI), now in its 10th edition. As significant pension reform is either considered or being implemented in many countries, it is important to learn what best practices may look like, both now and in the future. Co-sponsored by Mercer and the Victorian government, the MMGPI compares 34 retirement-income systems, encompassing a diversity of pension policies and practices.

The primary objective of the research is to benchmark each retirement-income system using more than 40 indicators measuring three subindices: adequacy, sustainability and integrity. An important secondary purpose is to highlight some shortcomings in each system and to suggest possible areas of reform that would provide more adequate retirement benefits, increased sustainability over the longer term and/or a greater trust in the private-pension system.

Pensions Under Multiple Pressures

Significant aging of the population is not the only pressure point on our pension systems. The low-growth/low-interest economic environment reduces the long-term benefit of compound interest, particularly affecting defined-contribution arrangements. The increasing prevalence of defined-contribution schemes, increased responsibility on individuals to understand the new arrangements, and the lack of easy access to pension plans, whether due to informal labor markets or the growth of “gig employment,” also make saving for retirement more challenging.

In some countries, government debt affects the ability to pay benefits in pay-as-you-go systems, while high household debt in other countries will affect the long-term adequacy of the benefits provided. There is also the need to develop sustainable and robust income products as retirees seek more control and flexibility over their financial affairs.

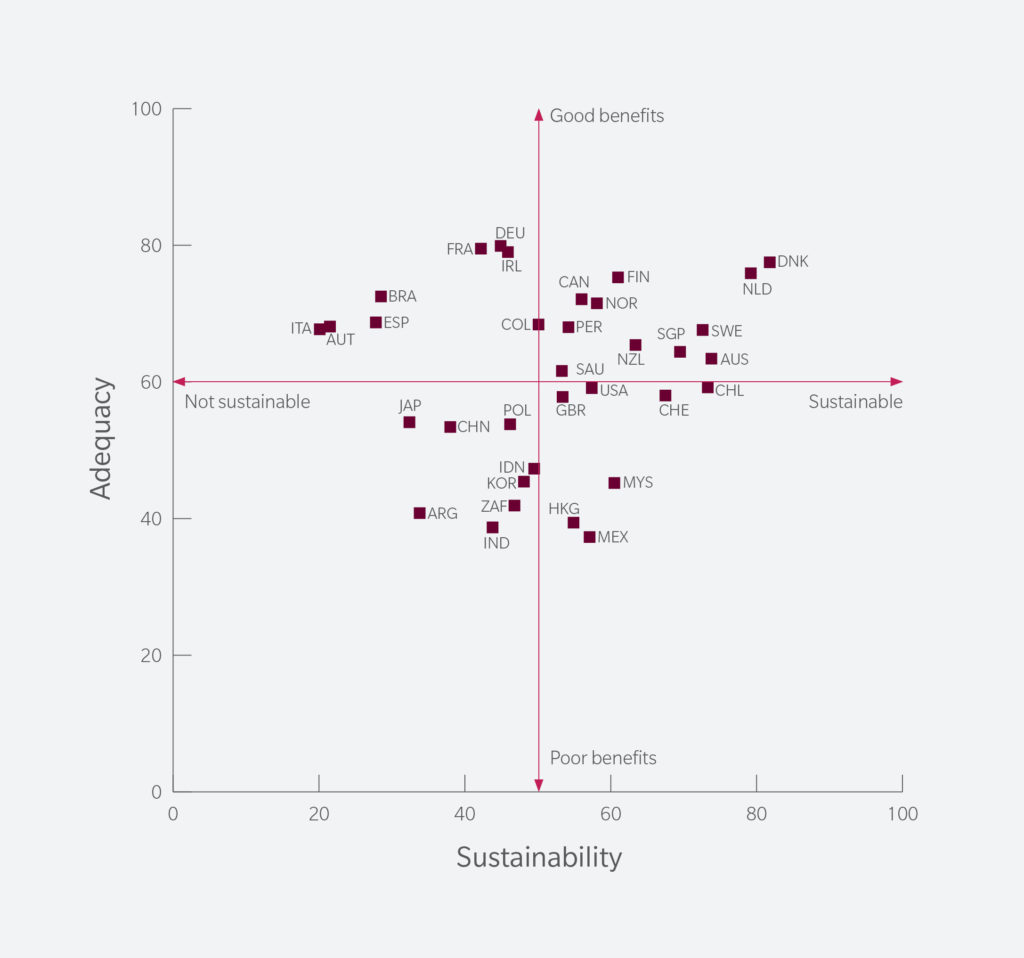

Exhibit 1: Adequacy versus Sustainability Ratings for Global Pension Systems

Critical Lack of Sustainability

In the latest rankings, the Netherlands took the top spot with a score of 80.3, edging out last year’s leader, Denmark, at 80.2. At the other end, Argentina’s pension system ranked bottom out of 34 countries, with a score of 39.2.

Since last year’s index, the average score for all the measured systems edged up to 60.5 from 59.9, but no one should be lulled into a false sense of security. The tension between what countries’ retirement systems offer and how long they can continue to offer it is growing as more baby boomers enter retirement.

For example, Italy, Austria and Spain have relatively high adequacy scores of 67 or 68—but sustainability rates of between 20 and 28. The sustainability index measures various indicators—such as total assets, government debt and economic growth—which will influence the likelihood that the current system will be able to continue to provide these benefits into the future.

The different systems in Europe also highlight the tension between pay-as-you-go and funded-pension arrangements. While there is no single answer to cover all circumstances, it is important to recognize that with aging populations, the assets of pension funds represent a key contribution toward sustainable retirement incomes in the future.

Work Longer To Live Longer

Although each system reflects a unique history, there are some common themes for improvement, as many countries face similar problems in the decades ahead. As the OECD notes: “OECD countries should not wait until the next crisis to implement the needed reforms to deal with increasing longevity, increasing risk of old-age inequality and changing work patterns.”

There continues to be a range of reforms that can be implemented to improve the long-term outcomes from retirement-income systems. These include:

- Increasing the state pension age and/or retirement age to reflect increasing life expectancy, both now and into the future, thereby reducing the future costs of the publicly financed pension benefits.

- Promoting higher labor-force participation at older ages, which would increase the savings available for retirement and limit the continuing increase in the length of retirement.

- Encouraging or requiring higher levels of private saving, both within and beyond the pension system, to reduce the future dependence on the public pension while also adjusting the expectations of many workers.

- Increasing the coverage of employees and/or the self-employed in the private-pension system, recognizing that many individuals will not save for the future without an element of compulsion or automatic enrollment.

- Reducing the leakage from the retirement-savings system prior to retirement, thereby ensuring that the funds saved, often with associated taxation support, are used for the provision of retirement income.

- Reviewing the level of public-pension indexation, as the method and frequency of increases are critical to ensure that the real value of the pension is maintained and balanced by its long-term sustainability.

- Improving the governance of private-pension plans and introducing greater transparency to improve the confidence of plan members.

Last year’s World Economic Forum highlighted three key areas that would have the biggest impact on the overall level of financial security in retirement: a “safety net” pension for all; improved ease of access to well-managed cost-effective retirement plans; and support for initiatives to increase contribution rates.

Healthy pension systems contribute positively toward a stable and prosperous economy in every nation. The challenge is to implement the best practices in securing the future for a world population that is living longer.